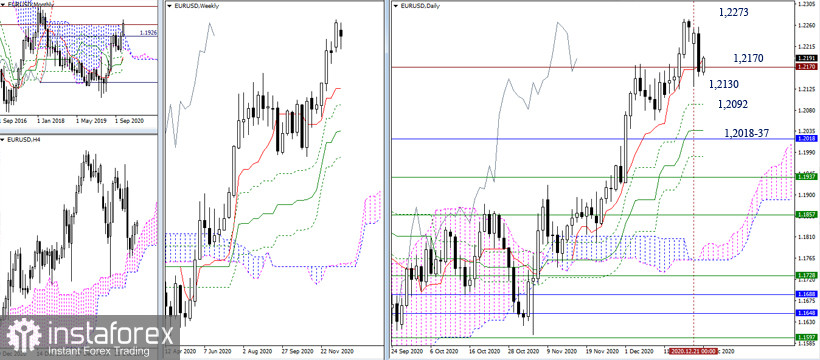

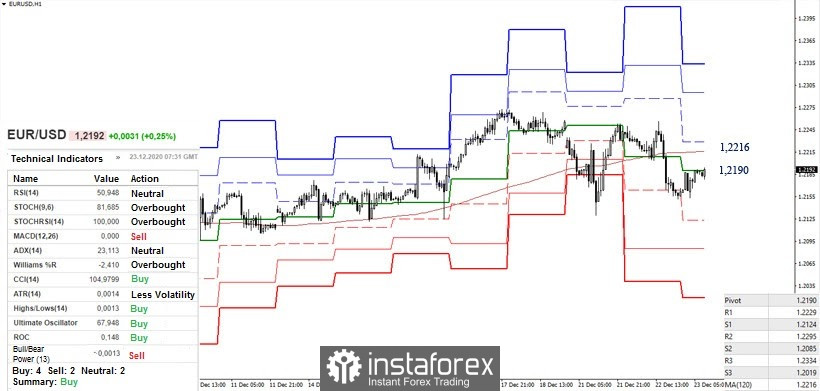

EUR/USD

The pair returned to the attraction zone and support of the historical level of 1.2170, but failed to move beyond Monday's low (1.2130). As a result, the situation did not change significantly, so the conclusions and expectations about possible scenarios for the development of the situation remain unchanged. The role of attraction and support belongs to the level of 1.2170, while the nearest important upward level is located at 1.2273 (last week's high). In turn, the downward targets can now be noted at 1.2130 (Monday's low extreme) - 1.2092 (daily Fibo Kijun) - 1.2018 -37 (daily Kijun + monthly cloud limit).

The key levels in the smaller time frames are currently located at 1.2190 - 1.2216 (central pivot level + weekly long-term trend). Now, if we move beyond the attraction zone with small deviations above or below, it will contribute to the preservation of uncertainty, which means the lack of clear preferences and directional movements. On the other hand, if we move beyond the previous movement (1.2273 - 1.2130), it will return the relevance to the classic pivot support levels 1.2085 - 1.2019 as well as resistances 1.2295 - 1.2334.

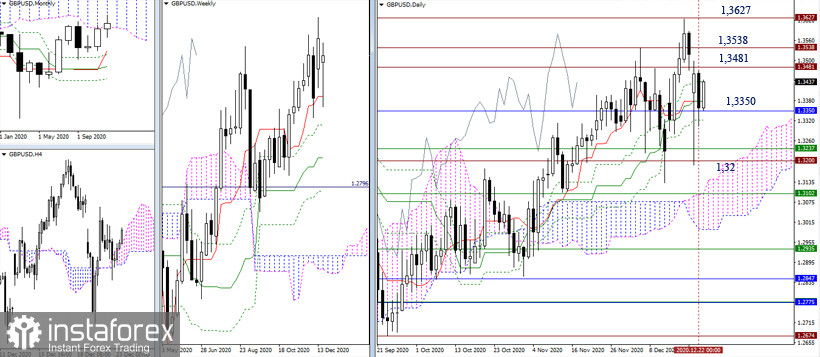

GBP/USD

The lower limit of the monthly cloud becomes the middle ground once again. Yesterday, the situation did not change significantly in the main direction. The resistance levels for the bulls, which open up new prospects, are still located at 1.3481 - 1.3538 - 1.3627. In case the price consolidates below the level of 1.3350, the area of 1.32 (historical level + weekly short-term trend) will continue to be important for bearish traders.

In the smaller time frames, the key levels have occupied an almost horizontal position and are now at 1.3458 (weekly long-term trend) and 1.3377 (central pivot level). A movement in the influence and attraction zone will contribute to the development of uncertainty.

The resistances of the classic pivot levels are now located at 1.3543 (R2) - 1.3617 (R3). The main task for the bulls will be to consolidate above the high (1.3624). Here, the support of the classic pivot levels can be currently noted at 1.3285 (S1) - 1.3211 (S2) - 1.3119 (S3).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)