Tight quarantine measures are further implemented in the United Kingdom following the detection of a new strain of coronavirus infection in the country. This was primarily applied to London and the South-Eastern part of the country. At the same time, there is no guarantee that the increase in quarantine will not happen in the rest of the British regions. Several countries around the globe have already begun to issue transport ban links with the British Isles. Meanwhile, negotiations between the UK and the European Union to reach a trade agreement remain at an impasse. Optimists still believe that the deal can be concluded right on New year's eve. However, the positions of the parties do not yet provide for reaching a compromise, although it should not be completely excluded. Negotiators from both sides, Michel Barnier and David Frost continue to feed promises and instill hope that a compromise is still possible. At least, hard work continues in this direction, but whether it will give any positive results will be known in the very next few days or even hours. According to British Prime Minister Boris Johnson, the end of the transition period until December 31 of this year, in his opinion, does not provide for its extension and the continuation of any negotiations, which means that the UK will leave the EU without a trade agreement. In this case, both parties will have to face significant difficulties and additional costs in the subsequent trade relationship. This scenario is particularly painful for the British economy.

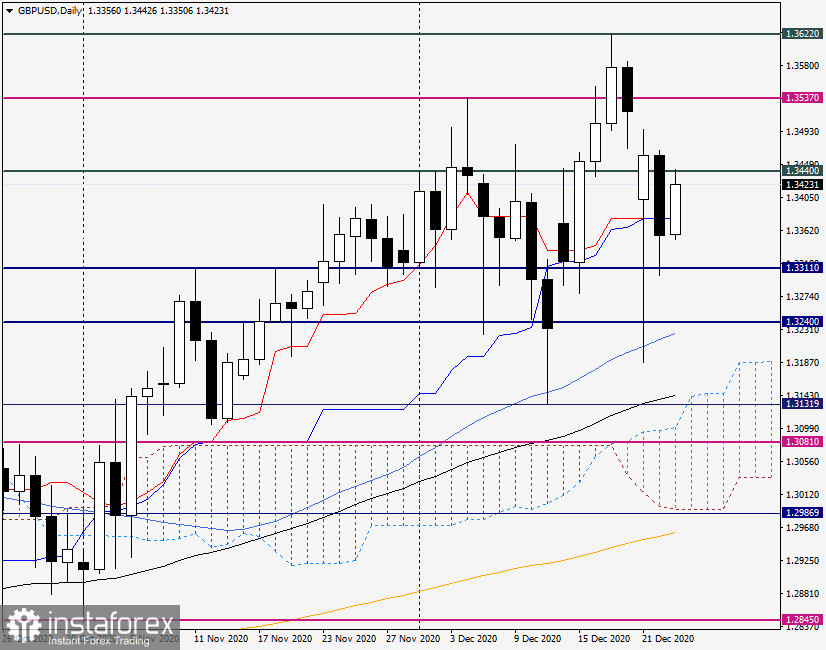

GBP/USD, Daily chart:

The GBP/USD pair declined during Tuesday's trading session closing it at the level of 1.3360. Let me remind you that this mark is technically quite strong, hence the reversal or strong rebound of the price has been observed more than once. Tuesday's good GDP reports for the third quarter did not help the pound sterling either. However, the US economy showed stronger growth than experts expected over the same period of time. In today's trading, at the time of writing this article, the GBP/USD pair is trading higher, near 1.3418. If the rise continues, the nearest target will be the levels of 1.3495 and 1.3500 (the highs of trading on December 21, and an important psychological level). Closing today's session above 1.3500 will give new strength to the subsequent growth and strengthen the position of buyers of the pound. If, at the end of trading, a candle with a long upper shadow appears on the daily chart and the closing price is below 1.3380, there is a high probability that the quotes will continue its downward trend.

According to trade recommendations, the situation continues to be quite ambiguous and complex. We will focus exclusively on technical signals. If after the rise above 1.3440, in the area of 1.3490-1.3510, bearish patterns of Japanese candlesticks appear on the four-hour or hourly charts, we try to sell the pound sterling with the nearest targets in the area of 1.3400-1.3360. Risky purchases can be tried from current prices or after a decline in the area of 1.3377. It is worth buying the pair above 1.3500 only after a clear consolidation above this mark, and then, even after that, it is impossible to exclude that the quotes will fall to the area of 1.3400. News about the Brexit negotiations and a large block of American statistics, which will start arriving at 13:30 UTC, can play a role in the price dynamics of the GBP/USD pair.