GBP/USD pair has slumped from today's high at 1.3210 and has fallen to a daily low of 1.3086 after the Bank of England announced its monetary policy decision.

This sudden drop in the British pound was due to disappointment on the part of investors, as they expected an interest rate hike of 50 basis points. Another factor is the uncertainty generated about economic growth in the coming months. Tthese were details that weighed on the pound.

On Wednesday, the US Federal Reserve raised its interest rate by 25 basis points. According to the policy statement, there are six more rate increases on the Fed's agenda for 2022. So, no doubt that the US dollar will continue its upward path in the coming months.

However, the US dollar index (DXY) is very overbought, which could favor the recovery of the British pound in the next few days and GBP/USD could reach the 200 EMA at 1.3324.

On the other hand, there are expectations of a recovery of the British pound in the short term, with the hope of an agreement between Ukraine and Russia, or at least a truce. Investors remain bullish and this could weigh on the US dollar safe-haven.

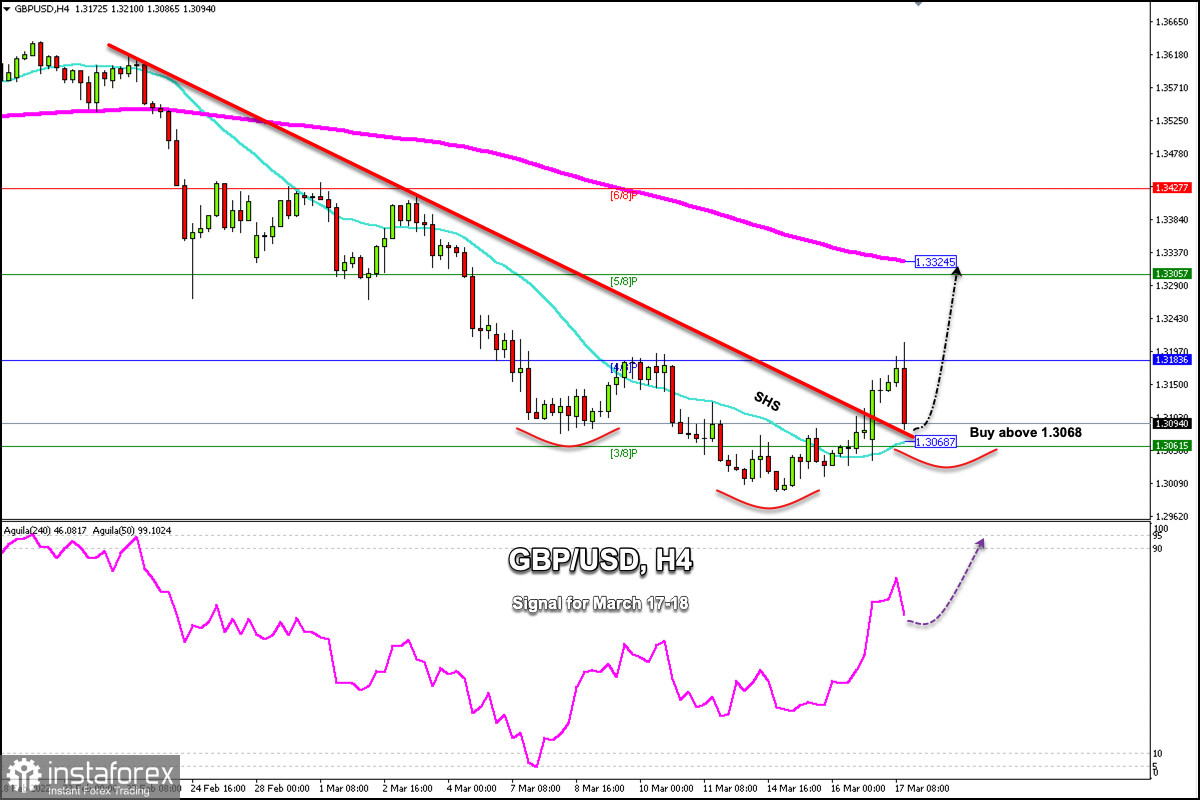

According to the 4-hour chart, we can observe the formation of a head & shoulder pattern. As long as the pound trades above the 21 SMA at 1.3068, there will be a clear opportunity for it to hit its target at 1.3305.

GBP/USD managed to break out of the downtrend channel that had formed since February 22nd. Now it is above this channel, making a technical correction.

If GBP/USD manages to rebound and stay above this channel in the next few hours, it could resume the bullish momentum and the price could reach 4/8 Murray again at 1.3183 and even the 200 EMA at 1.3324.

The eagle indicator is giving a positive signal. However, this sudden fall in the pound can be well seen as part of a correction to buy back above 1.3068.