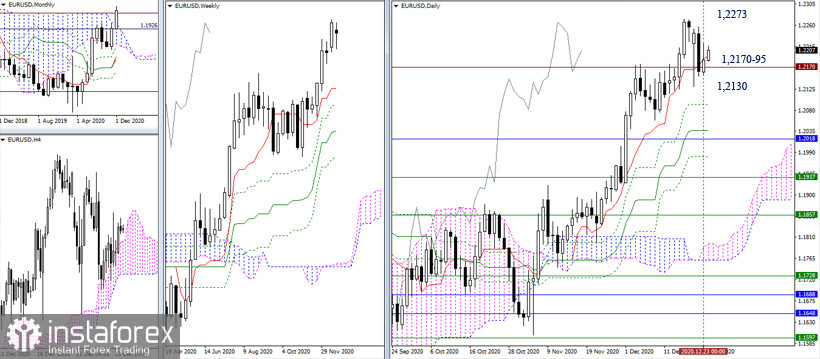

EUR/USD

The situation expectedly stalled within the current movement, after the sharp growth. Now, the daily short-term trend of 1.2195 and the historical level of 1.2170 is exerting attraction. The upside target is 1.2273 (high), while the downward target is 1.2130 (Monday's low). A reliable consolidation above or below these pivot points will allow you to consider new opportunities and prospects.

The key levels in the smaller time frames remain horizontal, while the pair continues to move in the attraction and influence zone. Today, the central pivot level is at 1.2187 and the weekly long-term trend is at 1.2216. The basic assessment of the situation remains the same. If you are near these levels and their horizontal position, the uncertainty of the situation will remain. The current resistance of the classic pivot levels can be noted at 1.2254 and 1.2287, while the support levels are at 1.2153 - 1.2120 - 1.2086.

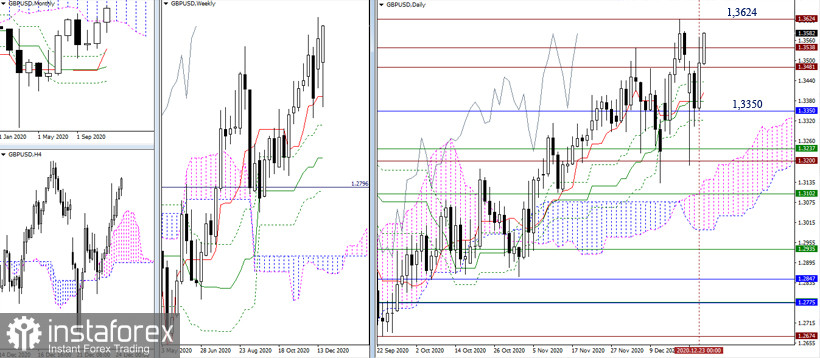

GBP/USD

The bulls are trying to regain their lost positions at the start of the week. At the moment, their nearest target is last week's low of 1.3624. A consolidation above which will allow the upward trend to be restored, which can result in new prospects that will further strengthen the bullish moods. The attraction zone can now be noted at 1.3538 and 1.3481. The lower limit of the monthly cloud 1.3350 remains to be the nearest support.

The pair in one-hour chart is above the key levels of the smaller time frame, which are located today in the area of 1.3471-55 (central pivot level + weekly long-term trend). Therefore, the bulls have the certain predominance of forces now and they are also supported by the analyzed technical indicators.

The levels of 1.3592 (currently being tested) -1.3690 - 1.3811 are the pivot points for continuing the rise inside the day. The loss of 1.3471-55 will affect the current balance of power, shifting the initial advantages on the bears' side. The support for classic pivot levels today is located at 1.3373 - 1.3252 - 1.3154.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)