Hi dear colleagues!

In 2020, gold offers lucrative investment opportunities, so multi-year patience of investors has been eventually rewarded. The precious metal opened the 2020 year at $1,560 per troy ounce. It is finishing the year at near $1,900, thus bringing those who hold it in their portfolios a 20% profit in US dollars. Nevertheless, gold faced a challenge in the second half of the year. Having soared to $2,075 in August, the yellow metal plunged to $1,780 in December. Such a dynamic proves the market wisdom that trees do grow as high as the heaven and a trend retraces to its average values.

What are prospects of gold for the next year? Let's try to figure it out for different time frames – for the short and medium term. I suggest that we find out levels to be carefully watched.

To begin with, let's agree that we are going to appeal to facts but not emotions. A long-term investor who buys gold as a physical asset or who invests in an ETF can afford a mistake. Indeed, there is no big difference whether to buy gold at $1,900 or $1,800. On the other hand, a trader who works with leverage and pays a swap for every day of operating in the market cannot afford such mistakes. A trader will have to pay dearly for a pleasure of opening a position prematurely.

Gold is denominated in US dollars. Therefore, monetary policy of the Federal Reserve is the key to understanding what's going on in the gold market. Nevertheless, it is not enough to open a position. The FOMC meeting, that was held last week, took a decision about an "eternal" QE program. It will go on until the US labor reached nearly full employment and consumer prices achieve stability at a target level set by the central bank. At first glance, it would be a good idea to buy gold and be happy. In fact, things are not so simple.

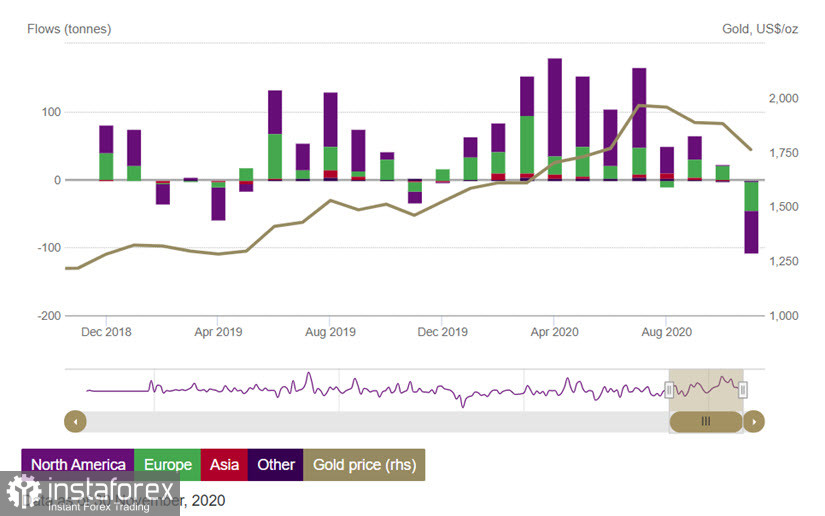

Demand for gold is sensitive to a variety of factors. In the short term, it depends on sentiment of investors in exchange traded funds (ETFs) and traders in the futures market. Here comes the problem. In essence, market participants are unwilling to buy gold at the current prices. According to a survey by the World Gold Council, exchange traded funds with physical replication of the precious metal (gold ETF) logged a significant outflow of investments in November 2020.

Picture 1 shows that last month investors rushed to withdraw their capital from gold. Amid massive selling, gold prices tumbled to a local low of $1,765. Even the weak US dollar could not support gold. It proves that despite the second COVID-19 pandemic wave, American and European investors are not keen on buying gold at the moment. Perhaps there are other options for fat profits.

Picture 1: Capital flow of exchange traded funds with physical replication of gold

In December, the situation improved a bit and gold regained footing from November lows. However, despite a positive signal to the precious metal market, the Fed's decision has not overcome the negative trend of the recent 4 months. In fact, the ongoing picture should be viewed as an upward correction following a decline in August – September. The situation in the futures market does not cheer up investors. Waning demand for gold is especially clearly seen through the open interest. Since August, the number of futures contracts decreased from 1.14 million to 773,000. In the next couples of weeks, demand revived and the open interest grew again. Speculators, who are the main buyers, added long positions. However, the question is still open whether it means a recovery of the gold prices. A short-term uptrend has not ruined yet the medium-term downtrend.

Now the gold chart suggests growth in the long term, roughly for 1 year. The target level is expected at $2,250 per troy ounce. The medium-term for a period of 3 to 6 months supposes a decline towards $1,675 (picture 2). This trend lasts for 4 straight months. The short-term trend could lift the gold price to $1,937, though it is cannot be said for sure. By the way, of the gold price manages to close the month above the level of $1,900, it could mean the end of the medium-term downtrend and the beginning of a new upward wave. The target level is $2,065. Besides, the price is expected to set a new historic high following $2,250. It looks like Three Elder Screens (long-term growth, medium-term decline, and short-term growth). Still, this scenario could be implemented on condition the price closes the month above $1,900.

Picture 2: Schemes of scenarios for gold development

Those readers, who keep track of analytical reviews, can be irritated about different scenarios. "What the hell? Where will the price go eventually?" I understand this frustration. The future always has a few scenarios. I cannot predict the future. Nevertheless, being aware of the price developments, I can suggest that before the price moves to $2,069 and $2,225, it should break the borders of the downtrend channel and fix above the level of $1,900. Interestingly, after the gold price sank below this level in early November, it has never managed to close the week above it. So, make sure you watch carefully this key level.

To sum up, we can conclude that at the moment the odds are that the gold price will decline to $1,700. There is a less likelihood that it will grow to $2,069. However, of gold closes the week and the month above $1,900, the situation changes for the opposite. Thus, traders willing to sell gold can open short positions setting a stop loss above $1,975. On the other hand, traders willing to buy gold would rather wait until the gold price climbs above $1,900. Then, they should consider buying opportunities, but not earlier.

No one knows what will happen in the future. So, the essential skill of any trader is to follow the ongoing trend and manage a capital in such a way that an accidental event could not destroy a deposit. Be careful and cautious! Merry Christmas to all those who are celebrating tonight!