For the past 4 years, Bloomberg experts have made a mistake when giving forecasts for the EUR / USD pair. At the end of 2016, they said the euro will decline, but thanks to the rapid growth of the eurozone's GDP, EUR / USD jumped 14%. In 2018-2019, estimates were also incorrect, and this is because of the trade wars that happened. Now, in 2020, the euro rose instead of the expected decline, although those who bet on its strengthening from the very beginning of the year found themselves in a deep minus. For 2021, forecasts say EUR / USD will reach 1.25. However, it is very doubtful whether this will come true or if it will become a mistake once again.

Aside from that, next year, there is a high chance that the US dollar will grow, especially because of these factors: increased uncertainty and a divergence in economic growth (of the US and the Euro area). Meanwhile, an ineffective vaccination, the emergence of new strains of COVID-19 that do not respond to vaccinations, the political crisis in the US in the form of Joe Biden's clashes with Republicans in Congress, and a new round of trade and diplomatic conflict between US and China seem unlikely events.

As for the dynamics of the US GDP, judging by the financial conditions and business activity, it will be a bit mediocre, at least in the first quarter.

Dynamics of financial conditions and business activity:

At the moment, tough restrictions have been implemented in many countries, but as the third quarter report shows, economic recovery has grown faster. Defeating COVID-19 will revive international trade and support the currencies of export-oriented countries and regions, in particular, the euro area and the euro. Therefore, EUR / USD will see drivers for growth, at least for the first half of 2021.

Then, most likely, the bullish trend of the euro will change if the Fed adjusts its outlook, which will only happen if inflation accelerates. Currently, the FOMC does not plan to raise interest rates before 2024, but who knows for sure that this stance will remain until the end of 2021.

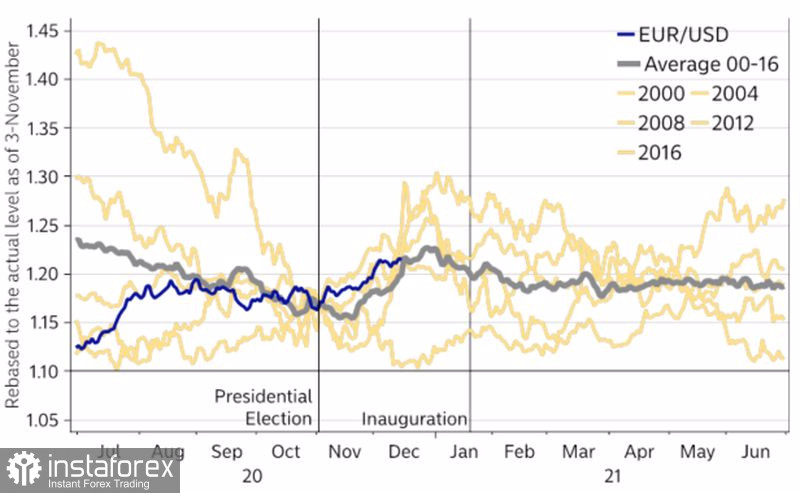

As long as the Fed is "dovish" and does not think about normalizing monetary policy, the US dollar will be sold, which will accordingly lead to the rise of the euro. However, there is also a chance that EUR / USD will repeat what happened during the US presidential elections, when it peaked and then fell sharply right after.

EUR / USD's reaction to the US presidential election

In my opinion, the euro is capable of reaching $ 1.25-1.27. However, this may be the limit of its capabilities.

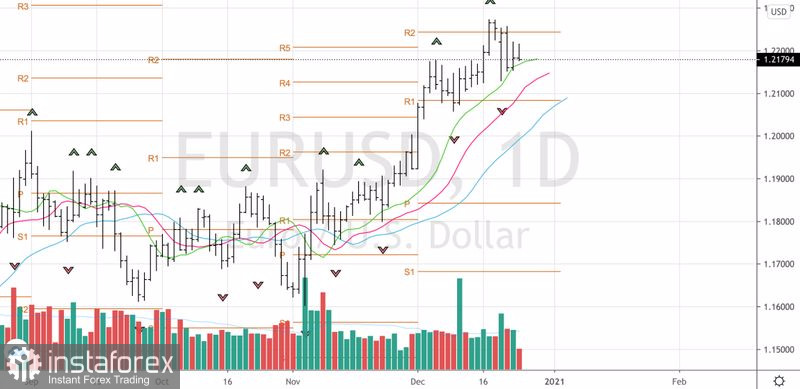

Nonetheless, on the EUR/USD daily chart, several bars have formed, and the exit from short-term consolidation will provide a hint about the further dynamics of the pair. In any case, long positions should be placed from 1.204-1.208, or on the breakout of 1.2245 and 1.2265.

EUR/USD daily chart: