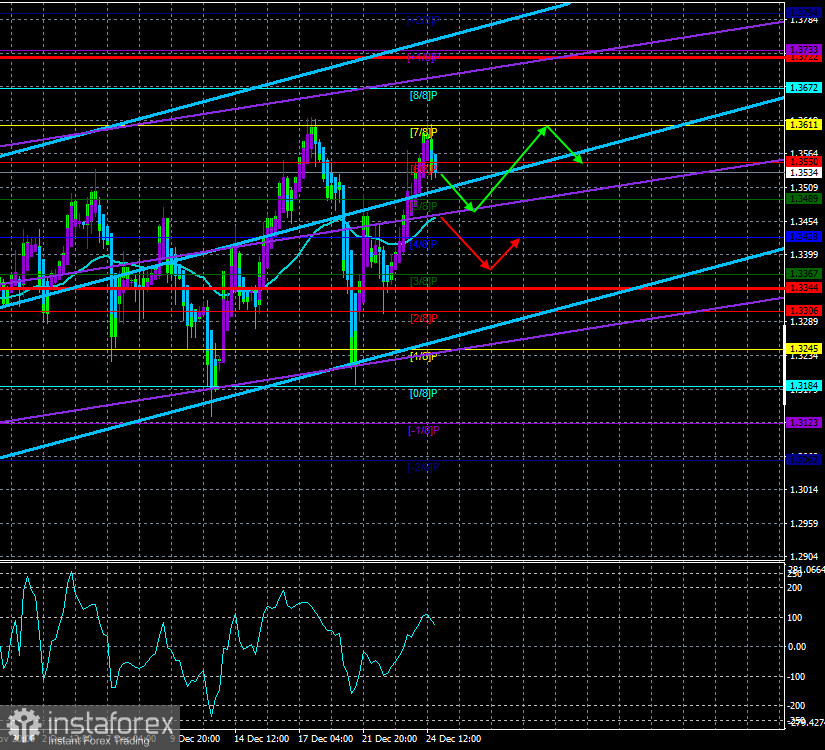

4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 71.2214

The British currency paired with the US dollar continued its upward movement on Thursday, December 24. By the end of the day, a pullback began, which may be a banal correction or the beginning of a new downward trend. Agreeing on a trade deal on Brexit is behind us, and it is this topic that has remained the driver of the pound in recent months. Now, in theory, the markets should calm down about this, and the British currency should start to become cheaper since the current exchange rate has already been included in the trade deal five times. We have repeatedly drawn traders' attention to the fact that the British economy will not be saved by this deal. Simply put, a deal with the EU for the British economy is not a panacea, but only a slight weakening of the harsh reality. We have spoken about this repeatedly over the past year, and many British and American media outlets are also of the same opinion.

For example, the British independent writes that Brexit will inevitably cause damage to the UK in the long term. Recall that the Bank of England expects -1% of GDP in the first quarter of 2021 due to Brexit. The publication warns that if a deal was not reached, it would be a "satisfactory option" for British businesses. Experts of the publication warn readers against the propaganda of Boris Johnson, who declares the "mighty prosperity" of the nation and the country, thanks to the deal "in the Australian version". The independent's biggest fear is that once Brexit is complete, the UK will become a "third country". It will lose its link to the powerful European Union and will become far from the main players in the international arena. Experts believe that Brexit will increase trade barriers between the EU and the UK, as well as reduce trade turnover. Economic modeling suggests that GDP will not reach 4% due to the "divorce" with the European Union. However, journalists of The Independent also note the huge significance of the deal. In the short term, almost all industries in the country will avoid duties. Huge queues at the UK's borders with the EU have been avoided. It was possible to avoid the so-called "black day" for the pound, which could collapse down almost to parity with the euro, which would lead to an increase in prices for imports from the European Union. Experts also believe that the free trade agreement with the EU increases the chances that Scotland will remain part of the United Kingdom, and there will be much fewer problems on the border with Northern Ireland.

However, almost immediately after the news of the agreement between London and Brussels, the First Minister of Scotland, Nicola Sturgeon, made a speech. Sturgeon said Brexit was happening against the will of Scots who did not vote to leave the EU, and that no deal could make up for all that Brexit deprives Scots of. "It is time for us to determine our future as an independent European state," the head of state said.

What remains to be seen is what key points were agreed upon in the negotiations between Michel Barnier and David Frost. First and most importantly, duty-free trade will be maintained between the countries. Secondly, Britain will leave the customs zone and control will be carried out at the borders with the EU. Third, Britain's financial institutions and, in principle, all its legal entities will not be able to enjoy privileged conditions in the EU. Fourth, British companies from the service sector will be restricted access to the European market. Fifth, Britain gets the right to support its own companies as it pleases. Sixth, a visa regime is being introduced between the Bloc and the Kingdom, and it will not be possible to cross the border just like that (for a long-term stay abroad). Seventh, over the next 5.5 years, fishing quotas for European vessels in British waters will be reduced by 25% annually. Eighth, Britain and the EU will cooperate in the fight against crime and terrorism. Ninth, in case of disputes between the parties to the transaction, a special group of experts and an independent court (not the European court in Luxembourg) will be involved.

Thus, at the end of 2020 and the beginning of 2021, the British economy is almost guaranteed to suffer losses. It is unlikely that this factor will allow the British currency to continue to grow. Everything, the trade deal is won back by the market, it's time to face the truth. At the beginning of the new trading week, the pound may still rise in price and even update its 2.5-year highs, as news of the deal came in the middle of Friday, and not all market participants had the opportunity to work them out. We still expect a new downward trend. And we still remind you that we need technical confirmation of this hypothesis. As long as the price continues to be located above the moving average line, it is necessary to consider trading for an increase.

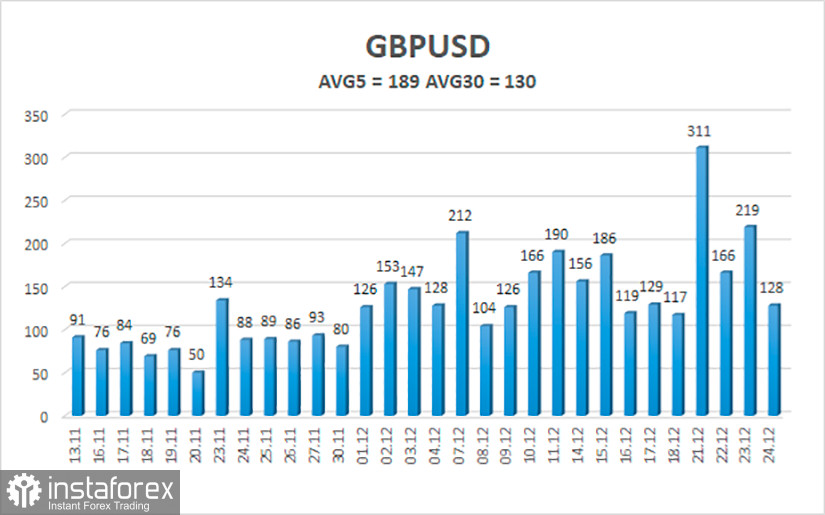

The average volatility of the GBP/USD pair is currently 189 points per day. For the pound/dollar pair, this value is "high". On Monday, December 28, thus, we expect movement inside the channel, limited by the levels of 1.3344 and 1.3722. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement.

Nearest support levels:

S1 – 1.3489

S2 – 1.3428

S3 – 1.3367

Nearest resistance levels:

R1 – 1.3550

R2 – 1.3611

R3 – 1.3672

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe is now in a new round of upward movement. Thus, today it is recommended to keep long positions open with targets of 1.3611 and 1.3672 until the Heiken Ashi indicator turns down. It is recommended to trade the pair down again with targets of 1.3367 and 1.3344 if the price is fixed below the moving average line. In general, the "swing" continues now. Not a good time to trade.