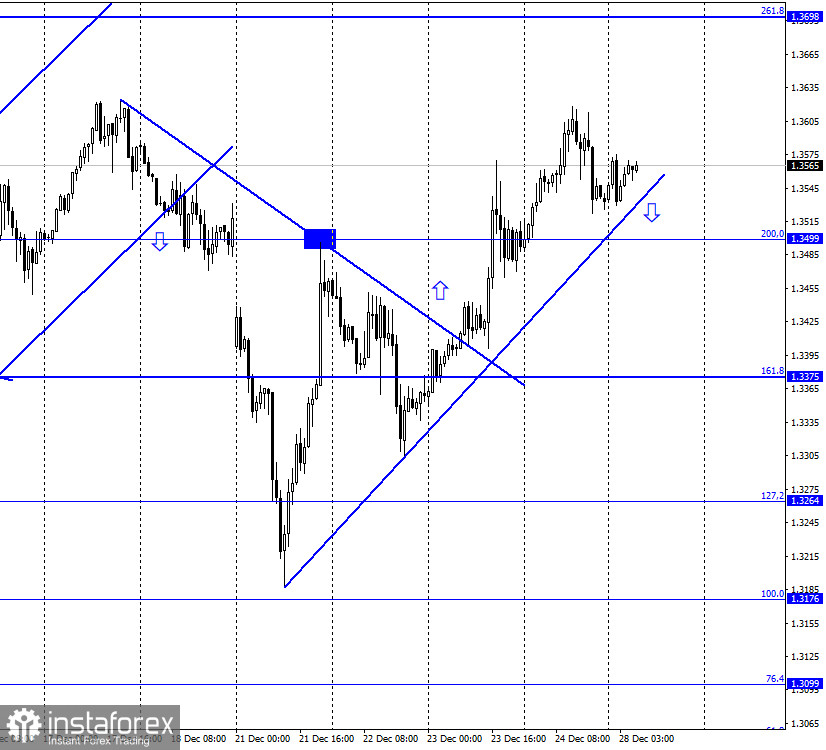

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair were trading near the ascending trend line on the night of December 28, which still characterizes the current mood of traders as "bullish". Thus, the growth process can be resumed in the direction of the corrective level of 261.8% (1.3698). Fixing the quotes under the trend line will allow traders to expect a reversal in favor of the US currency and some fall in the direction of the corrective level of 161.8% (1.3375). The tension eased from the traders. The trade deal has been agreed and now no one doubts that both parliaments will ratify it. Thus, it remains only to wait for the official results of the vote of both parliaments. Britain will meet in an emergency meeting on December 30 to vote on the 1,240-page bill. The European Parliament will vote after the New Year, however, the European Union will still be able to temporarily accept the agreement to avoid a "hard" Brexit from January 1. Thus, this whole series is left behind, and traders will now analyze the state of the UK economy in late 2020 and early 2021. The deal is good, however, many experts still believe that the UK economy will shrink in the coming months. The Bank of England has said it expects GDP to fall by 1% in the first quarter of next year. So Britain's financial problems will not go away, they will simply not be as complex and disruptive as they might have been without a deal.

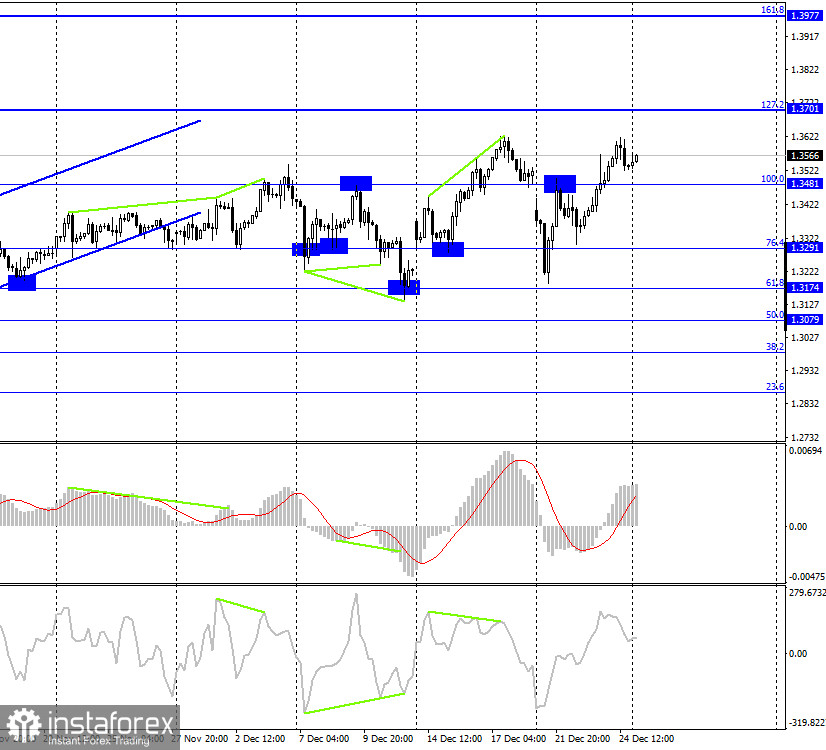

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair continues to grow in the direction of the corrective level of 127.2% (1.3701). The rebound of quotes from this level will work in favor of the US dollar and some fall in the direction of the Fibo level of 100.0% (1.3481). Today, the divergence is not observed in any indicator.

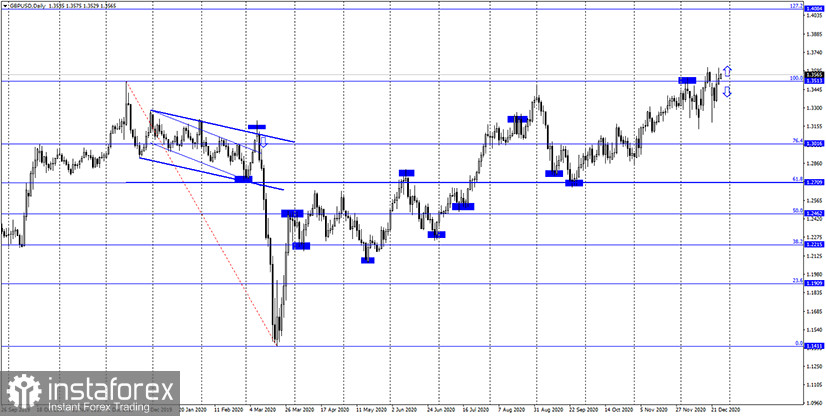

GBP/USD – Daily.

On the daily chart, the pair's quotes returned to the corrective level of 100.0% (1.3513). The rebound of the exchange rate from this level will again work in favor of the US currency and the beginning of a new fall in the direction of the Fibo level of 76.4% (1.3016).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the second downward trend line. A rebound from it in the long term will mean a reversal in favor of the US dollar and a long fall in the British dollar's quotes.

Overview of fundamentals:

On Friday, there were no economic reports in the UK and the US, and trading on this day was not conducted. The information background was completely absent.

The economic calendar for the US and the UK:

On December 28, the calendar of economic events in the UK and the US are empty. The information background will be absent today.

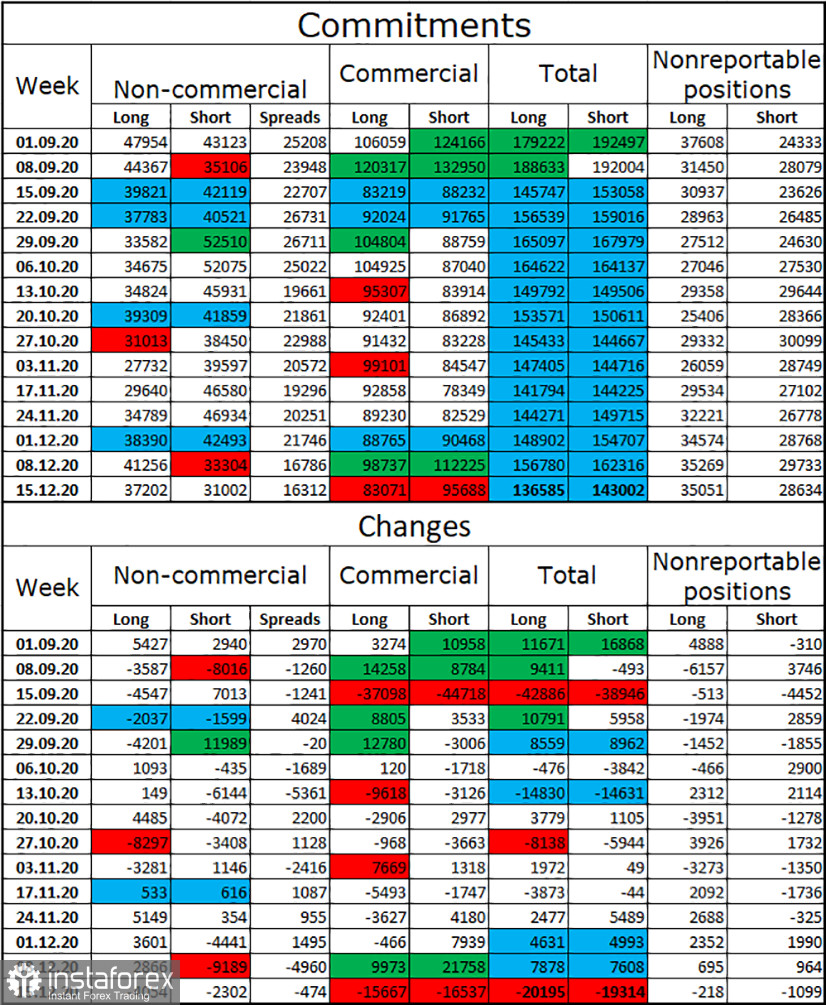

COT (Commitments of Traders) report:

The latest COT report showed that speculators were getting rid of both long and short contracts. This again suggests that traders are afraid of the British and the information background. It is extremely difficult to predict what will happen to the UK economy in 2021. Therefore, the "Non-commercial" category of traders prefers to close trades rather than open new ones. This time, speculators closed 4 thousand long contracts and 2.5 thousand short contracts. Thus, the mood of speculators has become much less "bullish". At the same time, the British continued the growth process, thus, I can draw the same conclusion as for the euro. Major traders are preparing for a new fall in the pound sterling.

GBP/USD forecast and recommendations for traders:

It is recommended to open new purchases of the British dollar on Monday in case of a rebound from the ascending trend line on the hourly chart with the target level of 261.8% (1.3698). I recommend selling the pound sterling when it is fixed under the ascending trend line on the hourly chart with a target of 1.3375.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.