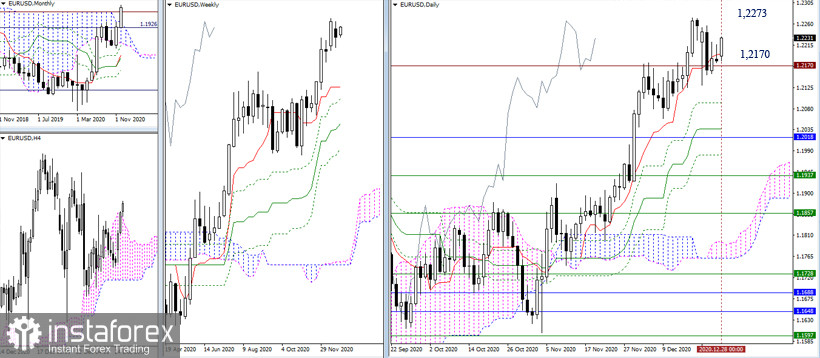

EUR/USD

The initiative belongs to the bulls after the holidays and weekends. Currently, the pair remains in the movement zone of the previous week. An achievement and an opportunity to turn the favor on the bulls' side is to consolidate above the high (1.2273). If December closes with bullish optimism, new prospects can be considered. On the contrary, if the bulls do not dominate now, and the bears manage to confirm the prerequisites for a weekly reversal candlestick pattern, then the bearish scenario in the near future will be very relevant.

The analyzed technical instruments are now giving the bulls the initial advantage in the smaller time frame. The upward pivot points are the resistance levels of 1.2230 and 1.2245. In turn, the loss of key supports 1.2191 (central pivot level) and 1.2207 (weekly long-term trend) will change the favor towards the opponent on the hourly TF. So, further support for classic pivot levels today can be noted at 1.2167 - 1.2152 - 1.2128.

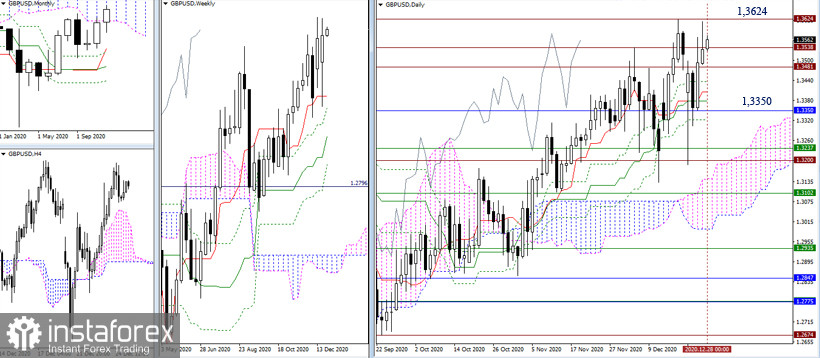

GBP/USD

This week began without any sharp change in the situation. The bulls are now hoping to recover the lost and unsecured positions last Friday. As a result, the overall distribution of forces as well as further development options and prospects remains the same. The attraction which is now provided by historical levels of 1.3538 - 1.3481 - 1.3624 (high extreme) and 1.3350 (lower limit of the monthly cloud) can affect the change of moods and opportunities.

Today, the key supports in the smaller time frame are located at 1.3546 (central pivot level) and 1.3453 (weekly long-term trend). A movement above these levels keeps the initial advantage on the bulls' side, but losing support levels will give the advantage to the side of the opponent. If the pair remains in the attraction zone of the levels and does not show effective movements, then there will most likely be a time of uncertainty and reflection before the close of the month and year.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)