While European and British officials are full of euphoria over the biggest trade deal in the UK's history, the euphoria in financial markets is slowly fading. The GBP/USD pair rushed up after reports that London and Brussels came to a consensus, but failed to gain a foothold above 1.36. Since the end of September, when the Brexit negotiations entered the final stage, the pound has grown against the US dollar by 7%, which suggests that the positive has already been taken into account in the quotes. Is it time to sell on the facts?

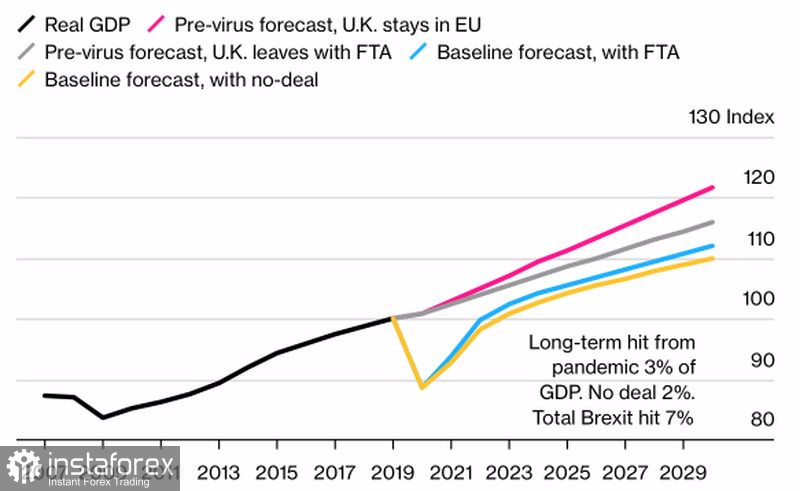

First of all, you need to understand the details of the agreement. Both sides will continue to trade without tariffs, Britain will be able to conclude contracts with other countries on its own behalf, but will be forced to follow EU standards. If, for example, Brussels changes them, and London does not do the same, the European Union will have the opportunity to impose sanctions. The free flow of workers between countries will cease, and trade in services will significantly decrease. Its share in the UK accounts for about 80% of GDP, so the forecast of the Office for Budget Responsibility, that even with a successful Brexit, the economy will not reach 4% within 15 years, looks logical. If an agreement could not be reached, the loss would amount to 6%.

UK GDP dynamics:

A successful Brexit allows the British economy to avoid the worst-case scenario for itself. A break in relations with the region, which accounts for 43% of exports and 52% of imports, would be a real disaster and, according to Bloomberg experts, would bring down the GBP/USD quotes to 1.25.

According to Boris Johnson, the agreement will put an end to uncertainty in British politics and will help in the recovery of the UK economy after the pandemic. A deal is primarily about confidence. In my opinion, it is the reduction of uncertainty that will contribute to the continuation of the rally of sterling against the US dollar.

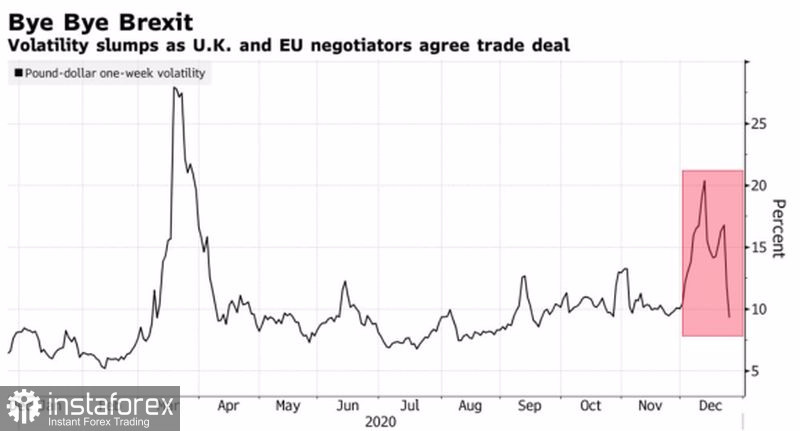

The fall in the volatility of the pound and the undervaluation of British assets are important drivers of the growth of the analyzed pair. Since the 2016 referendum, the FTSE-100 has been losing out to the world's major stock indexes in both local currency and dollar terms. At the same time, 2021 promises to be a great time for stocks in case of the victory over the pandemic and the rapid growth of global GDP. It is not surprising that the number of recommendations for buying undervalued securities of British issuers is growing.

Pound volatility dynamics:

While the GBP/USD pair digests the information, weighs the consequences of the deal, and does not rush to rise, it will certainly follow global trends. In particular, the idea of further growth in global risk appetite and the sale of safe-haven assets. In this regard, Societe Generale's forecast that the pound will reach $1.4 very soon does not look like a utopia.

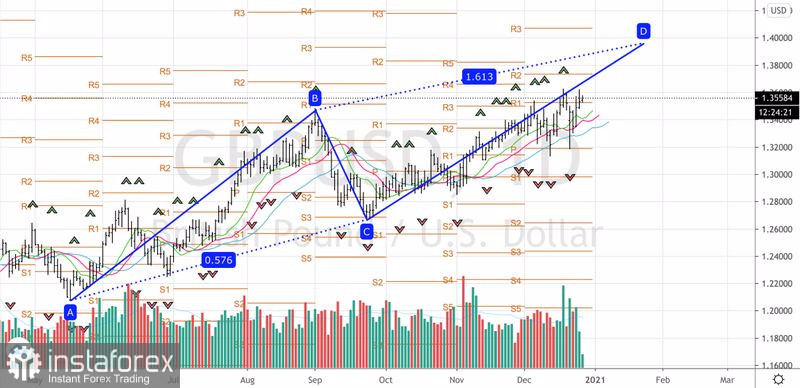

Technically, if we proceed from the target of 161.8% on the AB=CD pattern, the potential of the upward movement of GBP/USD is far from exhausted. Rebounds from supports at 1.345 and 1.34, as well as a breakout of resistance at 1.362 should be used to build up longs formed from the level of 1.333.

GBP/USD daily chart: