The trade agreement between the UK and the EU has brought great relief for business, but major issues remain open or simply unresolved, which could lead to new rounds of speculative panic.

Major trade agreement issues that may arise in the future:

- Smooth level playing field

A trade deal on the so-called "flat field", creating conditions for fair competition between enterprises, was one of the most difficult parts of the negotiations. The agreed compromise means the UK is not required to agree to EU laws, but the bloc can impose proportionate tariffs subject to compromise if it can show that the UK's actions have distorted fair competition.

This means that the issue of taxes on trade between the UK and the EU is still far from being resolved and is an urgent issue. One of the central arguments in the referendum to leave the Eurobloc was that Britain would regain control of its own laws, and eurosceptics in Boris Johnson's Conservative Party called on the Prime Minister to take the chance to reduce the rules binding.

The current deal contains a revision clause that allows either party to periodically revise this portion of the contract if they are unhappy with the way it is being used. Thus, the trade deal could still fail in the future if the UK or EU decides that it doesn't work.

- Fish inquiry

The Brexit trade deal contains a five and a half year transition period for fisheries, after which access will be negotiated annually.

The agreement gives the UK and the EU the right to levy duties on each other's fish if they can prove that any future reduction in access to the waters is causing economic or social damage.

- Data flow

The UK and the EU have only agreed on a temporary solution to maintain the flow of data between their territories. During an interim period of not more than six months, data transfers may continue until a separate legal agreement is reached.

- Financial services

The current trade deal provides little clarity for financial institutions. There is no solution to the so-called equivalence, which would allow firms to sell their services in the EU single market from the city of London. The agreement contains only standard provisions on financial services, that is, it does not include market access obligations.

Chancellor of the Exchequer, Rishi Sunak, said yesterday that the Treasury is due to negotiate a memorandum of understanding with the EU as an urgent priority in 2021. In turn, negotiations on access and financial equivalence between London and Brussels will continue.

It can be seen from the above material that there are still quite a few problems and what was planned for the 2021 referendum in 2016 looks different.

The previous trading week ended with a pullback from the area of the conditional high of the medium-term upward trend of 1.3600/1.3625.

At the same time, the market dynamics amounted to 129 points, which is below the average level, but still reflects speculative activity.

Analyzing the trading chart on a daily time frame, it can be seen that the medium-term upward trend is considered the main one in 2020. However, if the focus is changed to a long-term trend, then all the recent fluctuations took place in the structure of the 2008 downward trend.

Today, the countries of the British Commonwealth: Great Britain, Canada, Australia and New Zealand are celebrating Boxing Day. Due to the weekend, low trading volumes can be expected, and so traders will try to follow the negotiation process of a trade deal. Perhaps, there will be new details that will act as a catalyst for trading activity.

We can assume that the quote will continue to focus on the last week's pullback of the 1.3520/1.3620, where the main surge in activity will occur after the price consolidates outside a particular border.

The following scenarios can be considered as possible prospects and entry points:

- Buying a pair at a price above the level of 1.3625, with the prospect of moving to 1.3700 can be considered.

- Selling a pair at a price below the level of 1.3520, with the prospect of moving to 1.3470-1.3400 can be considered.

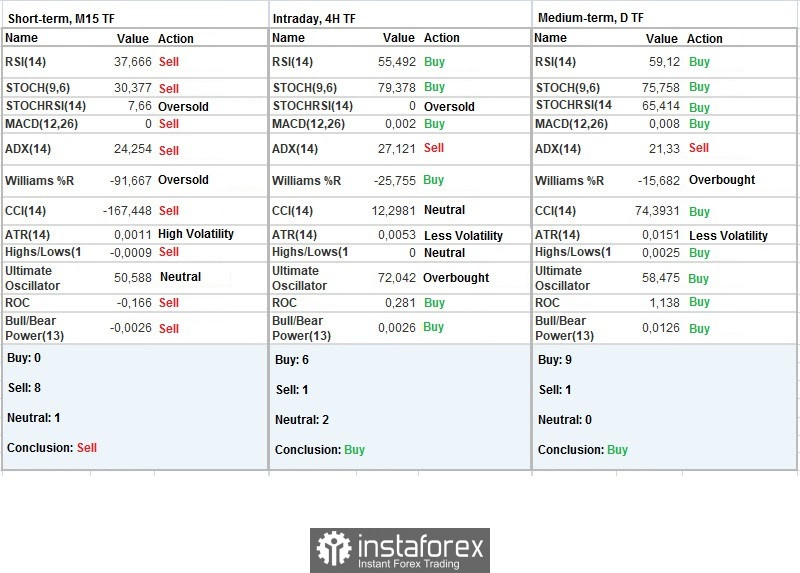

Indicator analysis

Analyzing the different sectors of time frames (TF), it is clear that the technical indicators on the hourly and daily TFs signal a buy due to price fluctuations at the high of the medium-term upward trend.

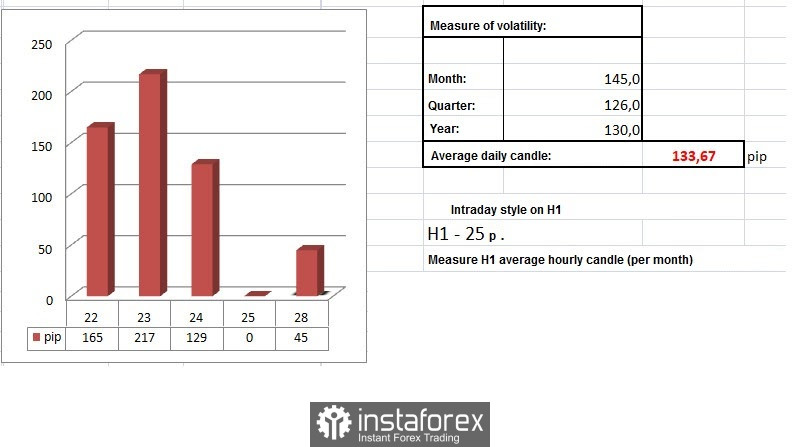

Weekly volatility / Volatility measurement: Month; Quarter; Year

The volatility measurement reflects the average daily fluctuations, calculated per Month/Quarter/Year.

The current dynamics is only 45 points, which is very small for such a dynamic trading instrument. Low activity is associated with the lack of proper trading volume, as well as understanding everything that is happening in the Brexit process.

Key levels

Resistance zones: 1.3650 **; 1.3850; 1.4000 ***; 1.4350 **.

Support zones: 1.3300 **; 1.3000 ***; 1.2840/1.2860/1.2885; 1.2770 **; 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957).

* Periodic level

** Range level

*** Psychological level