To open long positions on GBPUSD, you need to:

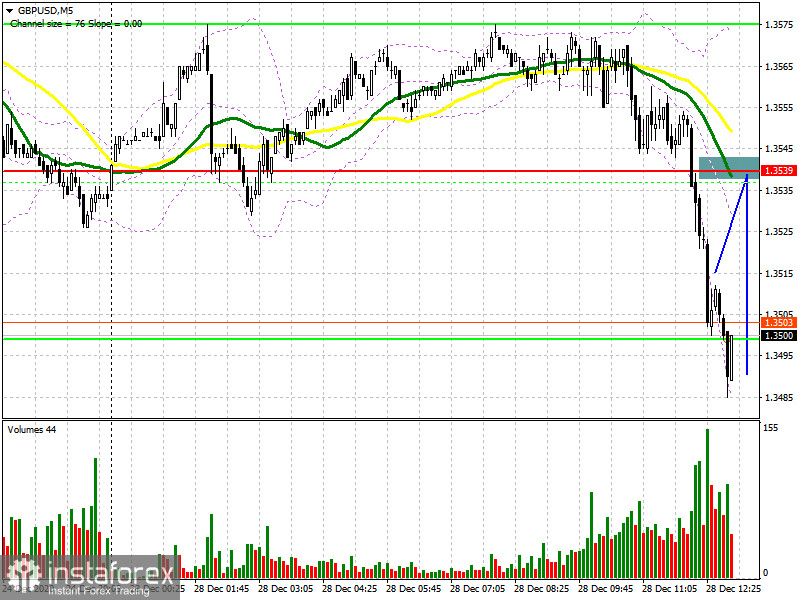

In the first half of the day, the British pound fell sharply against the US dollar, as optimists become much less. In my morning forecast, I recommended opening short positions from the level of 1.3539. Let's take a look at the 5-minute chart, and talk about where you could enter the market. It is visible how the pound breaks through the area of 1.3539, after which several stop orders are demolished and the pair falls. However, to my regret, I missed this deal, as I did not wait for a convenient entry point. On the chart, I noted where I would open short positions in the continuation of the downward trend. However, the test of the level of 1.3539 from the bottom up did not happen.

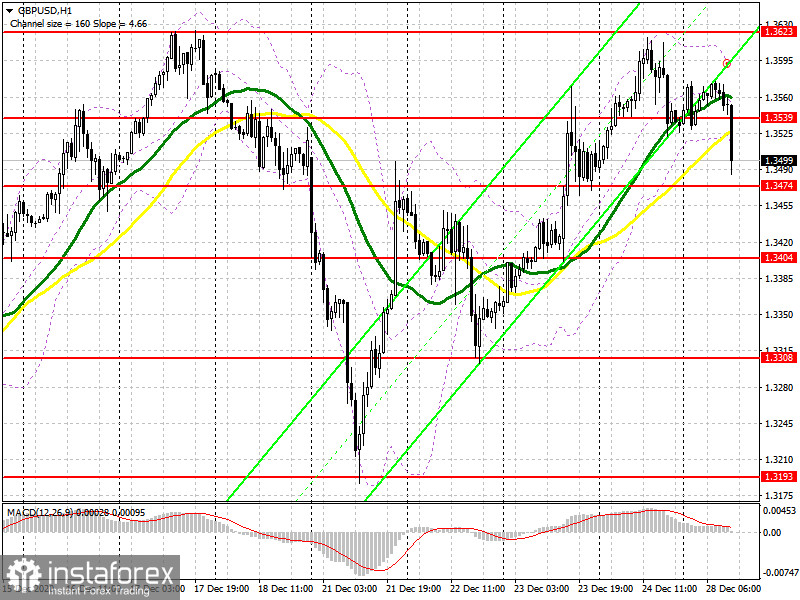

At the moment, as long as trading is below the level of 1.3539, the pressure on the pound will remain. Therefore, it is time for buyers to think about how to protect the support of 1.3474, to which the pair is slowly but surely declining. The formation of a false breakout will be a signal to open long positions to return to the resistance of 1.3539, where I recommend fixing the profits. If there is no activity of buyers at this level and its breakdown, it is best to postpone purchases to a larger support area of 1.3404, from which you can open long positions immediately for a rebound in the expectation of a correction of 30-35 points within the day. An equally important task for the bulls will be to regain control over the resistance of 1.3539, as only in this case it will be possible to count on the continuation of the upward trend in the pound at the end of this year. The test of the area of 1.3539 forms a good buy signal with an exit to a maximum of 1.3623.

To open short positions on GBPUSD, you need to:

Bears coped with the task for the first half of the day and did not let the pair to the highs of this year, taking control of the support of 1.3539. While trading will be conducted below this range, we can expect the pound to fall to the support area of 1.3474, which is now the primary target of sellers. Only fixing below this range with a test of it from the bottom up will open a direct road to the area of the minimum of 1.3404, where I recommend fixing the profits. If the pressure on the pound eases in the second half of the day, an upward correction of GBPUSD is not excluded. In this case, I recommend opening short positions only after the resistance test of 1.3539, provided that a false breakout is formed or immediately on a rebound from the annual maximum of 1.3623 with the aim of a downward correction of 30-35 points within the day.

Let me remind you that in the COT reports (Commitment of Traders) for December 15, there is a decrease in interest in the British pound, both buyers and sellers. Long non-profit positions fell from 39,344 to 35,128, while short non-profit positions fell from 33,634 to 31,060. As a result, the non-profit net position remained positive, but fell to the level of 4,068, against 5,710 a week earlier. Given that the UK has imposed strict quarantine measures due to a new strain of coronavirus that is out of control, and for which there is no vaccine yet, it will not be the right decision to expect a further strengthening of the pound at the end of this year. The good news on Brexit will no longer be able to push the pair up.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 daily averages, which indicates the probability of forming a downward correction for the pound.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

If the pair grows, the upper limit of the indicator will act as a resistance in the area of 1.3590, from where you can sell the pound immediately for a rebound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.