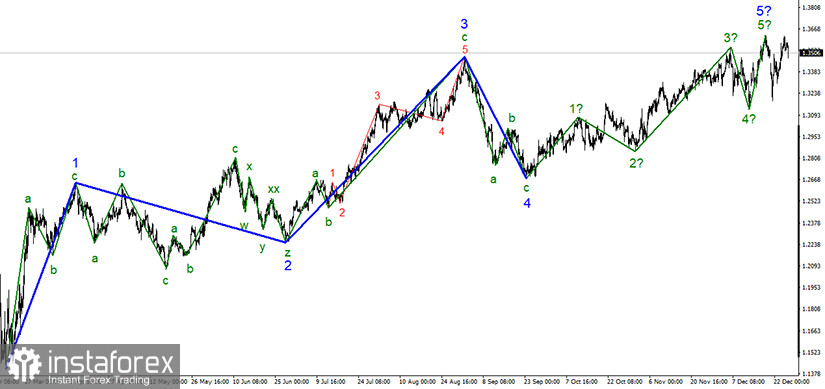

The section of the trend, which originates on September 23, finally took a five-wave form. Moreover, the view is quite complete. Of course, wave counting can be complicated, however, at the moment, everything looks like a complete wave structure. Even the increase in the price of the instrument in the last week is still interpreted as a corrective wave b as part of a new downward correction structure of waves. However, a successful attempt to break the maximum of the expected wave 5-5 will indicate the readiness of the markets for new purchases of the British.

On the lower chart, the wave marking also looks quite convincing and also allows for the option in which the entire section of the trend will take a more complex form. At the moment, the pair's quotes have risen to the maximum of the previous wave, which is the top point of the entire upward trend section, if the current wave marking is correct and does not require adjustments. If a downward reversal occurs without a successful attempt to break the expected wave 5-5, then the waves after December 17 can be interpreted as waves a and b, therefore, I will expect to build a wave C with targets below the minimum of the expected wave a.

The UK Parliament will meet for an emergency meeting on December 30 to vote on this day for the trade deal, which Michel Barnier and David Frost managed to agree after all. The European Parliament will not vote this year, as it simply does not have time to read the document, which has more than 1,200 pages. Thus, the Committee of Permanent Representatives of the European Union approved today the temporary application of the deal from January 1. This means that the UK and the EU will continue to trade "freely" with each other after December 31, although the European Parliament will not have time to ratify the agreement. It is noted that the ambassadors of all 27 EU countries unanimously voted "for" this decision. "We have finally reached an agreement. It was a long and tortuous road, but we managed to get a good deal," said European Commission President Ursula von der Leyen. Thus, the British economy will not collapse in 2021 due to a sharp and powerful drop in trade with the European Union. And the British now, when it's time for it to increase in price, began building a new corrective wave. By and large, after the moment when London and Brussels announced an agreement, the pound sterling no longer rose in price. Many analysts foresaw this option, as in recent months, demand for the British pound remained very high due to market expectations of a deal. My wave marking now also warns about the readiness to build at least one new descending wave with targets located below the 32nd figure.

General conclusions and recommendations:

The pound/dollar instrument has presumably started building a new downward trend section. Thus, I currently recommend selling the pound/dollar instrument for each MACD signal "down" with targets located around 32nd and 31st figures, within the expected first (global) wave of a new downward trend section. A successful attempt to break the maximum of the wave 5-5 will indicate the readiness of traders for new purchases of the British and cancel the option of building a new downward trend.