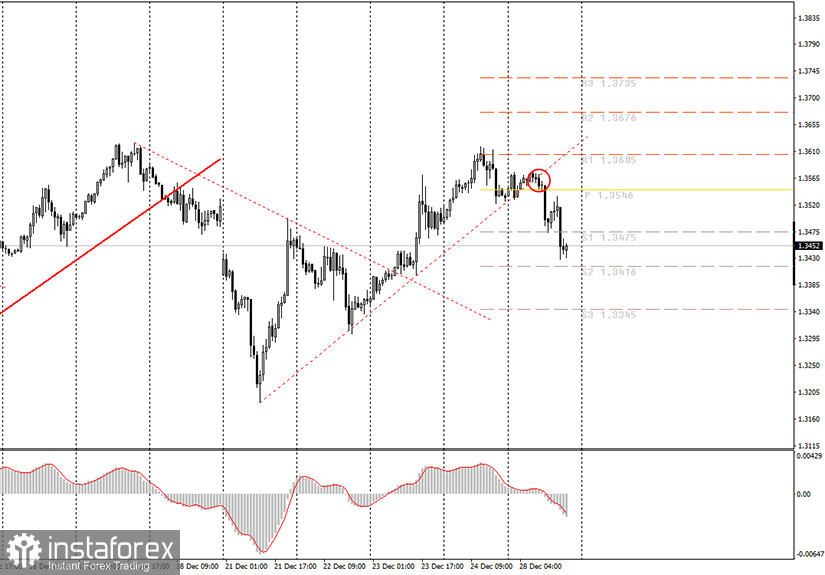

Hourly chart of the GBP/USD pair

The GBP/USD pair crossed the upward trend line in the morning, which created a sell signal. Yesterday we marked 1.3471 and 1.3373 as target levels, the first of which was both reached and surpassed. Thus, if novice traders took profit near it, they could earn around 75 points. The sell signal is still relevant and those who have not yet closed the sale are now in profit of about 100 points. A new downward trend has formed for the pound/dollar pair, and the price was unable to update and/or overcome the previous local high of 1.3624. Thus, chances that a downward trend will be created in the short term has increased. We now expect the pair to fall to the $1.32 area. In order to be able to consider short positions again, you need to wait for the pair to correct and form a new sell signal. However, the pound may continue to move down without a correction. We still recommend being content with the profit you could get up to now.

Fundamentally, there is absolutely nothing to say now. The trade deal has been agreed upon between the UK and the European Union, but now there is little to do - it needs to be ratified by both sides. The British Parliament will deal with this issue on December 30 and, no doubt, will approve the deal. The European Parliament will vote for ratification after the New Year. In the meantime, the European Council has approved the so-called "provisional application", which allows the entry into force of an international agreement without ratification by the European Parliament. The fall of the British currency is now, from our perspective, fundamentally justified. The pound has been rising for a long time on the basis of only positive expectations on the London-Brussels talks. Now is the time to pay back your debts. The deal is good, but it does not remove all of the UK's economic woes. We estimate that the UK economy will lose about 2% of GDP in the fourth quarter, while the US will grow by a few percent. The British economy may lose around 1% in the first quarter of 2021, the Bank of England ascertains. Thus, not only is the pound overbought, but all forecasts speak in favor of the fact that the economy will contract. Well, technically, we have a signal for a downward trend.

No major macroeconomic reports or other events scheduled for Tuesday, December 29th. Thus, there will be no fundamental background, which does not mean the absence of movement for the pound/dollar pair.

Possible scenarios on December 29:

1) Buy orders have lost their relevance, since the price settled below the trend line. And so, the bulls have released the initiative and now we need to wait for a new upward trend in order to be able to trade up. Such a trend is unlikely to appear the next day.

2) Selling has now become relevant, but today the pair has already fallen by more than 100 points. Thus, the best solution would be to close short positions and wait for a new sell signal from MACD. You can also continue to keep sell orders open with targets at 1.3416 and 1.3345 until the MACD indicator turns up.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.