To open long positions on GBP/USD, you need:

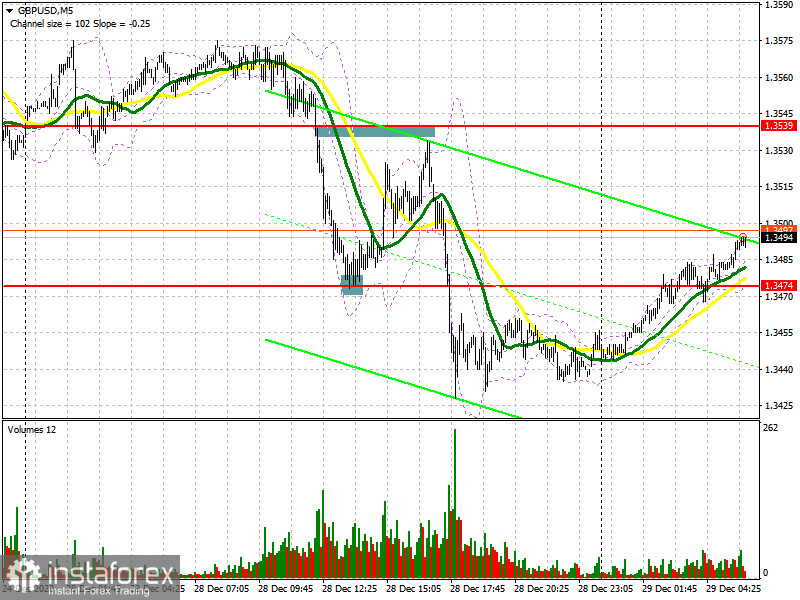

If you recall yesterday's afternoon forecast, I mentioned that it is necessary to open long positions from the 1.3474 level, which happened. Let's take a look at the 5-minute chart. We can see how the bears pulled down the pair after surpassing support at 1.3539, which exactly leads to the 1.3474 level, where after a false breakout, an excellent signal to open long positions was created, as a result of which the pair returned to support at 1.3539. A couple of points were missing before this level was tested from the bottom up, therefore, as in the first half of the day, I was forced to miss this sell signal, which turned out to be quite profitable since that the pair immediately collapsed by 80 points right after.

Before analysing the technical picture, let's take a look at what happened in the futures market last week. The demand for the pound remains, even considering that at the time when this report was released, the signing of a trade agreement between the UK and the EU was not yet announced. The Commitment of Traders (COT) reports for December 21 recorded an increase in interest in the British pound, both among buyers and sellers. Long non-commercial positions increased from 35,128 to 37,550. At the same time, short non-commercial remained practically unchanged and increased only from 31,060 to 31,518. As a result, the non-commercial net position remained positive and grew to 6,032, against 4,068 a week earlier. All this suggests that traders continue to bet on the pound's growth, even in the face of the new Covid-19 strain, which was first reported in the UK. Everyone believes in the vaccine and that the beginning of next year, as soon as the quarantine measures are lifted, will be associated with strong economic growth, which will give the market a new bullish impetus and cause the pound to update new annual highs. Additional stimulus from the Bank of England may somewhat smooth out the upward trend in the pound, but it may not be there, since the trade agreement with the EU was concluded at the very last moment.

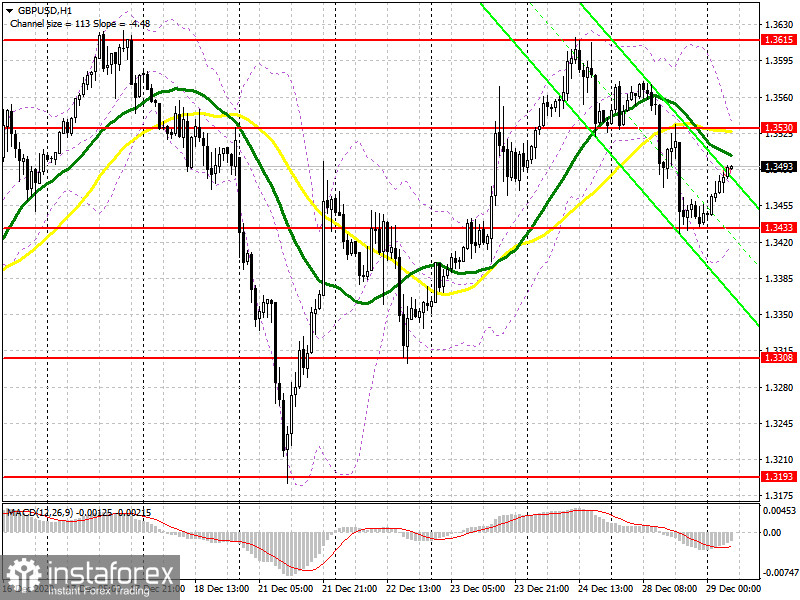

As for the technical picture, the pound slightly recovered during the Asian session and it may continue at the beginning of the European session. Buyers must maintain control over the 1.3433 level in the first half of the day. Forming a false breakout will be a signal to open long positions in sustaining the pound's recovery in the short term and for it to reach the resistance of 1.3530. The main goal will be to surpass this level and settle. Testing this level from top to bottom creates an additional entry point into long positions in hopes to reach a high of 1.3615, which is where the pair fell yesterday. The succeeding targets are still resistances 1.3690 and 1.3750, but they will be available only if excessive volatility appears amid low trading volume on the pre-New Year days. In case the pound falls and bulls are not active in the support area of 1.3433, it is best not to rush to buy, but wait for an update of the 1.3308 low, from which you can buy GBP/USD immediately on a rebound, counting on a correction of 30-40 points within the day.

To open short positions on GBP/USD, you need:

The lack of important fundamentals earlier this week will continue to exert some pressure on investors who are taking profits after the lack of major gains expected from the signing of the UK-EU trade deal. Forming a false breakout in the resistance area of 1.3530 will return pressure to the pair and result in a decline and a test of yesterday's support at 1.3433. Only a real breakout of this level and being able to test it from the bottom up, creates a good signal to open short positions in GBP/USD, in hopes for the pair to fall to lows of 1.3308 and 1.3193, on which the succeeding bear market depends on. Such high volatility at the end of the year should not be ruled out, especially given the low trading volume. If the bulls manage to recapture the 1.3530 level in the morning, then it is better not to rush with short positions. The optimal scenario for selling the pound would be failure to settle above 1.3615. I recommend opening short positions immediately on a rebound from the high of 1.3690, counting on a downward correction of 30-35 points within the day.

Indicator signals:

Moving averages

Trading is carried out below 30 and 50 moving averages, which indicates the pound's succeeding decline in the short term.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the D1 daily chart.

Bollinger Bands

A breakout of the upper border of the indicator in the 1.3530 area will lead to a new wave of growth for the pound. A breakout of the lower border of the indicator around 1.3430 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.