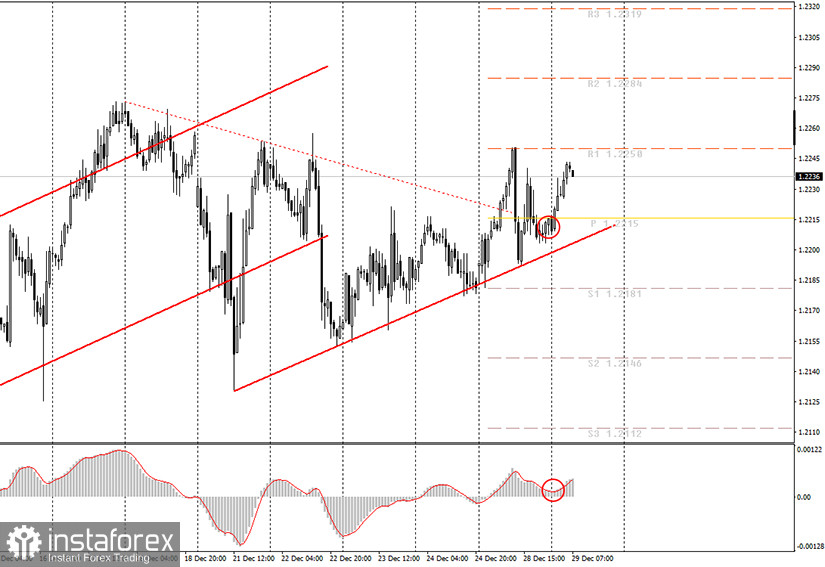

Hourly chart of the EUR/USD pair

The EUR/USD pair began a new round of upward movement last night. Let's remember that one of the two trend lines - the downward trend - lost its relevance yesterday. But the rising one kept it. Thus, formally, we now have an upward trend and should trade up. A buy signal was created from the MACD indicator last night but it wasn't strong, since the indicator did not have time to discharge to zero. There was no rebound from the trend line either. And so those novice traders who did not sleep at night could have opened new long positions and would be in profit at around 15-20 points. We draw your attention to the moment that along with the trend line, there is also a strong resistance level of 1.2250, from which the pair has already rebounded at least three times in the last week. Thus, it is quite possible that the quotes will rebound off this level again and start moving towards the trend line. In general, we would call everything that is happening now in the foreign exchange market as a kind of flat. Therefore, you need to trade accordingly.

No major report or any other event scheduled in America or the EU today, December 29. New Year's week is already in full swing and there isn't really any important information in the markets. Thus, traders can only trade on technique or not trade at all until the end of the New Year holidays. Most of all, the euro/dollar pair is now confused by the fact that the price still does not want to correct in the long term. In fact, the euro has been rising in price since November 2 without interruption. And now would be the ideal time for the pair to fall, but it does not do so. Thus, taking into account this very fact, we can conclude that the upward trend will continue and the euro will keep rising in price in 2021. Moreover, right from the beginning. Well, we just have to identify trends and work them out.

Possible scenarios on December 29:

1) Long positions are currently relevant, since the downtrend line has been overcome, and the upward trend has been preserved. At this time, traders may have kept long deals from last night's signal. When the MACD turns down, these trades can be closed. After that, you should wait for the MACD indicator to discharge and create a new buy signal from it, and then consider opening new long positions with targets at 1.2250 and 1.2284. Also, you can consider the price rebound from a trend line as a buy signal. There is also a possibility that the pair will continue to move in different directions.

2) Trading for a fall does not seem appropriate now. In order to be able to re-examine sell orders, you need to get the price to settle below the rising trend line. In this case, short positions can be opened with targets at 1.2181 and 1.2146.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.