On Monday morning, the markets were mainly trading in the buy area. Oil had consolidated above $ 50 per barrel and the Asia-Pacific stock indices added more than 1% on average, in response to the growth in the US stock market. This is due to the fact that the current US President, Mr. Trump signed a law that provides a large-scale aid package for the economy. There will be no disruption to government operations, and each adult resident of the states will receive $ 600.

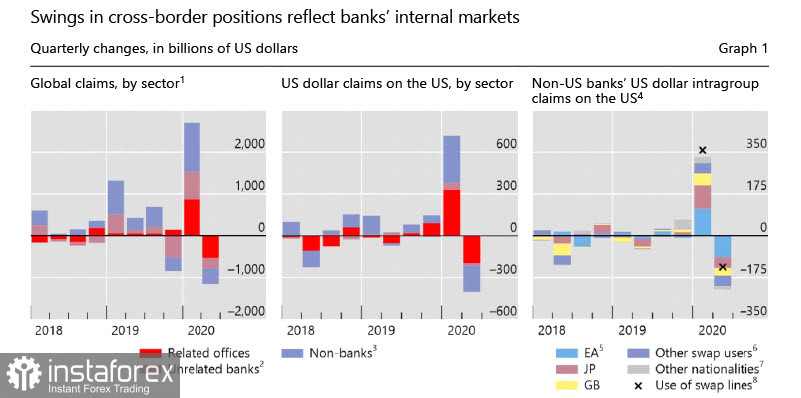

Markets, hoping for additional liquidity, reacted with expected growth. The liquidity issue in the context of the second wave of COVID-19, which is weighed down by new mutations, will become one of the main ones, since the probability of putting new restrictions into effect is getting higher every day. The Bank for International Settlements (BIS) published a study in December that analyzed the use of US dollar swap lines by a number of central banks with the Fed.

According to the BIS, the volume of cross-border banking flows sharply rose in the first half of 2020. As the cost of funding in US dollars soared, the Fed used its swap line network with 14 central banks to globally regulate dollar liquidity. By May, the use of swap lines reached 449 billion, which is a sign of a stressful situation in the entire currency system.

What does all this mean for the currency market? This exactly indicates that central banks have to make much more efforts to satisfy the demand for dollar cash and prevent sharp fluctuations in the currency markets. In fact, it was only due to this mechanism and the unprecedented emission that the exchange rates were kept within limits.

Swap lines are actually an overdraft to keep the dollar currency system afloat. Its creation for currency exchange was announced in 2011, when the Fed led the 6 largest central banks. This measure was temporary and forced, but because of it, the price of gold was brought under control. The system received a respite, since swap lines became permanent in 2013 and the number of central banks was limited to 6. However, their number increased to 14 this year and the volume of capital movement increased several times.

The volume of dollar liquidity was partially repaid in Q2. At the beginning of 2021, the situation threatens to further escalate. The Fed certainly does not allow the system to be unbalanced, so any news about additional liquidity will contribute to the depreciation of the US dollar. Therefore, the time for a strong dollar has not come yet.

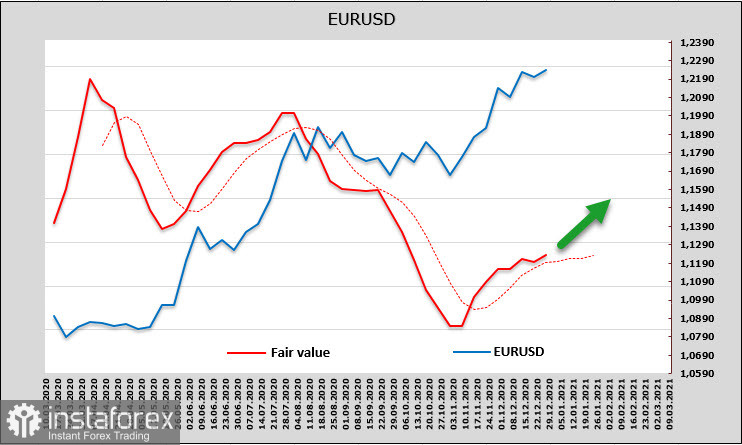

EUR/USD

According to yesterday's CFTC report, the net speculative position in the euro resumed its growth. The changes are minimal, but they have allowed the target price to stay above the long-term average, which increases the chances of continued growth.

There is a high probability of exiting above the level of 1.2275. The long-term target for the euro remains unchanged, which is the resistance zone of 1.2500/50. So, there is no reason to wait for the bullish trend to end and a downward reversal. However, some new factors are needed to continue growth, which are unlikely to appear in the next few days.

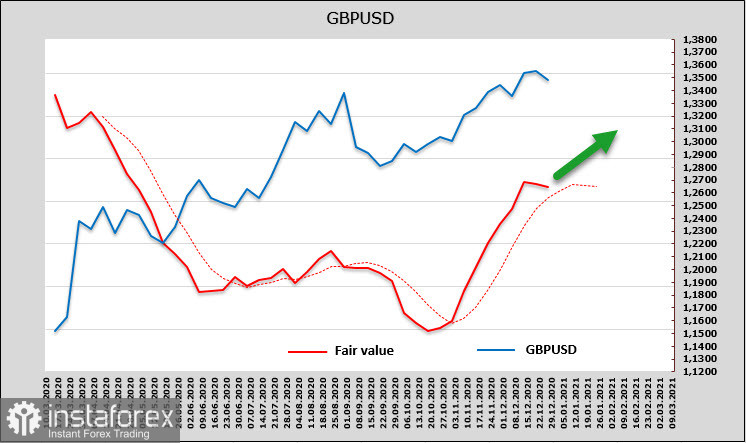

GBP/USD

On Monday, EU's Committee of Permanent Representatives approved the temporary trade agreement between the EU and the UK, concluded the day before. The agreement was approved unanimously. Michel Barnier, head of the European negotiating group, said he was satisfied with the compromise reached, but believes that Brexit is an overall defeat for the EU.

Technically, the momentum is clearly slowing down, while the pound is holding near the highs. The estimated fair price is above the long-term average, but has already reversed down, which increases bearish mood.

The pound can rise to the resistance zone of 1.3610/20. If overcome, it can be bought with the expectation that it will reach the long-term target of 1.3950/4000. However, the probability that profit-taking will start on the growth attempt is getting higher, as the economic situation in the UK will come to the fore after the Brexit issue is completed, which looks quite alarming.