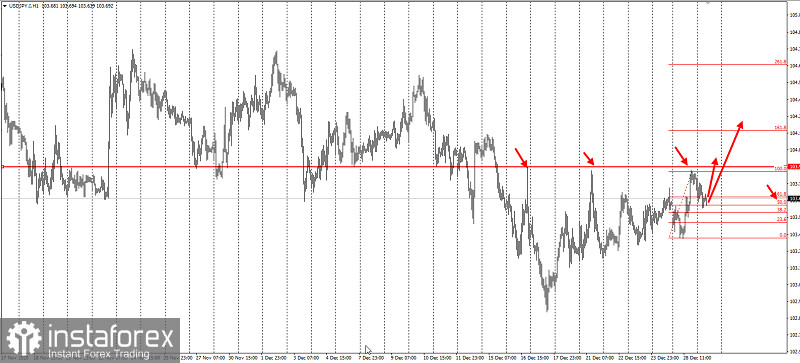

A very interesting situation is developing in the USD / JPY pair today. Sellers are trapped below 103.9, which suggests that traders could open long positions in order to increase the price of the pair.

In fact, the quotes have already formed three wave patterns (ABC), where wave "A" is the upward movement observed yesterday.

Because of this, long positions may be opened from 103.650, the target of which is a 50% retracement in the market. The risk for wave A is 103.4.

If the quote reaches 103.9 or 104, take profit.

But if the breakout from 104 turns out to be true, then half of the positions can be held longer.

The profit/risk ratio of these transactions is 1:1.

Of course, traders have to monitor and control the risks to avoid losing money. Trading is very precarious, but also very profitable as long as you use the right approach.

Price Action and Stop Hunting were used for this trading strategy.

Good luck!