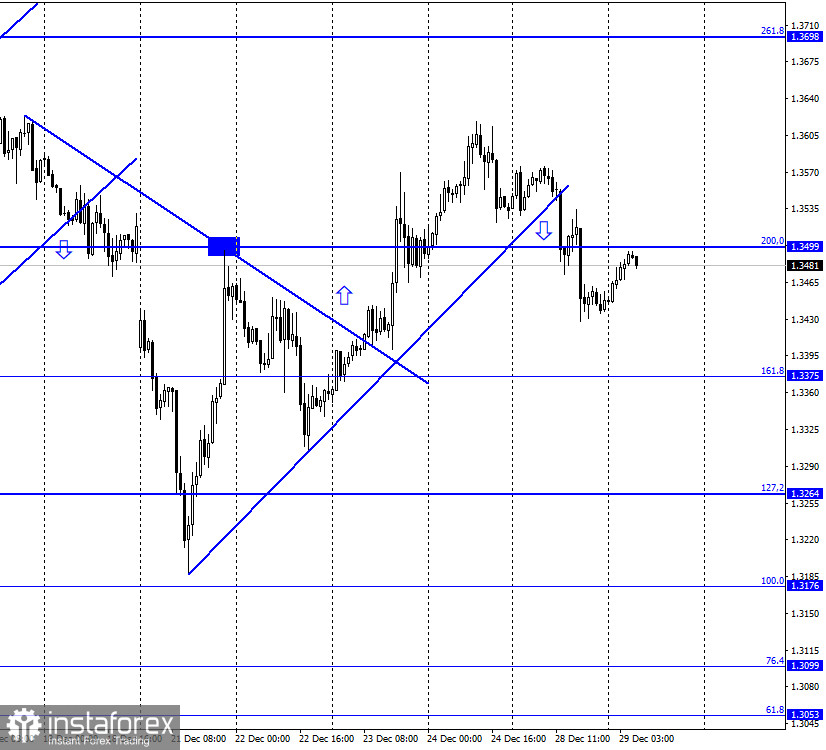

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair on December 28 performed a consolidation under the ascending trend line, so the mood of traders changed to "bearish". After a small pullback up to the corrective level of 200.0% (1.3499), the quotes again performed a reversal in favor of the US currency and resumed the process of falling in the direction of the Fibo level of 161.8% (1.3375). The Briton is not popular among traders this week, however, this does not mean anything at all, since its quotes reached the highs of the year at the very end of last week. Thus, I consider any conclusions that the British pound has started or may start falling now as premature. A vivid confirmation of this is the euro/dollar pair, which also continues to trade near the highs of the year. This suggests that traders are still not looking to buy the US currency. And reasons like Brexit or trade negotiations are only secondary reasons. The dollar index has been falling for several months in a row. The euro and the pound are growing even when the information background is against them. Thus, the conclusion of a trade deal between the EU and the UK helped the British. By and large, traders have already lost all interest in the trade agreement. They are no longer interested in when the European Parliament and the British Parliament will ratify the agreement. However, they should be very interested in the state of the British economy at the end of 2020 and the beginning of 2021, as many experts believe that GDP will still fall in this period.

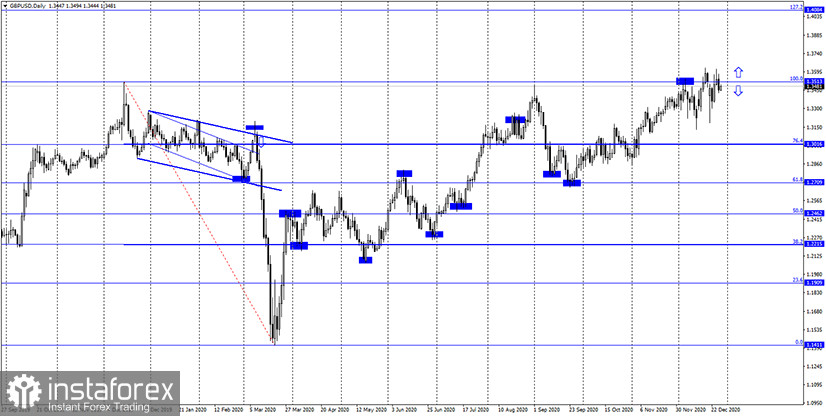

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a reversal in favor of the US dollar and began the process of falling in the direction of the Fibo level of 76.4% (1.3291). In general, starting from November 20, the pair's quotes are moving in a sideways corridor. At first, it was narrow and limited to the levels of 76.4% and 100.0%, then it expanded and is now limited to the levels of 61.8% - 1.3174 and 1.3620.

GBP/USD – Daily.

On the daily chart, the pair's quotes returned to the corrective level of 100.0% (1.3513). The rebound of the exchange rate from this level will again work in favor of the US currency and the beginning of a new fall in the direction of the Fibo level of 76.4% (1.3016).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the second downward trend line. A rebound from it in the long term will mean a reversal in favor of the US dollar and a long fall in the British dollar's quotes.

Overview of fundamentals:

There were no economic reports or other developments in the UK and the US on Monday. The information background was completely absent.

The economic calendar for the US and the UK:

On December 29, the calendar of economic events in the UK and the US are again empty. The information background will be absent today.

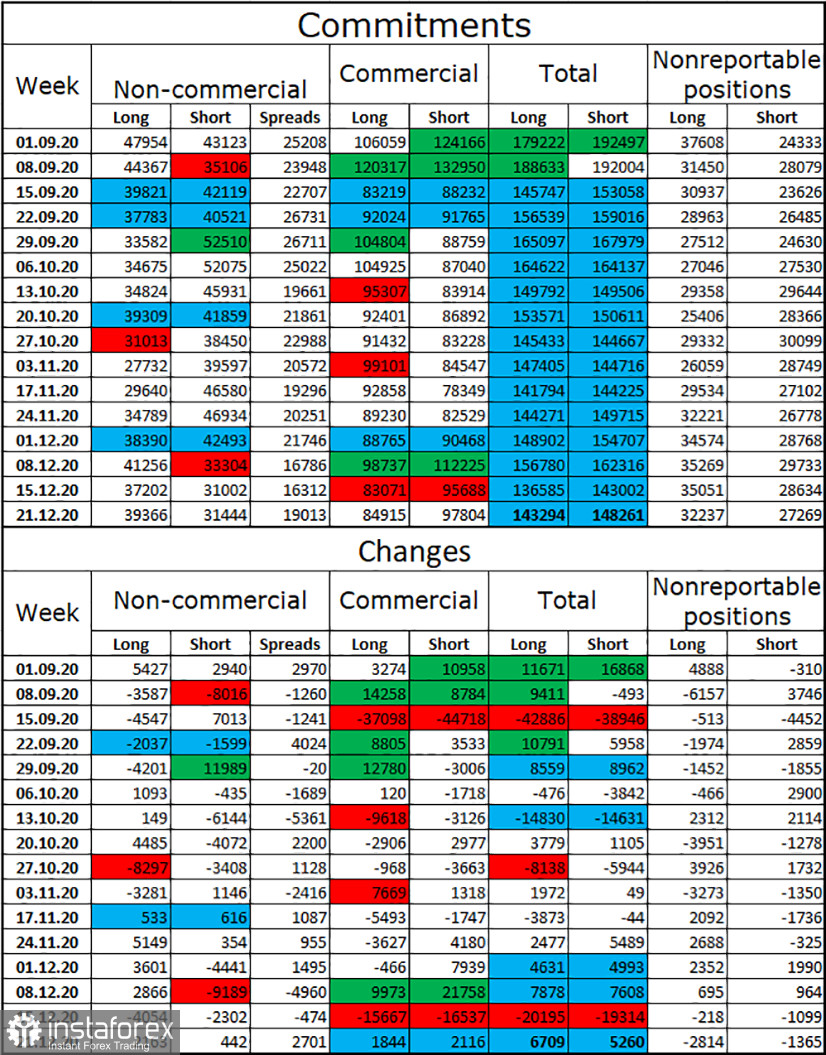

COT (Commitments of Traders) report:

The latest COT report showed that speculators were getting rid of both long and short contracts. The new COT report, which was released only last night, showed only small changes in the mood of large traders. The category of "Non-commercial" traders opened in the reporting week until December 21 - only 2 thousand new long-contracts, and 0.5 thousand short-contracts. Such figures do not allow us to draw any serious conclusions about the future of the British pound. It can be noted that speculators again increased purchases of the British, however, this was already 8 days ago. The total number of long contracts focused on the hands of speculators is only 8 thousand more than short contracts. For example, the difference in the euro currency is 3 times. Thus, I still can not conclude that the mood for the British is exclusively "bullish" and that the pound will continue to grow.

GBP/USD forecast and recommendations for traders:

It is recommended to open new purchases of the British dollar in case of consolidation above the level of 200.0% (1.3499) on the hourly chart with a target of 1.3620. I recommend selling the pound sterling at a rebound from the level of 1.3499 on the hourly chart with a target of 1.3375.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.