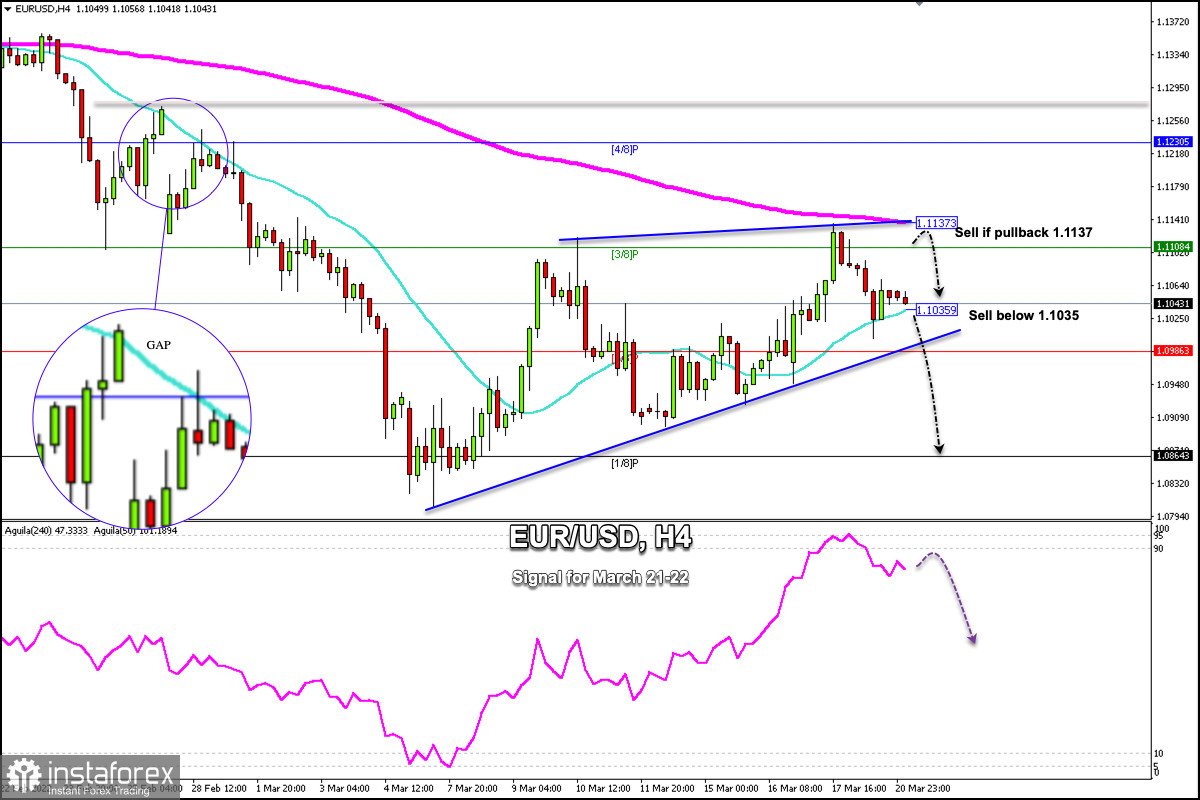

Having reached the maximum of 1.1136 last week, EUR/USD made a technical correction. This level of the 200 EMA was the obstacle that prevented the euro from continuing its upward trend.

Early in the Asian session, the euro is trading around the 21 SMA located at 1.1035. If the currency pair manages to break and consolidate below 1.1030 in the next few hours, it could continue its downward movement until 2/8 Murray located at 1.0986.

Since March 4, the euro has formed an uptrend channel. On two occasions, it has tried to overcome the area of 1.1130. Having failed to reach its target, the Euro made a technical correction.

Therefore, if in the next few hours, there is a pullback towards the 200 EMA located at 1.1137, it is likely to be an opportunity to continue selling the euro with targets at 1.1035 and 1.0864.

On the contrary, with a sharp break and a daily close above the 200 EMA around 1.1137 EUR/USD could continue its upward movement and could cover the gap left on February 25 around 1.1273.

Apparently, the talks between Russia and Ukraine will not end in a peaceful settlement. Ukraine said adamantly that it would not trade an inch of the Ukrainian territory. This could drive investors to the US dollar safe-haven and could increase the negative sentiment of the market.

On March 16, the Eagle indicator reached the 95-point level which represents an imminent technical correction. From that level, we have seen a drop in the Euro last week. However, the euro is likely to remain under downward pressure in the coming days provided that it remains trading below 1.1140.

Our trading plan for the next few hours is to sell below 1.1035 or wait for a pullback towards 1.1137 to sell, with targets at 1.0986 and 1.0864. The eagle indicator supports our bearish strategy.