Today's review of the pound/dollar pair starts with a breakdown of the weekly time frame. It should be recalled that the main and extremely positive event for the British currency was the agreement to sign a trade agreement, which avoids the "hard Brexit" or no-deal option. If the House of Commons of the British Parliament ratifies this agreement, this will allow the British economy to avoid the most negative scenario, as it is known to anyone that the EU will remain the United Kingdom's largest trading partner, even after the UK's official exit from the European Union.

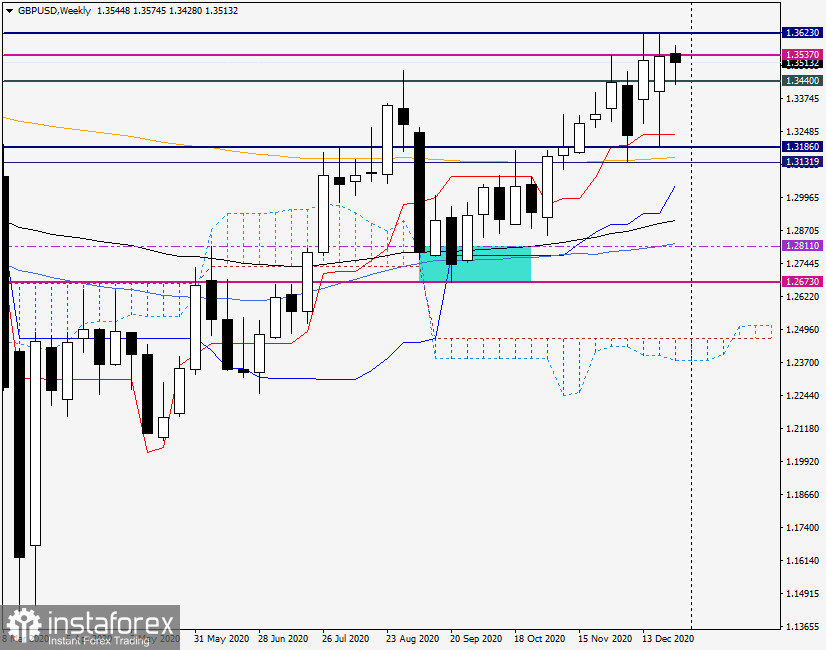

Weekly

Despite the growth shown during two consecutive trading weeks, the pound/dollar pair failed to break through the sellers' strong resistance not only in the level of 1.3623, but also in the level of 1.3537. As a result of repeated attempts, the last level was only broken, however, the pound bulls failed to close the weekly session above the level of 1.3537. This happened despite the reached agreement on future trade relations with the European Union. Therefore, the current five-day period began negatively for the GBP/USD pair. It pulled back to the level of 1.3428, found a strong support there and recovered its losses. If the downward trend continues to change into an upward one, and the bulls manage to complete the weekly trades above 1.3623, the direction will open to a strong and significant technical zone 1.3700-1.3740. On the other hand, if a bearish model of Japanese candlesticks appears as a result of attempts to break through the level of 1.3623, the pair can be expected for at least a corrective pullback. The target of which may be the price area of 1.3240-1.3180.

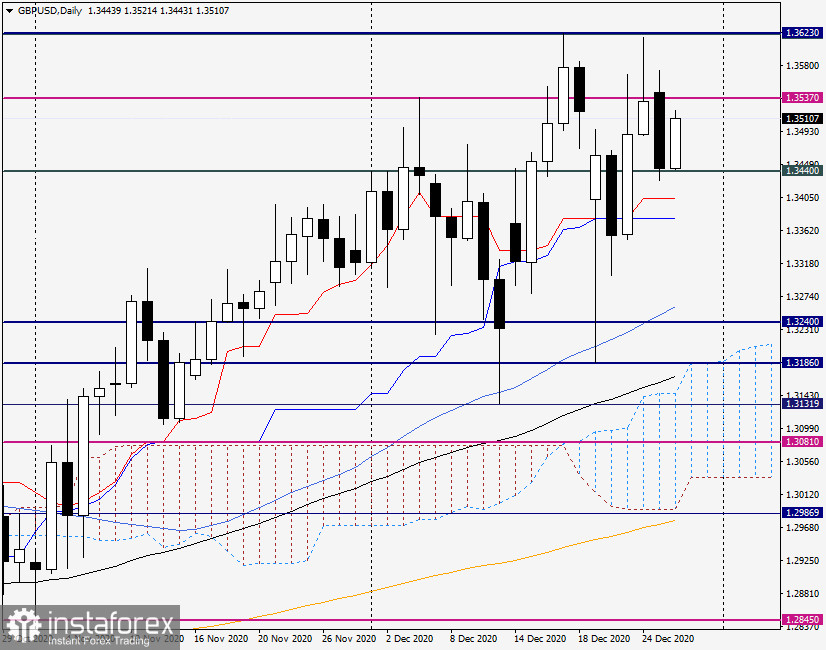

Daily

Yesterday, the pair showed a quite impressive decline and closed Monday's trading at the level of 1.3444 after the appearance of Friday's candle with a particularly long upper shadow. Today's trading for the GBP/USD pair is going positively. It is showing growth and is trading near the level of 1.3510. If the upward trend continues, the next task for the pound bulls will be to close today's session above yesterday's highs shown at 1.3574. Meeting this condition will allow you to retest the strong resistance level of 1.3623, where the maximum trading values were shown on December 17 and 24. However, the bulls should do its best, since the market has won back the positivity from the conclusion of the trade deal between the UK and the EU.

Nevertheless, the main trading recommendation for the pound/dollar pair is to buy, which are best viewed after short-term declines to the area of 1.3460-1.3430. A signal to open sales will appear if a bearish candlestick analysis pattern forms on the daily, four-hour and/or hourly charts in the resistance price zone 1.3575-1.3620.

In terms of today's economic calendar, the US house price index from S&P/Case-Shiller is the only statistics scheduled to be reported, which will be published at 14:00 Universal time. Despite this, I still believe that the course of trading will depend on market mood and the technical component.