To open long positions on EURUSD, you need to:

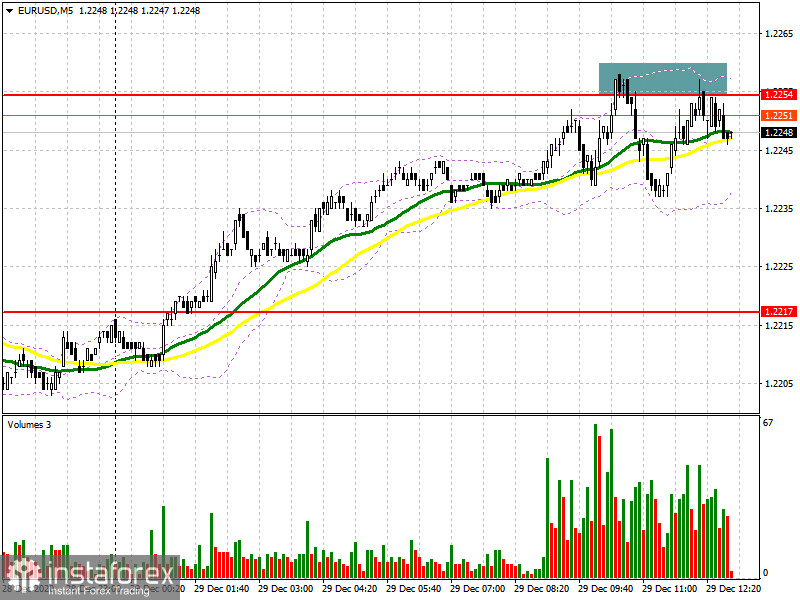

In my morning forecast, I paid attention to the level of 1.2254 and recommended to act from it. If you look at the 5-minute chart, you will see how the bears formed a good signal to open short positions from the level of 1.2254, forming a false breakout. The signal is still active. Until the moment when trading will be conducted below 1.2254, we can expect a decline in the euro. It is also convenient to put a small stop loss for the highs of today.

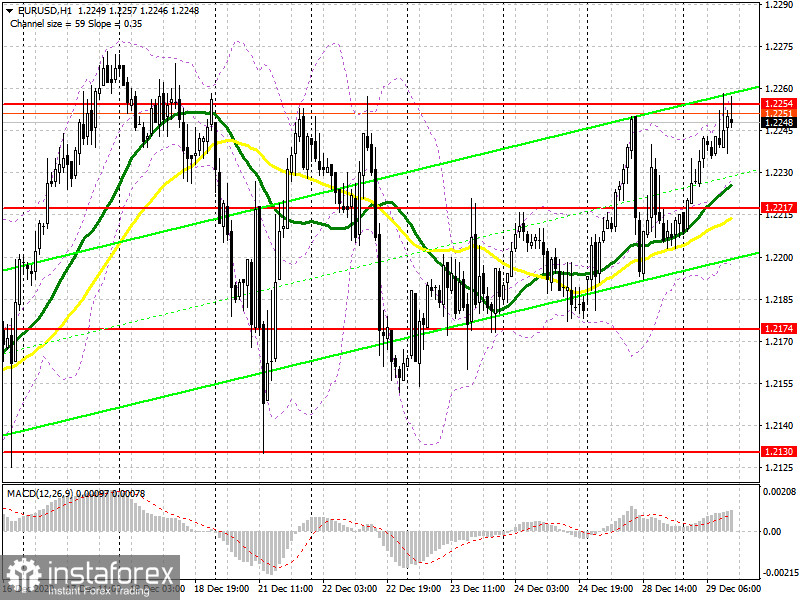

As for the technical picture of the EUR/USD pair, it has not changed compared to the morning forecast, except for the unsuccessful attempt of the bulls to get above the resistance of 1.2254. In the scenario of a decline in the euro in the second half of the day, major players will continue to focus on protecting the support of 1.2217. Only the formation of a false breakout will lead to the formation of a signal to open long positions in the euro. However, given the lack of important fundamental statistics and low trading volume in the last week before the New Year, you can not count on serious activity in the area of 1.2217. In the absence of any action at the level of 1.2217, I recommend to postpone long positions until the update of the larger support level of 1.2174 or buy EUR/USD immediately on the rebound from last week's low in the area of 1.2130 in the expectation of a correction of 20-25 points within the day. It will be possible to say that euro buyers managed to resume the upward trend only after a breakout and consolidation above the resistance of 1.2254, which once again the bulls failed to achieve today during the Asian session. However, only a test of this level from top to bottom forms an additional signal to open long positions in the euro with the main goal of updating the highs of 1.2304 and 1.2339, where I recommend fixing the profits.

To open short positions on EURUSD, you need to:

Sellers of the euro successfully showed themselves in the resistance area of 1.2254 and formed a false breakout, additionally forming a signal to enter the market in short positions. The main goal now is to return to the support of 1.2217, which is the middle of the side channel. However, only fixing under this range with a test from the bottom up will open a direct road to the area of the minimum of 1.2174, where I recommend fixing the profits. The lack of important fundamental statistics today will also affect trading volume, thus, volatility can be quite unpredictable. The further target of the bears will be the level of 1.2130, the test of which will mean a break in the current upward trend. If the bulls find strength and manage to get above the resistance of 1.2254, I recommend not to rush to sell. The optimal scenario will be a test of the maximum of 1.2304, from where you can sell EUR/USD immediately for a rebound in the expectation of a correction of the pair down by 20-25 points.

Let me remind you that the COT report (Commitment of Traders) for December 21 recorded the growth of short positions and the growth of long positions. Buyers of risky assets continue to believe in a bull market amid news that vaccination against the first strain of coronavirus has begun in Europe. However, due to the quarantine measures taken after the detection of a new strain of COVID-19, which appeared recently in the UK, there are still quite a lot of problems. Thus, long non-profit positions rose from the level of 218,710 to the level of 222,443, while short non-profit positions jumped to the level of 78,541 against 76,877. The total non-profit net position rose to 143,902 from 141,833 a week earlier. Delta growth has resumed, however, it is unlikely to continue at the end of this year, as the trading volume will be quite low. Therefore, do not count on the rapid growth of the euro this week, although low trading volume can lead to a surge in volatility.

Signals of indicators:

Moving averages

Trading is above 30 and 50 daily moving averages, which indicates a slight advantage for euro buyers

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

If the pair declines, the lower limit of the indicator around 1.2195 will provide support. A break of the upper limit of the indicator in the area of 1.2254 will lead to a new wave of growth of the euro.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.