The forecasts do not bode well for the dollar next year. And as it got closer, traders almost doubled their rates against the US currency. According to the CFTC, the volume of net short positions of non-commercial traders in the dollar index futures has jumped to its highest levels in the last nine years.

The weakening trend in the US dollar against major world currencies will continue due to a number of factors. According to currency strategists, the Federal Reserve's monetary policy will contribute to such dynamics. Therefore, "institutional investors will have an increased need to search for more risky investments, including in other currencies," experts write.

There are also opposite points of view. Perhaps the new American leader Joe Biden will not interfere in the activities of the central bank, as his predecessor did. Trump, as everyone remembers, put pressure on the Fed to ease monetary policy and lower the dollar.

"Trump needed a weak dollar, zero rates and unlimited quantitative easing to win the trade wars, which, judging by the dynamics of the trade balance, in the end, could not succeed," analysts write.

Meanwhile, the new head of the Treasury, Janet Yellen, is expected to contribute in every possible way to market exchange rates, free from outside interference. This is unlikely to help the dollar, at least in the first half of the coming year. The fact that Washington will focus on a strong dollar has not yet been confirmed.

Thus, the trend will remain downward. More aggressive moves by the Fed contribute to this. In addition, these very steps may be revised upward after the adoption of a new stimulus package by Congress.

The strengthening of the dollar next year should not be ruled out. Naturally, we are talking about corrective growth during a period of short-term pessimistic sentiments in global markets. Unless a new catastrophe occurs in the form of the coronavirus or other shocks that could break the current upward trend in the stock market, the US dollar will mostly trade in the red.

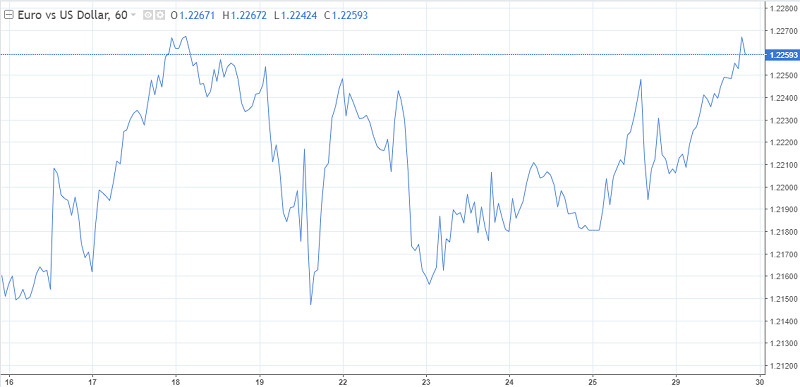

Analysts do not exclude a correction in the US currency at the very beginning of the year. What do we see now?

The dollar index is still at its lows in 2.5 years, but has not managed to gain a foothold below 90 points. This is the so-called milestone, from which the lion's share of investment bank analysts predicted a protracted drop in the greenback for the whole of 2021. Today, after another attack by sellers, the dollar index went below 90. It will not be easy to go beyond this turning point.

The greenback is at a crossroads, its further dynamics will depend on how quickly after the coronavirus crisis the economies of European and Asian countries will recover in comparison with the United States.

If America lags behind the rest of the world, investing in stocks outside the US will become more attractive than in the outgoing year. The prospect of further weakening of the dollar against a basket of competitors will remain.

As for the correction that some market players expect from the dollar at the beginning of the year, it is associated with a shortage of cash. There is almost no free money left on the market, more than 96% of all funds have already been invested in securities. This means that in January a partial return of investors in the dollar is possible. The drama certainly won't happen. The most that we will see is a correction phase similar to the one that took place after the dollar index fell in June and September. That is, about 3% for the dollar index. Thus, in January volatility may surge in favor of the dollar. One has only to take into account that it will be short-lived, on average up to three weeks, analysts predict.

In this scenario, the EUR/USD pair will decline from the current 1.22 to 1.18.

In general, the European economy will recover as the pandemic recedes and the lockdowns weaken. This will be facilitated, among other things, by the stimulating policy from the ECB.

"Taking into account the fact that the real interest rate in the euro area is above zero, while in the US it is below zero, the euro will maintain its advantage over the dollar in 2021 by this criterion," analysts write.

The high demand for risk will also play a role. During such periods, the single currency tends to strengthen against the dollar. EUR/USD in the new year may update its high since February 2018, surpassing the 1.25 level.