A weak dollar and a rapid increase in inflation. Two key topics that will excite the gold market in 2021. Are the forecasts of Bloomberg experts about the continuation of the downward trend in the USD index correct? Will large-scale fiscal and monetary stimulus really accelerate consumer prices? The fate of the precious metal will depend on the answers to these questions.

Gold's success in 2020 was largely due to the rapid response of central banks and governments to the recession. The Fed, ECB, and Bank of Japan have provided financial markets with about $8 trillion in additional liquidity over several months. It took them 8 years to do the same in response to the previous global economic crisis. Then inflation did not accelerate, which led to the fall of XAUUSD from the levels of the previous record high above 1900 to 1050. This time, the monetary stimulus was greater, the Fed acted more aggressively. It is quite possible that this will be enough for a rise in consumer prices.

Moreover, the monetary policy of central banks is not the only factor in the growth of inflation expectations. Once humanity begins to defeat COVID-19, the pent-up demand will drive prices up. The impact of oil on inflation should also be taken into account. It manifests itself with a time lag.

Dynamics of oil and inflation expectations

The key role in the rumors about the reflationary environment was played not so much by the Federal Reserve as by the US Congress. In December, a $2.3 trillion fiscal stimulus and government spending bill was passed in Congress. Moreover, Donald Trump voiced the idea of increasing checks per American from $600 to $2000, which immediately resonated with the Democrats. The House of Representatives has approved a document that will increase the amount of aid to the US economy by about $464 billion. Republicans in the Senate object, but markets believe that under Joe Biden, the fiscal stimulus will be expanded, which fuels talk of a crackdown on inflation and contributes to the growth of XAUUSD.

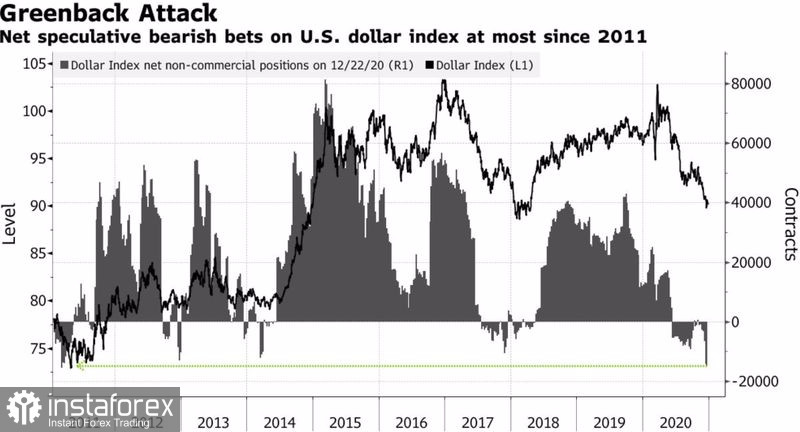

Double deficits (current account and budget), low real yields on US Treasury bonds, and the Fed's intention not to raise the federal funds rate until at least the end of 2023 are putting pressure on the dollar, which is also good news for gold. The US dollar is actively sold due to the growth of global risk appetite, which lowered the net positions of non-profit traders on the USD index to the lowest levels since 2011.

Dynamics of net positions of non-commercial traders in the US dollar

In such conditions, the risks of a pullback due to the avalanche-like closing of short positions increase. The reason may be the growth of uncertainty or the implementation of the principle of "buy the rumor, sell the fact" after the inauguration of Joe Biden. Nevertheless, the correction of the precious metal is unlikely to be deep. Thanks to the weak dollar and the acceleration of inflation, it is quite capable of returning above the $2000 per ounce mark in 2021.

Technically, the potential for a gold rally is likely to be limited by this important level. The probability of forming a 1-2-3 reversal pattern is high. Short-term pullbacks to $1840, $1805, and $1775 should be used for purchases.

Gold, monthly chart