The main currency pair ends the current year with a sharp growth in the market. Its upward movement continued during yesterday's trading, however, the euro bulls failed to break through the strong resistance level at 1.2272. We will give more details about this in the technical part of the review. But for now, you should remember what moves investors to risky operations and creates an overall positive market sentiment.

It should be recalled that the overall budget for the 2021 fiscal year is $ 2.3 trillion, before it became known that the still incumbent President, Mr. Donald Trump still managed to insist and agree with the US Congress to increase payments to citizens from $ 600 to $ 2 000. From the total budget, $ 900 billion will be allocated to support the world's leading economy from the consequences of the COVID-19 pandemic. In this regard, positive moods are observed on the global financial markets. The US dollar is weakening, while the European and commodity currencies are strengthening.

With regards to the ratification of the trade agreement between the UK and the European Union, European parliamentarians have already begun working on approving the bill. There should be no problems here, since the deal is more favorable of Brussels. Today, the House of Commons of the British Parliament will start the process of ratifying the deal that Prime Minister Boris Johnson signed with his European counterparts. I believe that the debate here will be much more intense, but in principle, the British have nowhere to retreat, since a "hard" Brexit can become a real collapse for the economy of the UK. Today, the economic calendar of European reports is not scheduled. In the United States, data on the foreign trade balance, the Chicago purchasing managers' index, as well as data on pending home sales transactions will be released starting from 13:30 (Universal time). However, these publications are unlikely to have a significant impact on the course of trading on the euro/dollar, but they should still be kept in mind.

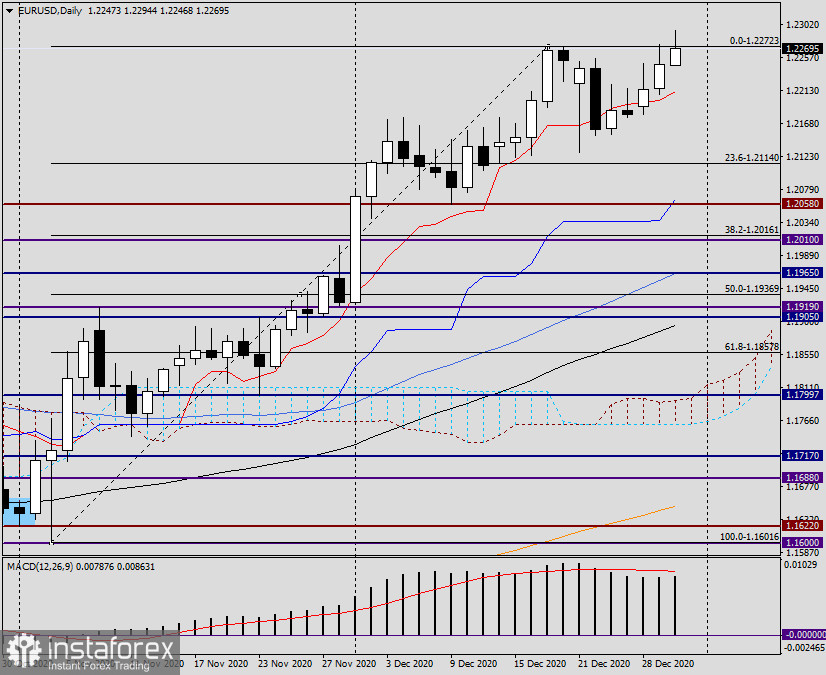

Daily

It can be assumed that technical factors, news from the UK, as well as the general mood of investors, will primarily affect the price dynamics of the EUR/USD pair. According to the technical picture, we should focus our attention to the sellers' strong resistance in the area of 1.2272-1.2294. On December 29, the euro bulls tried again to break through this value, but they only pierced it. The pair pulled back and ended the session at 1.2247, after reaching highs of 1.2274. Nevertheless, the bulls should be given credit, because they are not yet surrendering. At today's trading, they made an attempt to approach the unconquered peaks. The pair was found at the level of 1.2294, but met a strong resistance again. As a result, it pulled back and is trading near the level of 1.2258.

Trading ideas for the euro/dollar pair remain the same, which is opening deals with a trend or buying. However, the recommendations will be different depending on who uses the trading strategy. In my opinion, the best option is to buy after small corrective pullbacks, for example, from current prices near 1.2258. It is always uncomfortable and risky to buy at the peak of the market, and even at the breakout of such a strong resistance level, which is 1.2272. But if this level is still broken on both the four-hour and hourly charts, the pair will consolidate above. Another option is to buy the single European currency on a pullback to the area of 1.2270. However, considering that another rather significant level 1.2300 passes slightly higher, it is better and safer to buy EUR/USD from the bottom. In this case, the stop can be hidden lower, and if successful, the profit will be greater.