Outlook on December 31:

Analytical overview of major pairs on the H1 TF:

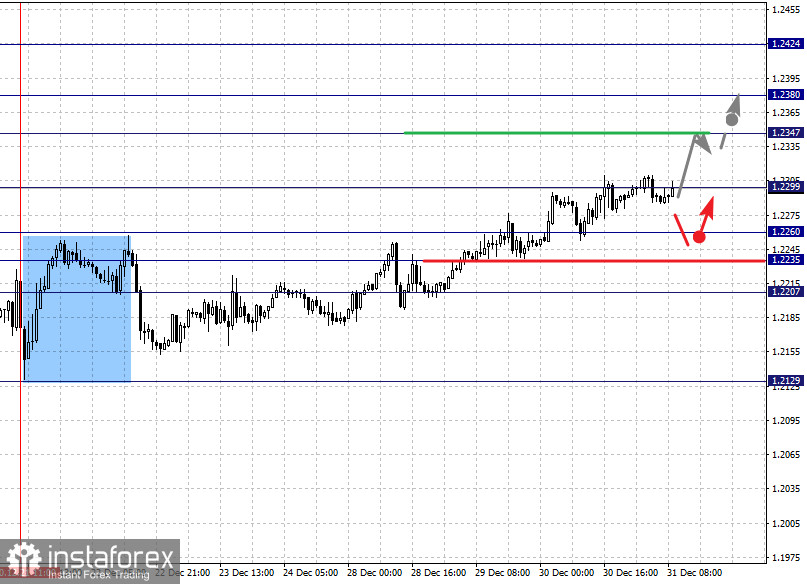

The key levels for the euro/dollar pair are 1.2424, 1.2380, 1.2347, 1.2299, 1.2260, 1.2235 and 1.2207. The development of the formation of the ascending trend from December 21 is being followed here. Therefore, the upward movement is expected to continue after the breakdown of 1.2300. In this case, the target is 1.2347. On the other hand, there is a short-term growth and consolidation in the range of 1.2347 - 1.2380. We consider the level of 1.2424 as a potential upward target. Upon reaching which, price consolidation and downward pullback can be expected.

Short-term decline, in turn, is possible in the range of 1.2260 - 1.2235. If the last value breaks down, a deep correction will occur. Here, the target is 1.2207, which is the upward key support level.

The main trend is the upward trend from December 21

Trading recommendations:

Buy: 1.2300 Take profit: 1.2345

Buy: 1.2350 Take profit: 1.2380

Sell: 1.2260 Take profit: 1.2237

Sell: 1.2233 Take profit: 1.2208

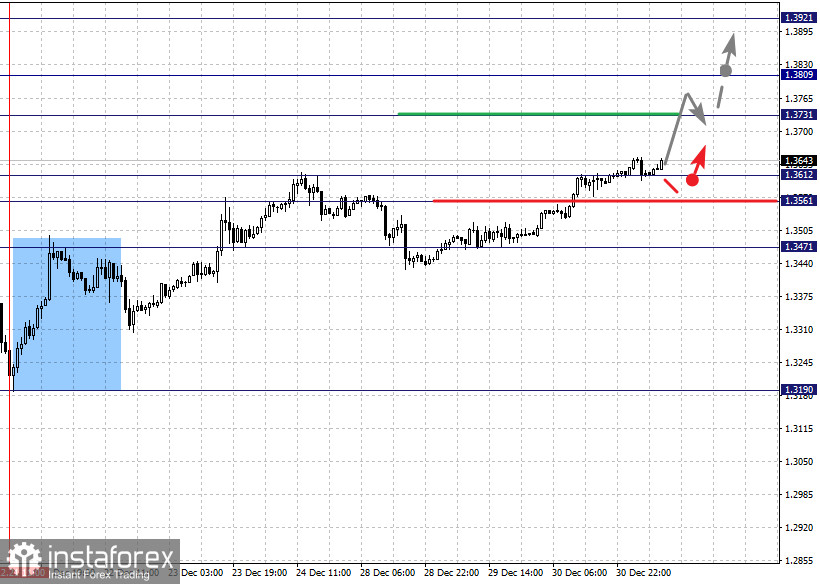

The key levels for the pound/dollar pair are 1.3921, 1.3809, 1.3731, 1.3612, 1.3561 and 1.3471. Here, we are following the upward trend from December 21. Currently, a movement to the level of 1.3731 is expected. In this case, short-term growth and consolidation are in the range of 1.3731 - 1.3809. On the other hand, we consider the level of 1.3921 to be an upward potential target. Upon reaching which, a downward pullback can be expected.

Meanwhile, short-term decline is expected in the range of 1.3612 - 1.3561. If the last value breaks down, a deep correction will occur. Here, the potential target is 1.3471.

The main trend is the upward trend of December 21

Trading recommendations:

Buy: 1.3614 Take profit: 1.3730

Buy: 1.3733 Take profit: 1.3808

Sell: 1.3611 Take profit: 1.3562

Sell: 1.3560 Take profit: 1.3471

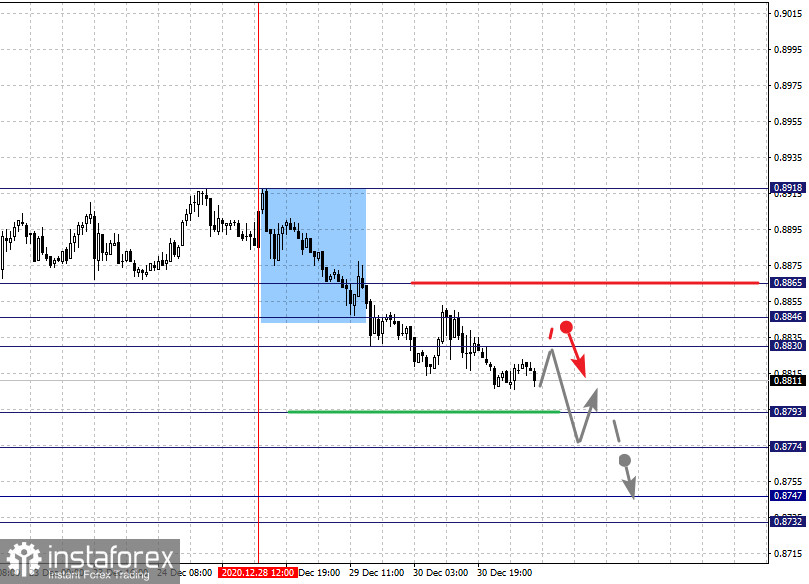

The key levels for the dollar/franc pair are 0.8865, 0.8846, 0.8830, 0.8793, 0.8774, 0.8747 and 0.8732. The downward trend from December 28 is carefully monitored here. So, a short-term decline is expected in the range of 0.8793 - 0.8774. If the last value breaks down, it will lead to a strong decline. The target here is 0.8747. For the potential next downward target, the level of 0.8732 is considered. Upon reaching which, price consolidation and upward pullback are possible.

On another note, short-term growth is possible in the range of 0.8830 - 0.8846. In case that the last value breaks down, it will lead to a deep correction. The next potential target is 0.8865, which is the key support level for the downward trend.

The main trend is the downward trend from December 28

Trading recommendations:

Buy: 0.8830 Take profit: 0.8845

Buy: 0.8847 Take profit: 0.8865

Sell: 0.8793 Take profit: 0.8775

Sell: 0.8773 Take profit: 0.8747

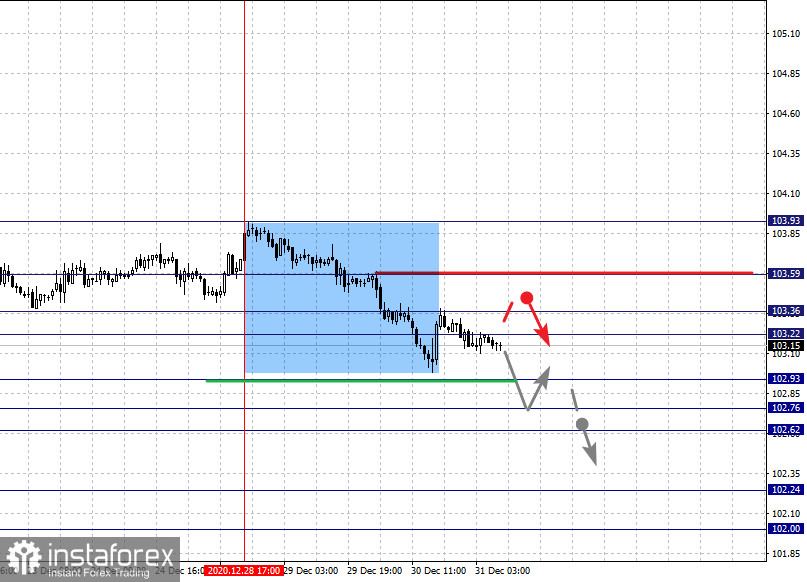

The key levels for the dollar/yen are 103.59, 103.36, 103.22, 102.93, 102.76, 102.62, 102.24 and 102.00. The downward trend from December 28 is being considered as a medium-term. Thus, the downward movement is expected to continue after the breakdown of 102.93. In this case, the target is 102.76. The price overcoming the noise range of 102.76 - 102.62 should be accompanied by a strong decline. The next target is 102.24. For the potential downward target, we consider the level 102.00. Upon reaching which, price consolidation and upward pullback are expected.

Short-term growth is expected in the range of 103.22 - 103.36. If the last value breaks down, a deep correction will occur. Here, the target is 103.59, which is the key support level for the downward trend from December 28.

The main trend is the formation of potential medium-term for the low from December 28

Trading recommendations:

Buy: 103.36 Take profit: 103.58

Buy: 103.61 Take profit: 103.90

Sell: 102.93 Take profit: 102.76

Sell: 103.62 Take profit: 102.25

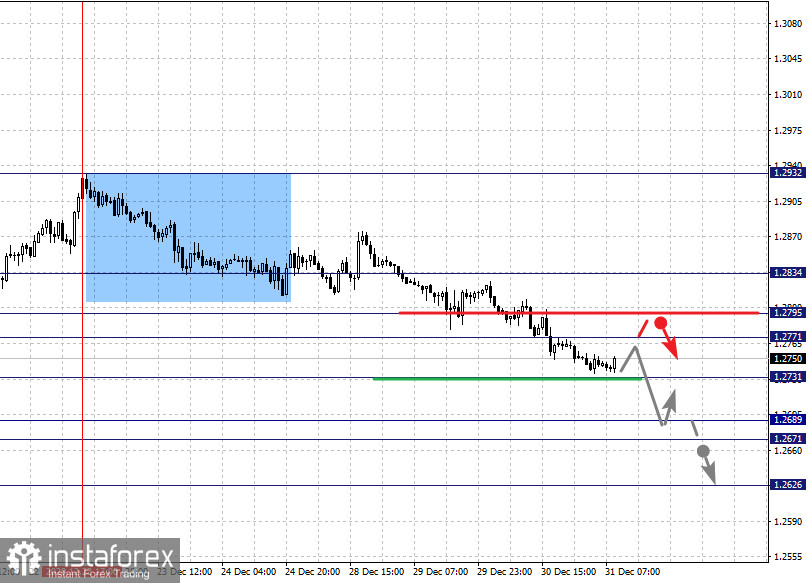

The key levels for the USD/CAD pair are 1.2834, 1.2795, 1.2771, 1.2731, 1.2689, 1.2671 and 1.2626. We are following the downward trend from December 22 here. Against this background, the downward movement is expected after the level of 1.2731 breaks down. In this case, the target is 1.2689. In connection to this, there is a short-term decline and consolidation in the range of 1.2689 - 1.2671. For the potential downward target, we consider the level of 1.2626. Upon reaching which, an upward pullback can be expected.

A short-term growth, on the contrary, is expected in the range of 1.2771 - 1.2795. If the last value breaks down, it will lead to the potential target - 1.2834.

The main trend is the downward trend from December 22

Trading recommendations:

Buy: 1.2771 Take profit: 1.2795

Buy: 1.2797 Take profit: 1.2834

Sell: 1.2730 Take profit: 1.2690

Sell: 1.2670 Take profit: 1.2627

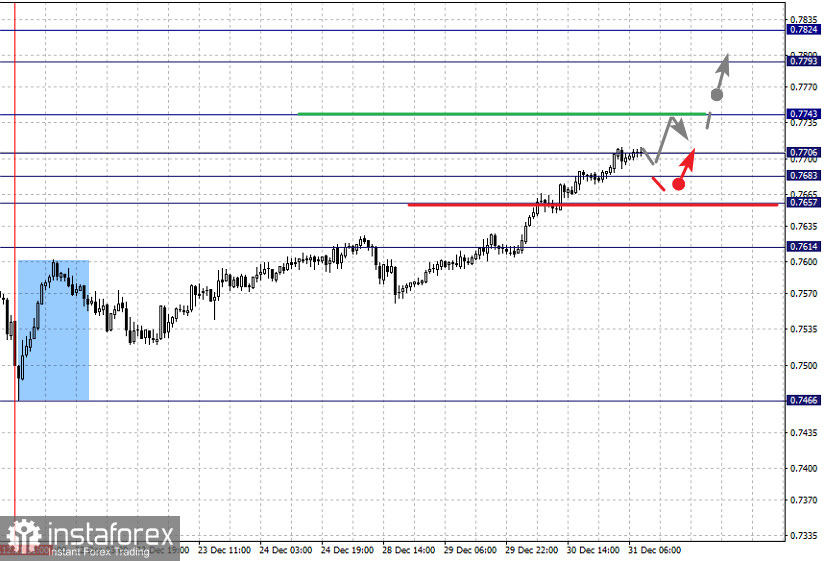

The key levels for the AUD/USD pair are 0.7824, 0.7793, 0.7743, 0.7706, 0.7683, 0.7657 and 0.7614. Here, we are following the upward trend from December 21. Now, the upward movement is expected to continue after the breakdown of 0.7743. In this case, the target is 0.7793. This will be followed by a potential upward target, which is the level of 0.7824. Upon reaching which, price consolidation and downward pullback can be expected.

In turn, short-term decline is expected in the range of 0.7706 - 0.7683. If the last value breaks down, it will allow us to move to the next level of 0.7657. Its breakdown will lead to a deep correction. Here, the target is 0.7614, which is the key support level above.

The main trend is the upward trend of December 21

Trading recommendations:

Buy: 0.7745 Take profit: 0.7791

Buy: 0.7793 Take profit: 0.7824

Sell: 0.7683 Take profit: 0.7658

Sell: 0.7655 Take profit: 0.7615

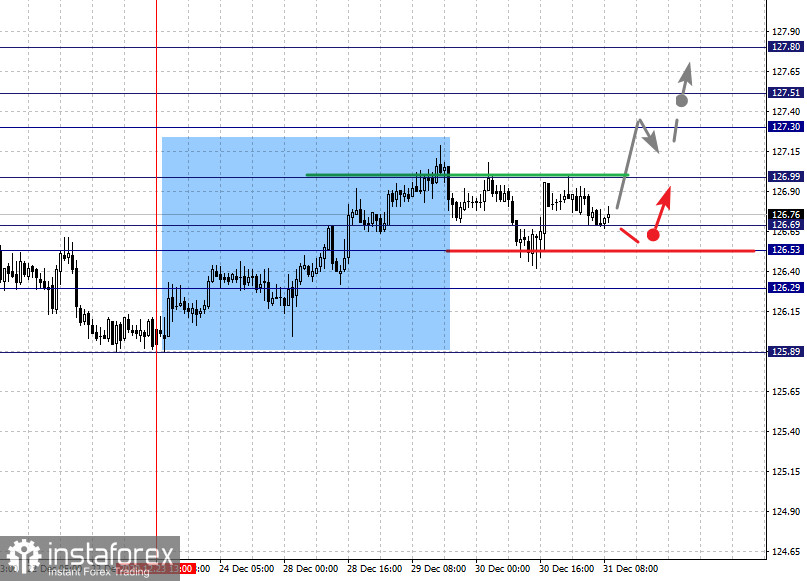

The key levels for the euro/yen pair are 127.80, 127.51, 127.30, 126.99, 126.69, 126.53 and 126.29. Here, we are following the formation of the upward trend from December 23. Due to this, the upward movement is expected to continue after the breakdown of 126.99. In this case, the target is 127.30. Meanwhile, short-term growth and consolidation are in the range of 127.30 - 127.51. If the last value breaks down, it will allow us to count on a movement towards a potential target – 127.80. Upon reaching which, price consolidation and downward pullback can be expected.

On the other hand, short-term decline is expected in the range of 126.69 - 126.53. If the last value breaks down, a deep correction will occur. Here, the target is 126.29, which is the upward key support level.

The main trend is the upward trend from December 23

Trading recommendations:

Buy: 127.00 Take profit: 127.30

Buy: 127.33 Take profit: 127.50

Sell: 126.69 Take profit: 126.54

Sell: 126.51 Take profit: 126.30

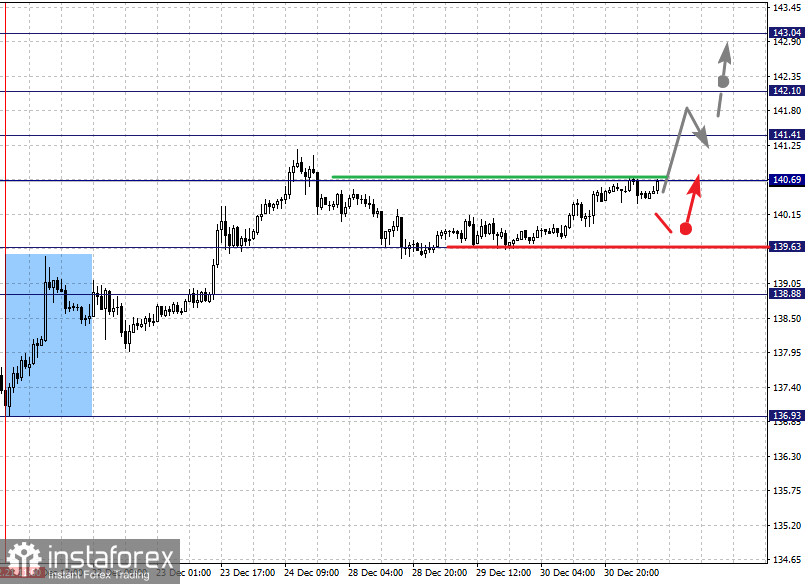

The key levels for the pound/yen pair are 143.04, 142.10, 141.41, 140.69, 139.63 and 138.88. The development of the upward trend from December 21 is being followed here. Therefore, the upward movement is expected to continue after breaking through the level of 140.69. In this case, the first target is 141.41. On the other hand, short-term upward movement and consolidation are in the range of 141.41 - 142.10. As a potential upward target, we consider the level 143.04. Upon reaching which, price consolidation and downward pullback can be expected.

Short-term decline, in turn, is expected in the range of 139.63 - 138.88, wherein a key upward reversal is expected. If the last value breaks down, it will be conducive to the development of a downward trend. In this case, the targets will be determined from the initial conditions on December 24.

The main trend is the upward trend of December 21, correction stage

Trading recommendations:

Buy: 140.70 Take profit: 141.40

Buy: 141.43 Take profit: 142.10

Sell: 139.61 Take profit: 138.90

Sell: Take profit: