Early in the Asian session, EUR/USD is trading above 2/8 Murray and above the 21 SMA located at 1.1001

The US Dollar index (USDX) remains firm around 98.70. Obviously, it is overbought, approaching 98.43 of 4/8 Murray. A sharp break of this support could accelerate the decline towards the 200 EMA located at 97.65. This drop in USDX could favor EUR/USD and it could rise in the next few hours.

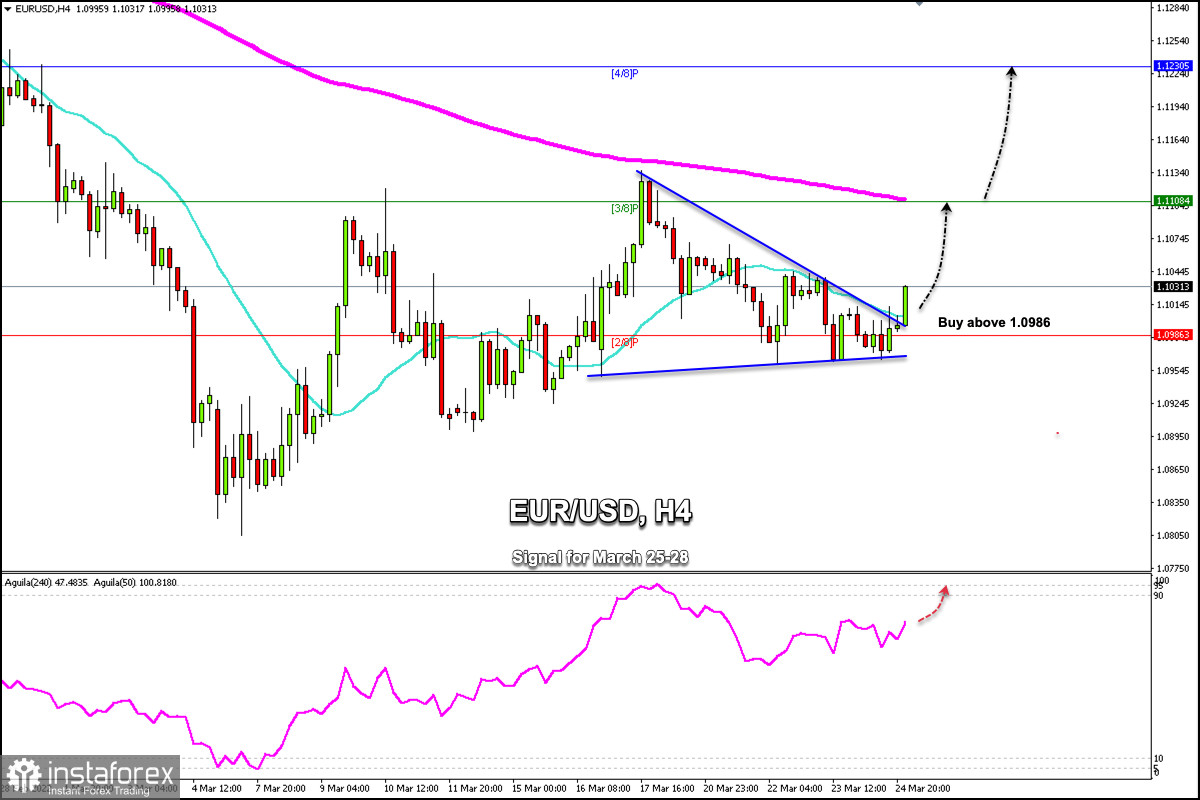

Since March 15, EUR/USD has been forming a symmetrical triangle pattern. Earlier in the Asian session, it made a sharp break above this triangle. This is a positive sign and the Euro is likely to continue this upward move in the next few hours towards the 200 EMA located at 1.1108.

The eagle indicator is giving a positive signal but approaching the overbought zone. In the next few hours, the euro could resume a bullish movement. If it fails to break the 200 EMA located at 1.1108 it could initiate a technical correction.

As long as the Euro continues to trade below the 200 EMA located at 1.1108, the bias remains bearish.

A pullback towards the 200 EMA will give us an opportunity to sell and could resume the dominant bearish move.

On the contrary, a close on daily charts above 1.1100 could mean that the euro has bullish strength and could reach the zone 1.1230 (4/8 Murray). Around this level, the euro left an uncovered gap in the past weeks.

Our trading plan for the next few hours is to buy above the symmetrical triangle. Besides, in case of a technical bounce towards support 2/8 Murray around 1.0986, we could have an opportunity to buy with targets at 200 EMA located at 1.1108. The eagle indicator is giving a slightly positive signal.