Crypto Industry News:

Firms in El Salvador have been in no rush to adopt Bitcoin since the country became famous in September 2021 for recognizing cryptocurrency as legal tender, according to a recent study by the Salvadoran Chamber of Commerce.

Of the 337 companies surveyed between January 15 and February 9, only 14% said they had traded in BTC since the Bitcoin Act came into force. Over 90% of companies indicated that the adoption of Bitcoin in the country had little effect on their sales.

Seventy-one percent of the surveyed companies are micro or small companies, 13% are medium-sized companies, and 16% are large companies.

While the low adoption rate may appear disappointing at first glance, El Salvador has been at the US dollar level since 2001. Unlike the currencies of other emerging economies, El Salvador's main medium of exchange is not susceptible to currency volatility. Even in this environment, more than one in ten companies in the country reported using Bitcoin in a five-month period.

El Salvador's President Nayib Bukele has placed Bitcoin at the heart of his economic growth strategy, even as institutions such as the International Monetary Fund and Moody's Investors Service warned against adopting the flagship cryptocurrency. In January, Moody's analyst Jaime Reusche expressed the opinion that the Bitcoin Bukele gambit could undermine his country's credit outlook.

Nevertheless, El Salvador is expanding its crypto strategy by issuing $ 1 billion in Bitcoin bonds. Also known as Volcano Bonds, the proceeds from the sale will be used to finance Bitcoin City, a fully functioning metropolis that will use geothermal energy to extract digital assets.

Bukele is set to speak at the upcoming Bitcoin 2022 conference where he has promised a "huge surprise".

Technical Market Outlook:

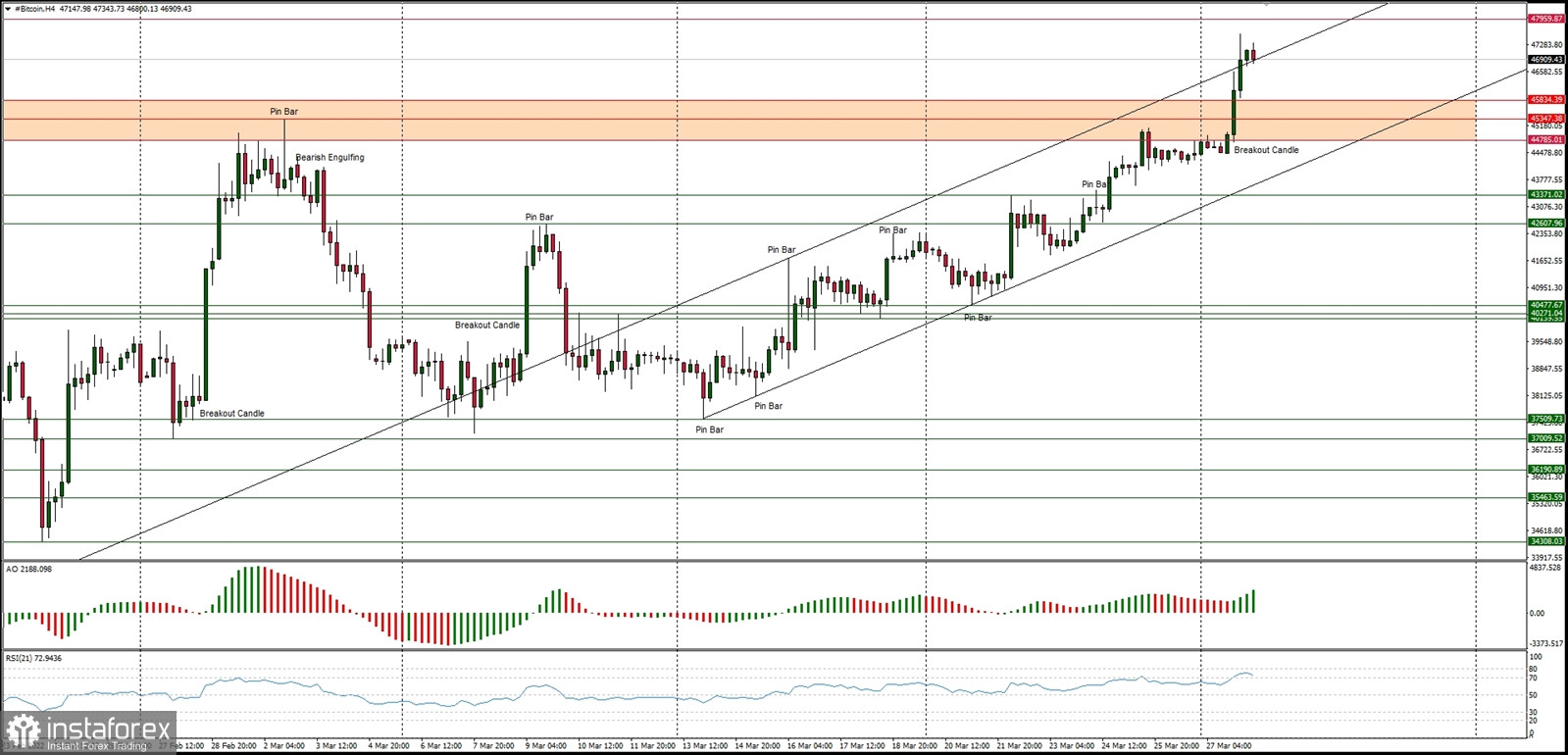

The BTC/USD pair had broken above the supply zone located between the levels of $44,785 - $45,823 and made a new local low at the level of $47,566. The market is trading inside the ascending channel and as long as the price stay inside the channel and above the old supply zone (now it is a demand zone), the outlook remains bullish. The strong and positive momentum supports the view. The next target for bulls is seen at the level of $47,959 and $49,419.

Weekly Pivot Points:

WR3 - $54,840

WR2 - $50,509

WR1 - $48,758

Weekly Pivot - $44,750

WS1 - $43,057

WS2 - $38,623

WS3 - $36,642

Trading Outlook:

The market still keeps trying to bounce after over the 60% retracement made since the ATH at the level of $68,998 was made. The bulls are now approaching the game changing technical supply zone seen between the levels of $52,033 - $52,899. When this zone is clearly broken, the BTC is back to the up trend, otherwise the bearish pressure might push down the BTC towards the level of $29,254.