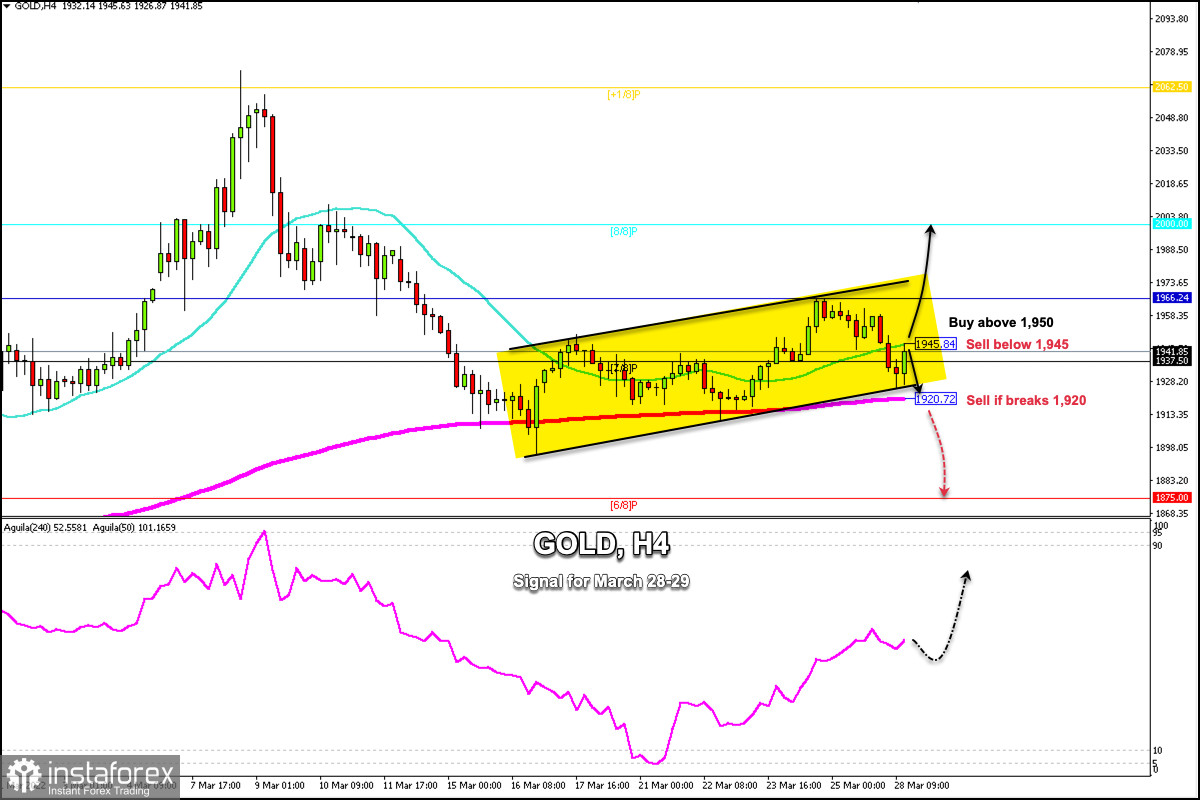

Gold (XAU/USD) is under bearish pressure below the 21 SMA. After hitting 1,966 last week, it continues its downtrend and could drop towards the 200 EMA at 1,920.

Since March 16, gold has been trading within an uptrend channel. In the European session, XAU/USD reached 1,924, right at the bottom of the uptrend channel, and then started a technical bounce back towards the 21 SMA located at 1,945.

One factor that puts the strength of gold at risk is the rise in 10-year government bonds, which reached 2.55%, the highest level since 2019, dragging gold down.

EMA of 200 is located at 1,920, this is a very strong dynamic support. A breakout and a close on daily charts below this moving average could trigger a further downward move, with the next relevant support at 1,875, where 6/8 Murray is located.

Technically, as long as gold remains above 1,920, we may have a hope for a recovery and a bullish bias remains in place. A return above 1,950 would give firmer support to the yellow metal, which could then go looking for the high of the last week at 1,966. Gold may even reach 8/8 Murray at the psychological level of 2,000.

Our trading plan for the next few hours is to sell gold while it trades below the 21 SMA located at 1,945, with a target at 1,875.

On the other hand, on 4-hour charts a close above the 21 SMA located at 1,945 will be a signal to buy with targets at 1,966 and 2,000.