USD/JPY opened the week with a strong move higher, reaching the key psychological level of 125.00 in the European session for the first time since August 2015.

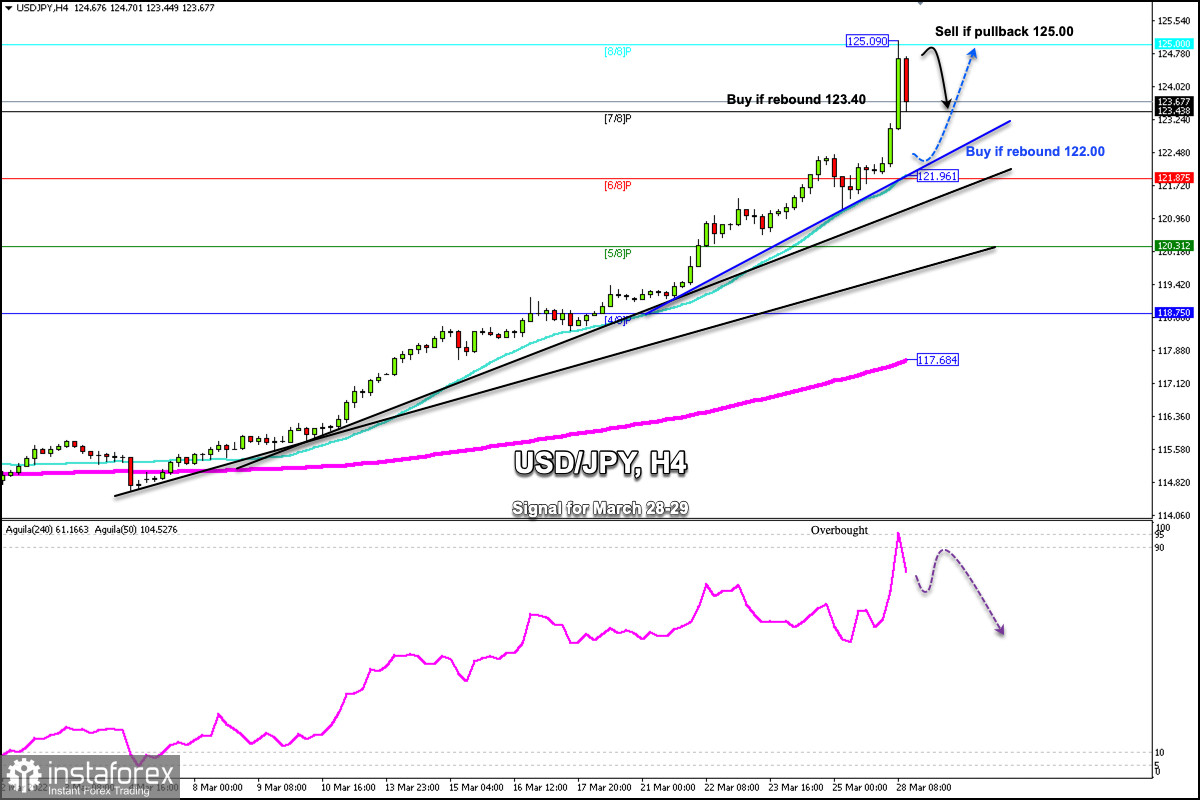

After this rally towards the zone 8/8 Murray at 125.09, the Japanese is making a technical correction and at the time of writing this article is trading at 123.67.

On March 4, the Japanese yen began an upward movement around the area 114.62. In less than a month, it has gained more than 1000 pips. This shows that the yen could continue its upward trend in the coming months and reach the level 130.00.

The eagle indicator climbed to the 95-point zone in the European session. It signals that the market is extremely overbought. It means that there could be a technical correction in the next hours or days and USD/JPY could reach the 6/8 Murray zone located at 121.87.

Around the 21 SMA located at 121.96, a technical bounce could occur and the market could resume its bullish move with targets at 123.43 and up to the psychological level of 125.00.

On the other hand, if the bullish force prevails and USD/JPY rebounds above 7/8 Murray around 123.43, it will be an opportunity to continue buying with targets at 8/8 Murray located at 125.00

Another opportunity that the market can give us will be to wait for a pullback in the area of 125.00 to sell, with targets at 123.40 and 122.00 (SMA 21).