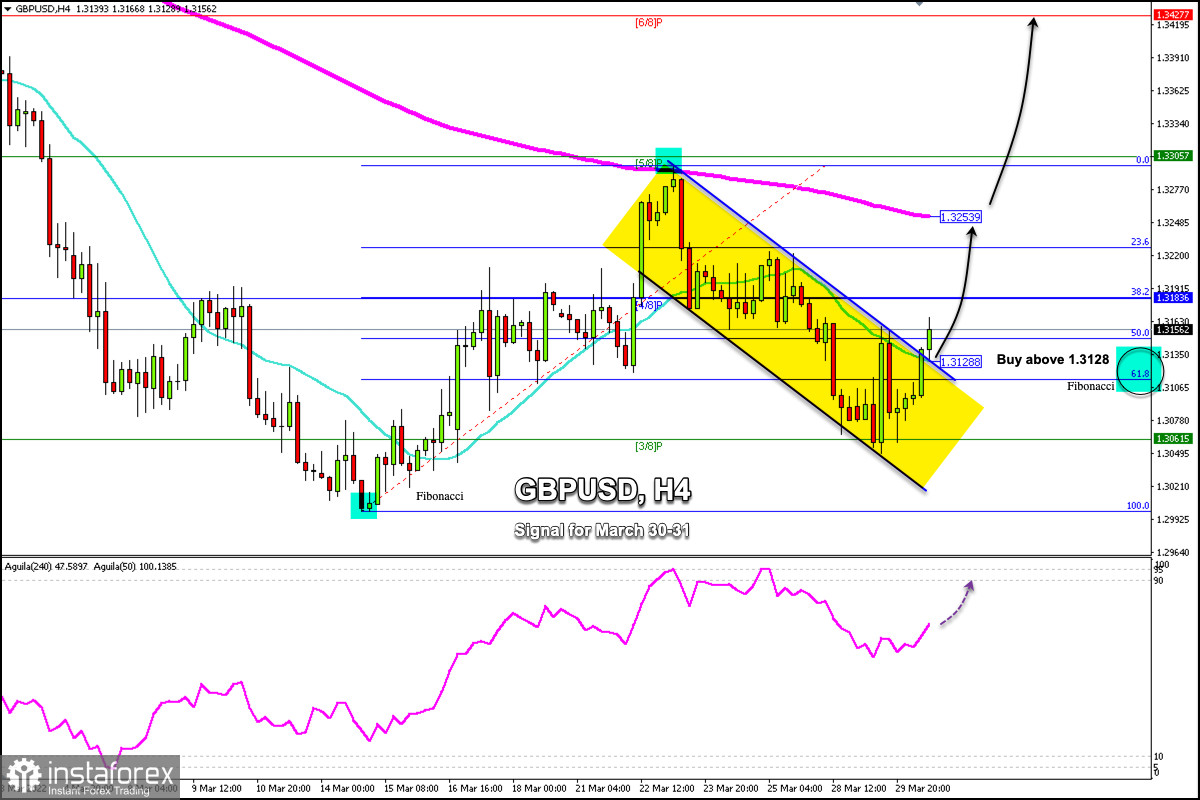

GBP/USD has recovered above 1.3061 (3/8 Murray), due to geopolitical optimism, which is weakening the strength of the US dollar. So, the British pound is taking advantage of the weaker US dollar.

Early in the American session, the British pound is trading above the 21 SMA located at 1.3128 and above the 61.8% Fibonacci.

We can see a breakout of the downtrend channel that has been underway since March 21.

As long as GBP/USD continues to trade above this downtrend channel, it is expected to extend its bullish move towards 4/8 Murray located at 1.3183 and can reach the 200 EMA located at 1.3253

GBP/USD has corrected to the zone of 61.8% Fibonacci around 1.3110. This means that the price could extend its bullish move in the next few days to the 200 EMA at 1.3253 amid the growing bullish force. The level of 6/8 Murray at 1.3427 is in the cards.

The main impetus to the rise of GBP/USD was a drop in the US dollar. Its index has been falling for the second consecutive day from 99.21. It is now located below the 21 SMA which is a clear sign that the dollar will continue to weaken in the coming days and favor the pound until it reaches the level of 1.3400.

The resistance of 1.3183 (4/8 Murray) could put pressure on the pound and it could fall until it bounces above the 21 SMA at 1.3128. Then, GBP/USD could resume the bullish move and reach 1.3253, and until the next resistance of 1.3305.