Crypto Industry News:

The International Monetary Fund (IMF) has issued a warning related to sanctions against Russia. According to the organization, obstructing Russia's access to banking services and imposing sanctions on its central bank may increase interest in cryptocurrencies. This, in turn, would lead to a weakening of the position of the US dollar.

On the one hand, Gita Gopinath, the deputy managing director at IMF, informed in a press interview that some countries are trying to renegotiate the currencies in which trade is settled:

"(...) renegotiating the currency in which they get paid for trade".

On the other hand, she underlined her belief that the dollar would remain the world's main currency even in such a situation. However, she added that minor divisions could occur:

"The dollar would remain the major global currency even in that landscape, but fragmentation at a smaller level is certainly quite possible."

The European Union has also repeatedly informed that it is necessary to quickly regulate cryptocurrencies so that the Russians cannot use them. However, it is worth understanding that most of such transactions are easy to trace (which is confirmed by the ongoing hunt for Russian cryptocurrency wallets), and in addition, it is still a relatively small market, so using it for such purposes does not make much sense.

Returning to concerns about whether the dollar will weaken, Berkshire Hathaway vice president Charlie Munger believes that the value of all Fiats will drop to zero in 100 years.

Technical Market Outlook:

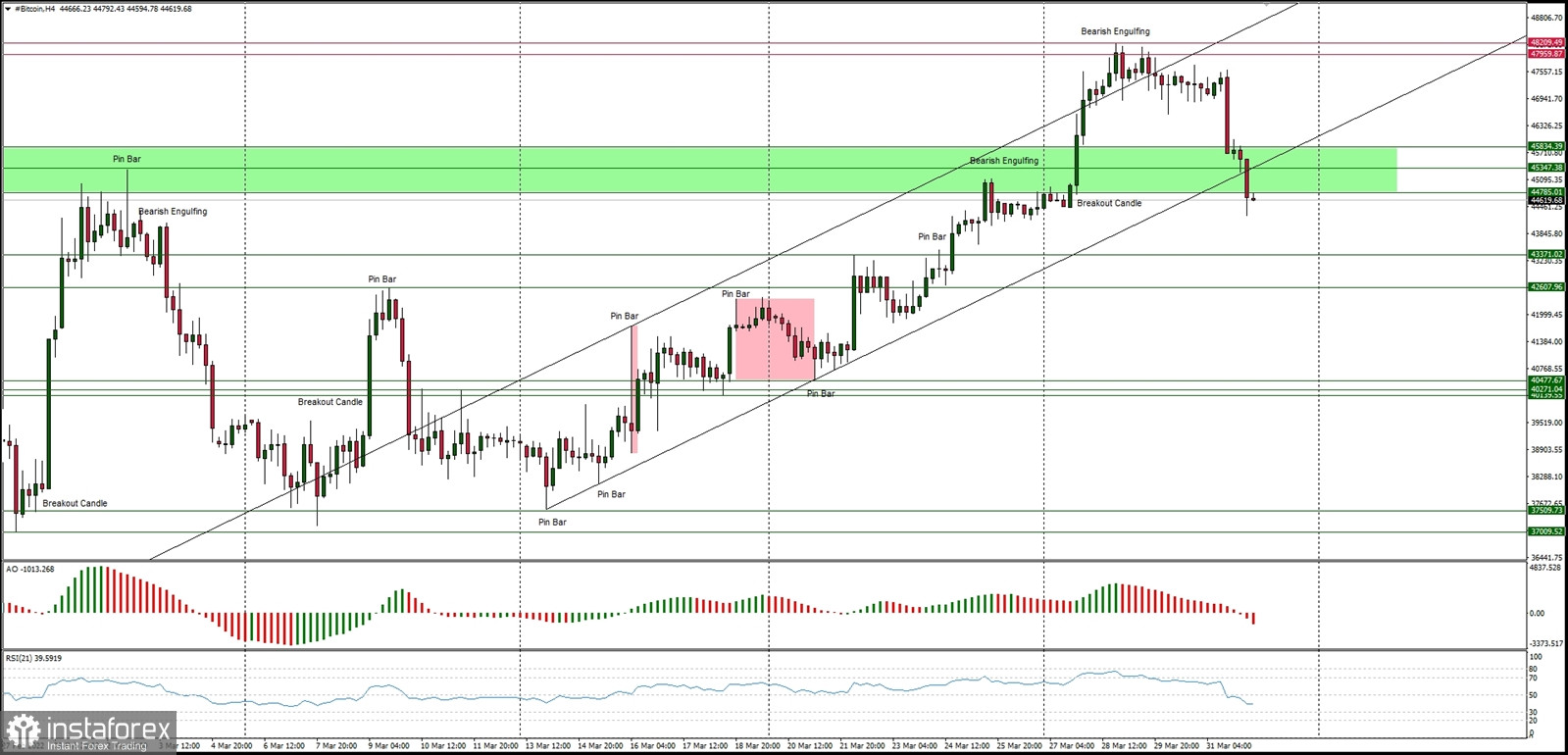

The BTC/USD pair had made a new swing high at the level of $48,200, but during the pull-back the price broke below the ovebalance level located at $46,357 and started a regular corrective cycle. The local low was made at the level of $44,257 (at the time of writing the article) and the demand zone located between the levels of $44,758 - $45,853 had been violated as well. The next target for bears is seen at the level of $43,371 and $42,607. The weak and negative momentum supports the short-term bearish outlook.

Weekly Pivot Points:

WR3 - $54,840

WR2 - $50,509

WR1 - $48,758

Weekly Pivot - $44,750

WS1 - $43,057

WS2 - $38,623

WS3 - $36,642

Trading Outlook:

The market still keeps trying to bounce after over the 60% retracement made since the ATH at the level of $68,998 was made. The bulls are now approaching the game changing technical supply zone seen between the levels of $52,033 - $52,899. When this zone is clearly broken, the BTC is back to the up trend, otherwise the bearish pressure might push down the BTC towards the level of $29,254.