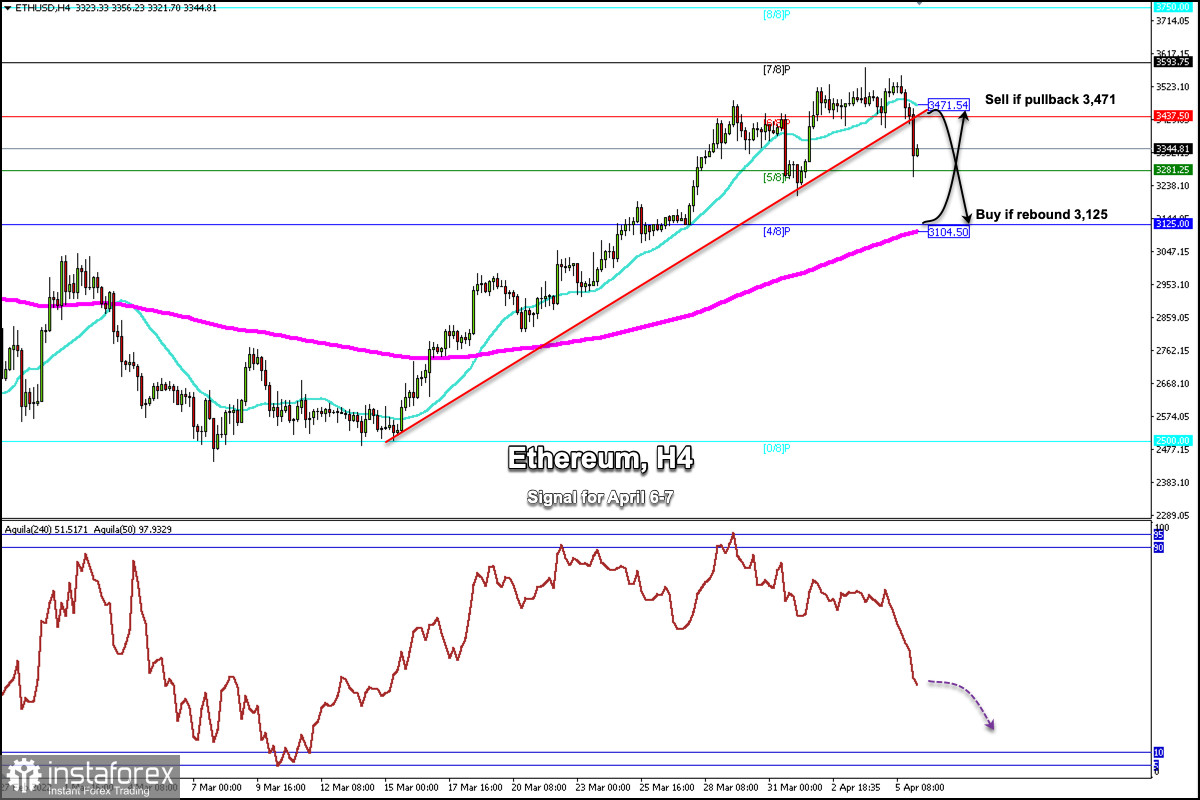

Since March 12 Ethereum (ETH/USD) has been moving above the 21 SMA until early April. ETH had an impressive rally from $2,500 reaching the resistance zone of 7/8 Murray around $3,593, a rebound of more than 40%

Today in the Asian session, the crypto is trading around $3,344 after having tested the support at 5/8 Murray. It is likely that this bounce could reach the 21 SMA zone located at $3,471.

Additionally, if Ether continues its corrective trend, could be a good opportunity to wait for the area $3,104 around 4/8 Murray and around the 200 EMA for a good buying opportunity.

Conversely, a pullback towards 6/8 Murray or the 21 SMA, if it fails to break and consolidate above this level, could be a good signal to sell with targets at $3,281 and $3,104.

The eagle indicator is giving a negative signal and it is likely to continue its downward movement in the coming days. ETH could reach the psychological level of $3,000.

7/8 Murray around $3,600 will be decisive for ETH. Failure to close above could probably result in a quick return to $3,000 or even lower to $2,500. But success above $3,600 probably means the price can reach the psychological level of $4,000.

Our trading plan is to sell in case of a pullback towards $3,471 or wait for a technical bounce off the around 200 EMA at $3,104 to buy. The eagle indicator is giving a negative signal. The technical correction is likely to continue in the next few hours.