The EUR/USD pair is trading in the red at the time of writing as the Dollar Index has managed to rebound. In the short term, the DXY retreated after its amazing rally, but the bias remains bullish. DXY's further growth could push the currency pair towards new lows.

Fundamentally, the Euro took a hit from the German Factory Orders which registered a 2.2% drop versus 0.2% expected, and from the Euro-zone PPI which surged only by 1.1% versus 1.2% expected. The EUR/USD pair increased a little only because the Dollar Index retreated.

Later today, the FOMC Meeting Minutes represent a high-impact event, anything could happen.

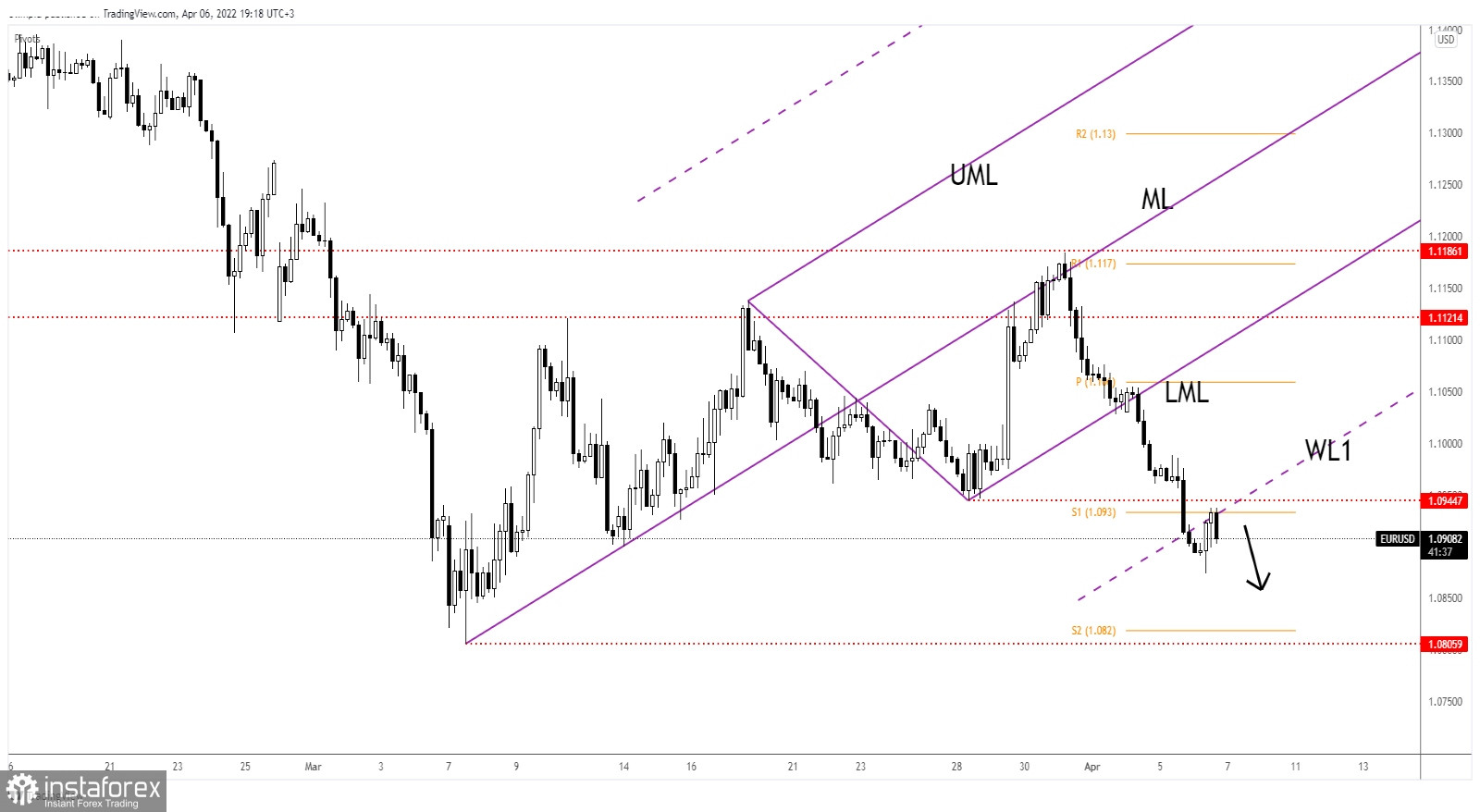

EUR/USD Breakdown Validated!

From the technical point of view, the bias remains bearish despite today's rebound. The rate retested the broken S1 (1.0930) and the warning line (WL1) and now it seems determined to resume its drop.

As long as it stays under 1.0944, EUR/USD could extend its downside movement. After its amazing sell-off, a temporary rebound was natural.

EUR/USD Outlook!

The warning line (WL1) retest could bring new short opportunities. As I've said, the bias is bearish as long as it stays under 1.0944. Also, retesting this upside obstacle or registering false breakouts above it may signal a new sell-off.

1.0805 lower low stands as a potential downside obstacle and target if the EUR/USD pair continues to drop.