Crypto Industry News:

A recent report found that almost a fifth of the total Bitcoin share is now owned by publicly traded mining companies.

The report, published by Arcane Research, details that publicly traded BTC mining companies now account for 19% of the total bitcoin hash rate. In January this result was only 3%.

The term hash rate refers to the total computing power used by a miner's hardware to confirm a transaction. A higher hashing factor provides increased protection against the BTC reverse process on the blockchain. This contributes to a BTC hash rate of at least 51%.

Although only a small number of public mining companies existed at the beginning of last year, a total of 26 different public companies are currently involved in bitcoin mining. This increase is due to the growing number of mining companies entering the stock exchange.

The report found that the rise in the number of publicly owned mining companies was driven by public companies that had greater access to capital. This allows them to develop their mining fleets faster than their private competitors.

Currently, 44.95% of the global hashing rate comes from North American miners, according to the latest Cambridge Bitcoin data. With the enormous expected increase in the target hash rate among publicly traded Bitcoin miners, that number is set to rise. This means that the Bitcoin network will gradually become more and more centralized over time.

Bitcoin mining has increased significantly in the last few years as the hash rate of cryptocurrency hit a new all-time record of 248.11 EH / s on February 18. Currently, this index is 213.16 EH / s, i.e. approximately two hundred and thirteen trillion hashs per second.

Technical Market Outlook:

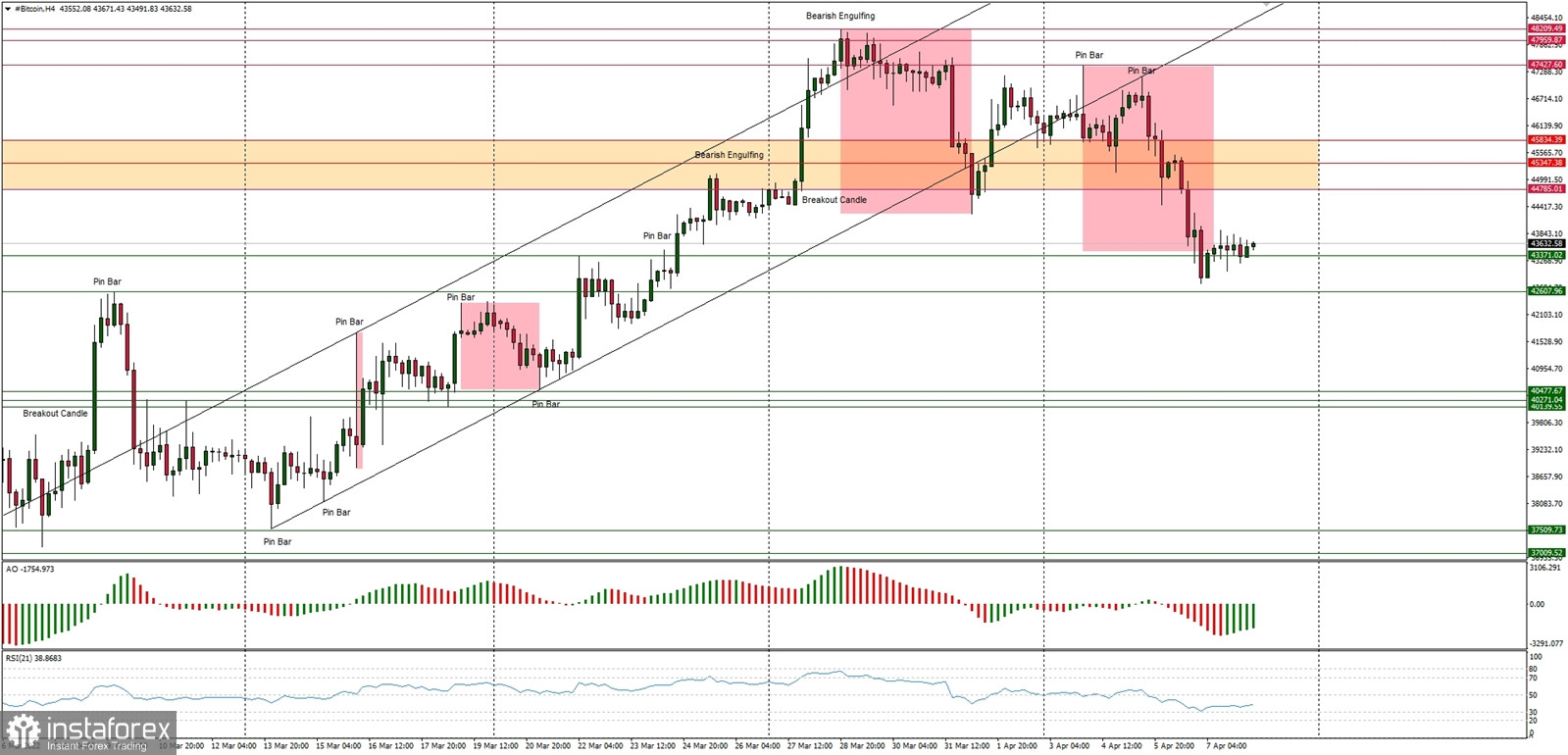

The BTC/USD pair is trying to bounce from the overbalance low made at the level of $42,756, but so far the bulls are not that keen to buy like crazy. Instead, the demand side prefers to consolidate in a narrow range located between the levels of $43,038 - $43,900. The next technical support for bulls is seen at $42,607 and $40,477. The nearest technical resistance is located at $44,758.

Weekly Pivot Points:

WR3 - $52,161

WR2 - $50,140

WR1 - $48,553

Weekly Pivot - $46,309

WS1 - $44,444

WS2 - $43,324

WS3 - $40,487

Trading Outlook:

The market still keeps trying to bounce after over the 60% retracement made since the ATH at the level of $68,998 was made. The bulls are now approaching the game changing technical supply zone seen between the levels of $52,033 - $52,899. When this zone is clearly broken, the BTC is back to the up trend, otherwise the bearish pressure might push down the BTC towards the level of $29,254.