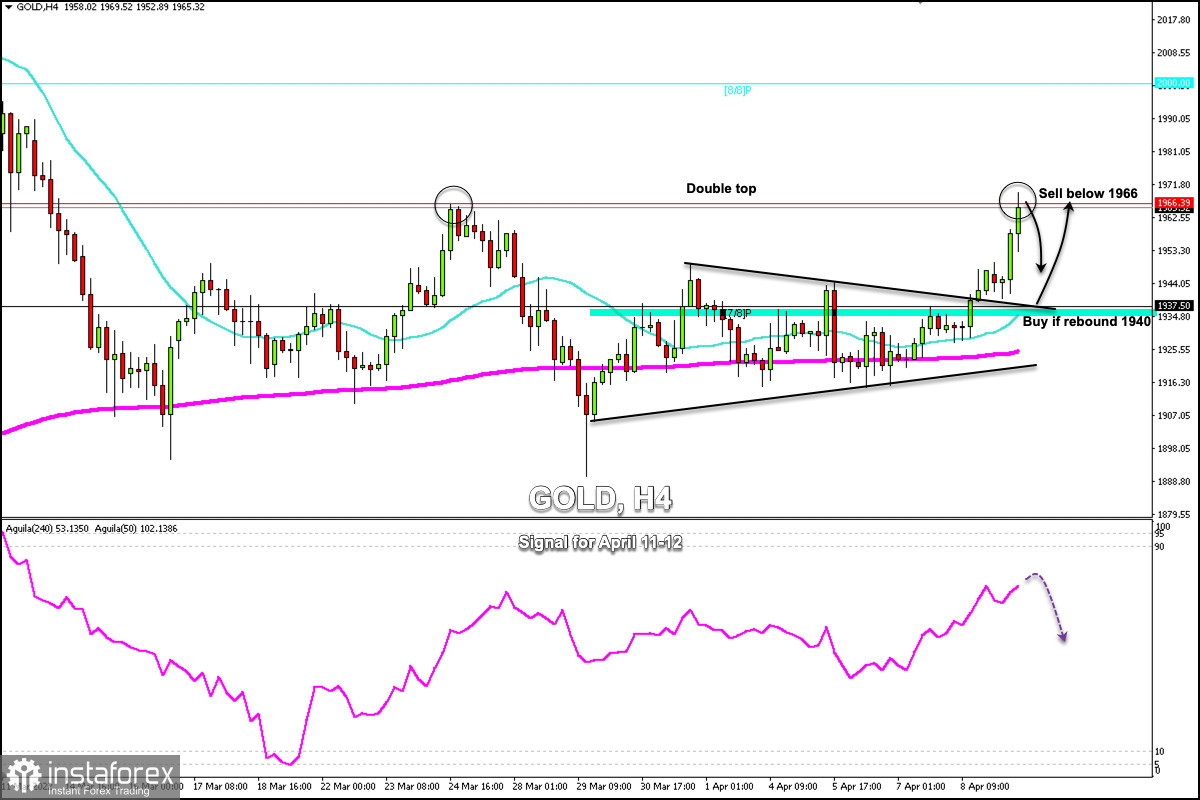

GOLD (XAU/USD) since the opening of a new week continued its uptrend from Friday when it broke the strong resistance at 1,937 (7/8 Murray).

Early in the American session, we see gold trading around strong resistance of 1,967. If it fails to consolidate above 1,970, a strong correction to support of a rising wedge pattern is expected around 1,940.

The zone 1,970-1,975 will be the next major resistance for gold. In case of exceeding it, the next strong level is around 1,990 and even reaching 8/8 Murray around the psychological level of $2,000.

In the opposite direction, if gold manages to stay below 1,967, it is expected to reach 1,949 and even up to the level 1,940, where there is the first relevant support. Only a drop below 1,937 (7/8 Murray) would remove the current short-term bullish bias and the price could resume a strong bearish move towards 1,875.

The markets are monitoring the conflict in Ukraine, after President Volodymyr Zelenskyy said this morning that Russia is concentrating thousands of soldiers for its next assault. This news could favor the demand for gold as a safe-haven asset. The metal could easily reach the psychological level of $2,000.

Investors remain concerned about the potential economic fallout from the war in Ukraine, which was made evident by weakness in equity markets, with the Dow Jones and Nasdaq falling. This, in turn, continued to benefit traditional safe-haven assets and pushed the price of gold higher.

According to the 4-hour chart, we can observe the formation of a double top between the high of March 23 and the level reached today around 1,969. This could be a signal of a technical correction which could set the stage for the price fall and it will be an opportunity to sell.

Our trading plan for the next few hours is to sell gold below 1,966, with targets at 1,950 and 1,940. On the other hand, a technical bounce around 7/8 Murray above 1,937 will be an opportunity to buy gold, with targets at 1,966 and at the psychological level of $2,000.