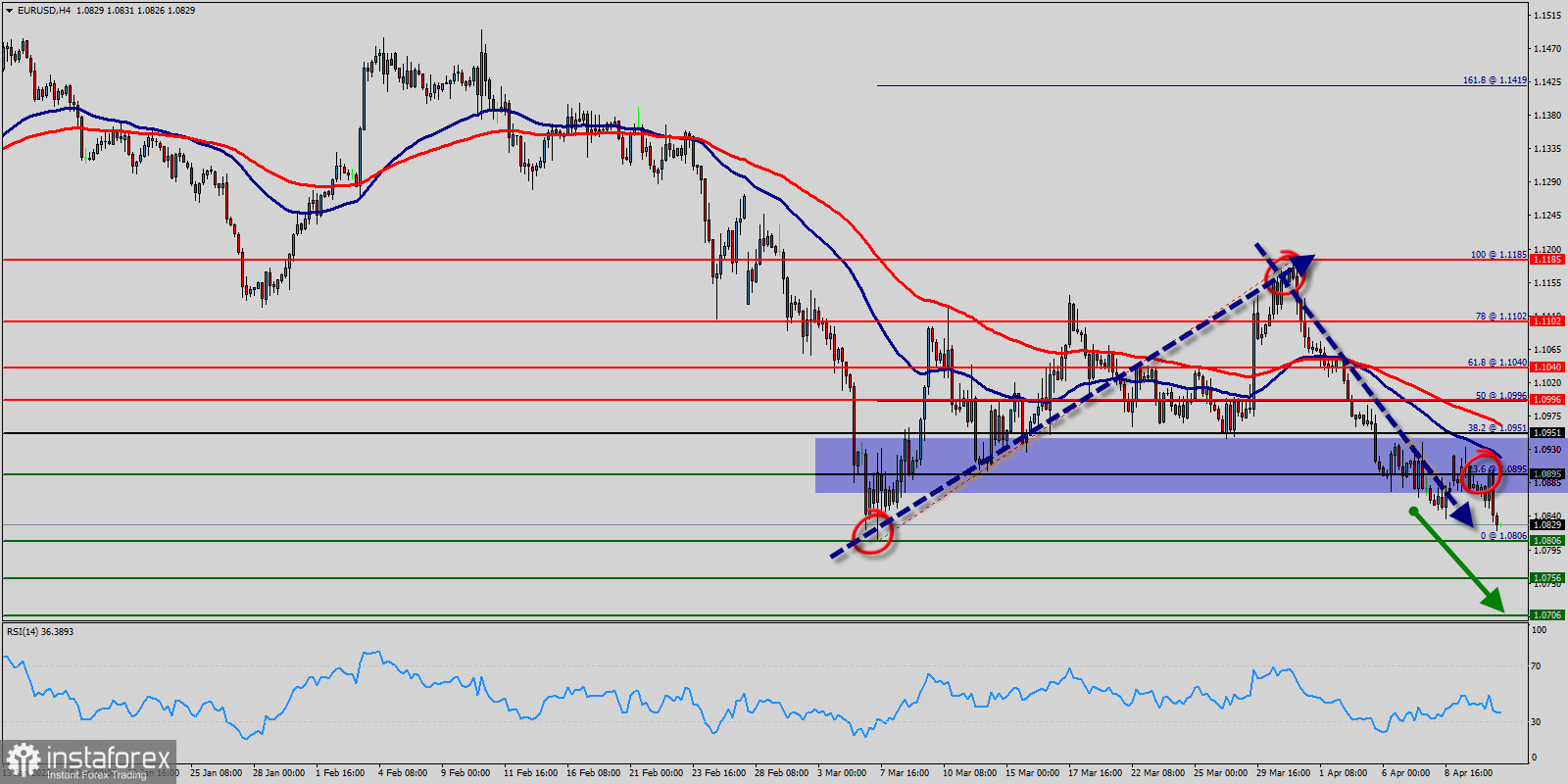

After a close below the price of 1.0895, The EUR/USD pair traded into a bearish zone. The EUR/USD pair extended decline and traded below the 1.0895 level. If there is a downside break below 1.0895, the price might revisit the 1.0827 support. The next key support is 1.0756.

Sellers regained traction after recovery peaked at 1.0828, as subsequent weakness closed again below broken the first support at 1.0951 which became a resistance on the four-hour chart.

At the same time frame, MA's remain in full bearish setup although 100-days momentum edged lower so as to remaining in the negative region and keeping the downside below the levels of 1.0895 and 1.0951.

Next, the EUR/USD keeps treading water after breaking below the 1.0895 mark. The chart shows that the pair remains downward biased and is set to hit the supports levels target at 1.0756, but it would find some hurdles on its way down.

The medium-term negative outlook for the EUR/USD pair is expected to remain unchanged while below the key 100-day EMA, today at 1.0895.

Sellers continue to rule the sentiment around the EUR/USD pair, which extended the downtrend to fresh lows in the nearness of 1.0756.

Therefore, it will be advantageous to sell abelow the first resistance 1.0895 with a first target 1.0806 in order to test the weekly bottom. It may resume to 1.0756 if the price is able to break 1.0895 (last bullish wave). On the other hand, stop loss should always be in account, consequently, it will be of wholesome to set the stop loss below the resistance 2 at the price of 1.0951.