Crypto Industry News:

Fresh data on the trading volume of Indian crypto exchanges reveal a significant decline in trading practices among Indians just ten days after the introduction of new tax laws. A new Indian crypto tax rule of 30% went into effect on April 1, despite warnings from many stakeholders and exchange operators of its ill effects.

A research report released by an Indian analyst company shows that trading volume on top Indian cryptocurrency exchanges has dropped by as much as 70% in the last 10 days.

In addition to the strict crypto tax laws directly inspired by India's gambling laws, many payment processing partners that offer access to the Unified Payments Interface (UPI) have also severed their ties to crypto exchanges.

Interestingly, even though cryptocurrency taxes are based on gambling laws, fantasy sports and gambling apps in the country have full access to all forms of payment integration, including UPI.

Many stakeholders in the crypto community have warned that these impractical tax measures and additional cryptocurrency trading restrictions would do more damage to the country's thriving crypto economy.

Technical Market Outlook:

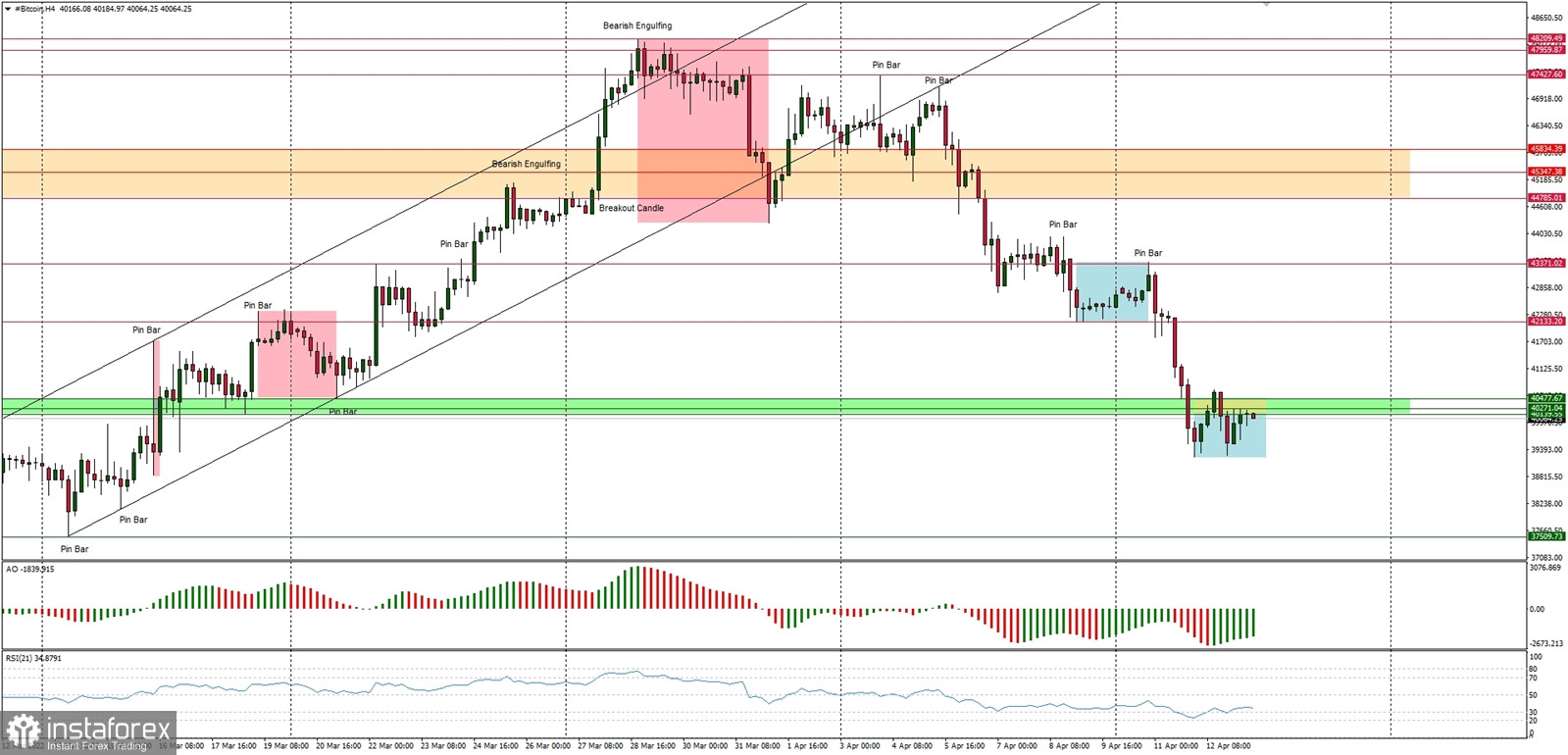

The BTC/USD pair has broken below the key technical support located between the levels of $40,139 - $40,477 and made a new local low below $40k at $39,240. The next target for bears is seen at the level of $37,509. Only a sustained breakout above the level of $48,200 would change the outlook to more bullish and the down trend could have been terminated. The nearest technical resistance is located at the level of $42,133.

Weekly Pivot Points:

WR3 - $50,831

WR2 - $49,471

WR1 - $45,659

Weekly Pivot - $43,872

WS1 - $40,465

WS2 - $38,484

WS3 - $34,936

Trading Outlook:

The market still keeps trying to bounce after over the 60% correction was made since the ATH at the level of $68,998. So far Bitcoin bulls retraced only a 38% of the last wave down and reversed. When this level is clearly broken, the BTC is back to the up trend, otherwise the bearish pressure might push down the BTC towards the level of $29,254.