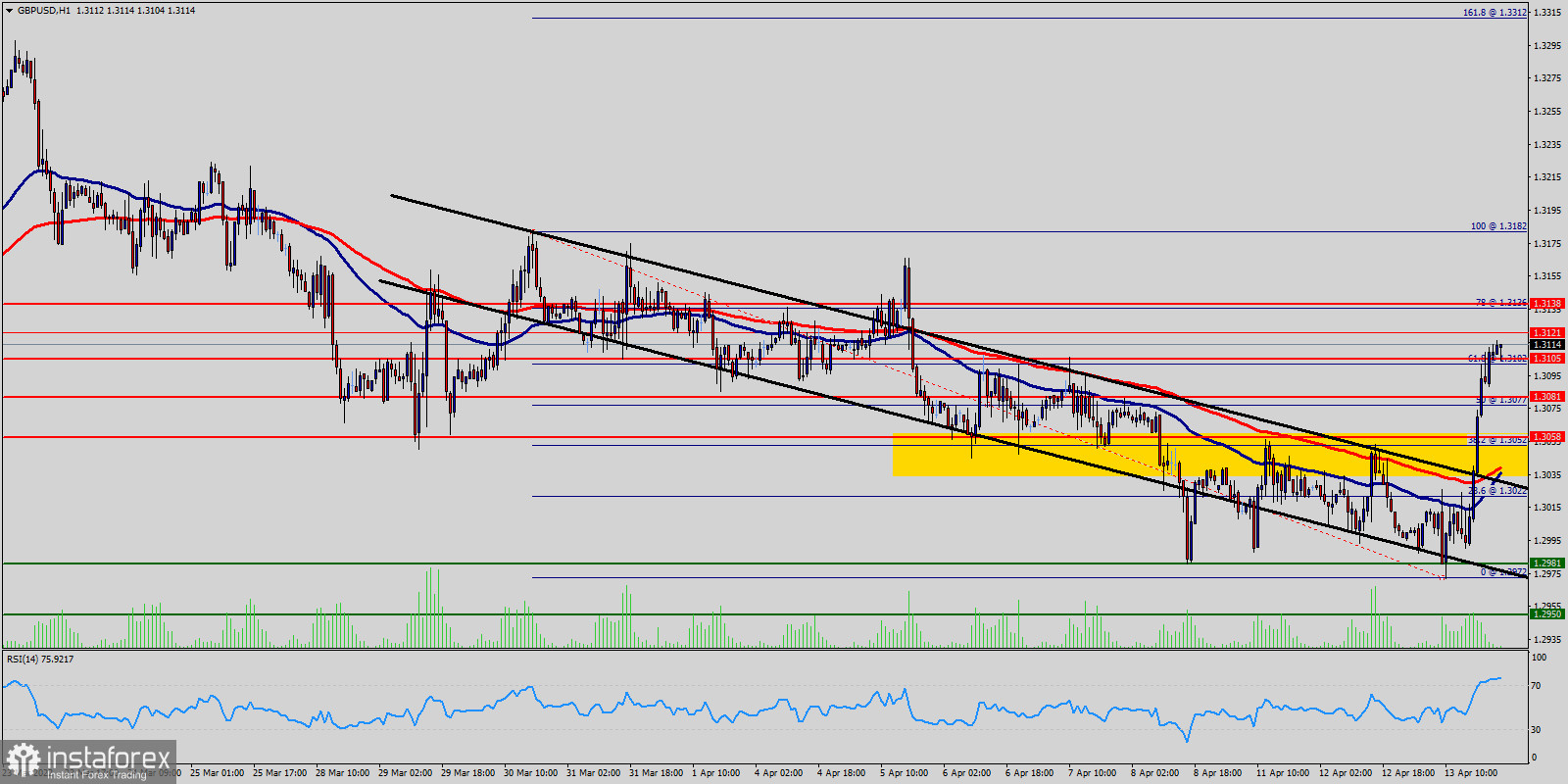

GBP/USD : Decisive break there will resume larger up trend to 50% Fibonacci of 1.3058 to 1.3105, and then 61.8% Fibonacci at 1.3105. On the upside, however, break of 1.3105 minor resistances will extend the consolidation pattern from 1.3138 with another rising leg.

There is a possibility that the GBP/USD pair will move upwards and the structure does not look corrective. The trend is still below the 100 EMA for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside. From this point of view, the first resistance level is seen at 1.3138 followed by 1.3182, while daily support 1 is seen at 1.3058 (38.2% Fibonacci retracement).

The level of 1.3058 is expected to act as major support today. Currently, the price is moving in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in a bullish market.

Above 1.3105 minor resistance will move bias back to the upside for 1.3138 resistance instead. Consequently, buy above the level of 1.3105 with the first target at 1.3138 so as to test the daily resistance 1 and further to 1.3182. Besides, the level of 1.3182 is a good place to take profit because it will form a double top.

On the contrary, in case a reversal takes place and the GBP/USD pair breaks through the support level of 1.3058, a further decline to 1.3025 can occur, which would indicate a bearish market. Overall, we still prefer the bullish scenario, which suggests that the pair will stay below the zone of 1.3058 today.