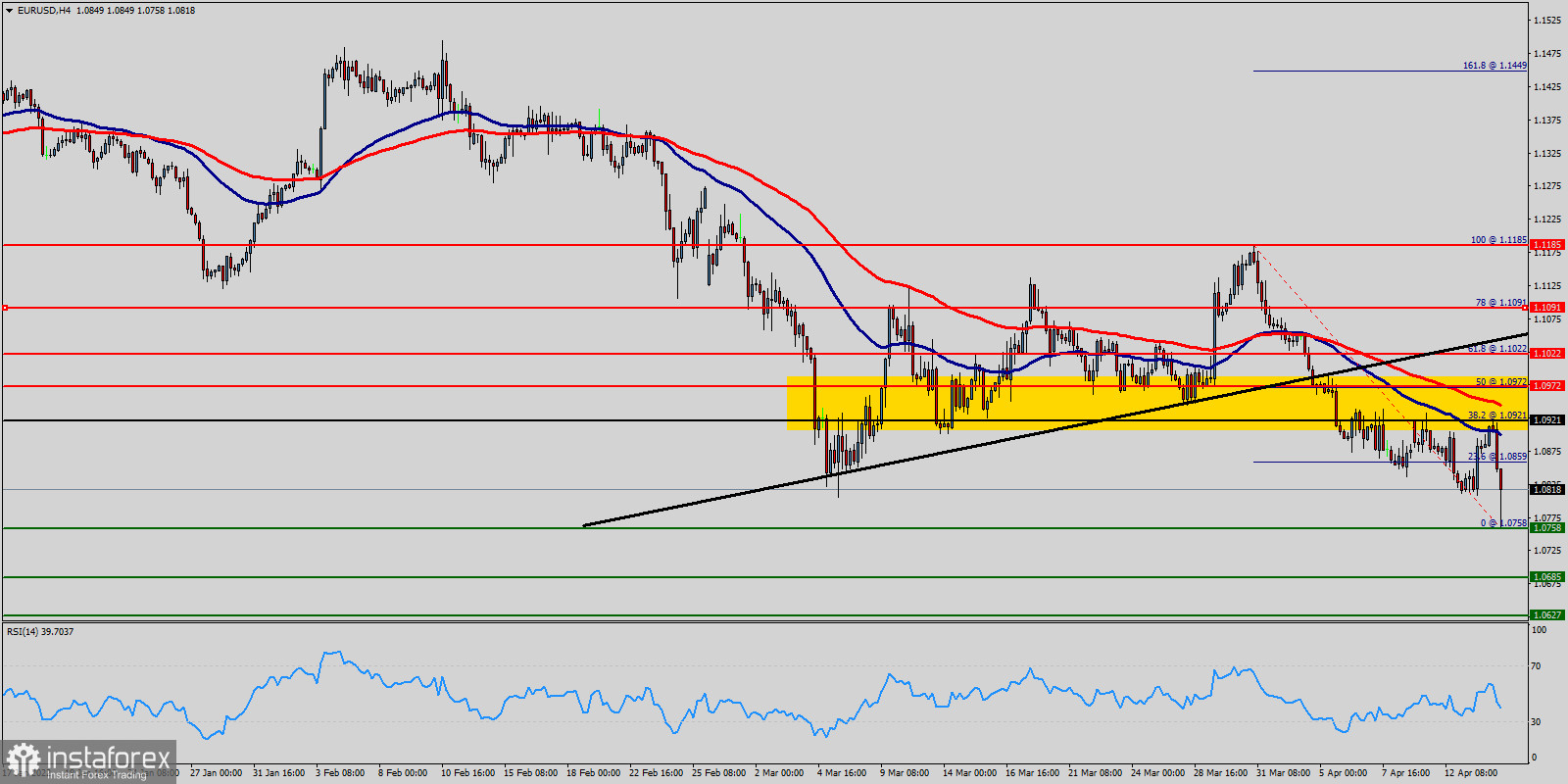

The EUR/USD pair is trading in the range of 1.0921 - 1.0758, retreating yesterday from a week low of 1.0758. On the Four hour chart, the pair is testing the moving average line MA (100) H4 (1.0921), because the lower bound of 1.0758 represents the support level.

The EUR/USD pair continues sharply after rising to break through 1.0921 major support (support becomes resistance). Intraday bias remains bearish first. On the downside, sustained break of 1.0758 low will resume larger down trend to 1.0685.

Some important news will impact on the EUR/USD pair such as Consumer Price Index – Since one of the goals of the ECB is to maintain price stability, they keep an eye on inflation indicators such as the CPI. If the annual CPI deviates from the central bank target, the ECB could make use of its monetary policy tools to keep inflation in check.

The volatility is very high for that the EUR/USDpair is still moving between 1.0921 and 1.0758 in coming hours. Consequently, the market is likely to show signs of a bearish trend again.

Moreover, the RSI is becoming to signal a downward trend, as the trend is still showing strong above the moving average (100) and (50). Thus, the maket is indicating a bearish opportunity below the 1.0921 level for that it will be a good sign to sell at 1.0921.

So, the trend is still bearish as long as the price of 1.0921 is not broken. Thereupon, it would be wise to sell below the price of at 1.0921 with the primary target at 1.0758. Then, the EUR/USD pair will continue towards the second target at 1.0685.

On the upside, break of 1.0921 major resistance will extend the consolidation pattern from 1.1022 with another rising leg. Intraday bias will be back on the upside for stronger rebound. But overall outlook will stay bearish as long as 1.0921 resistance holds.