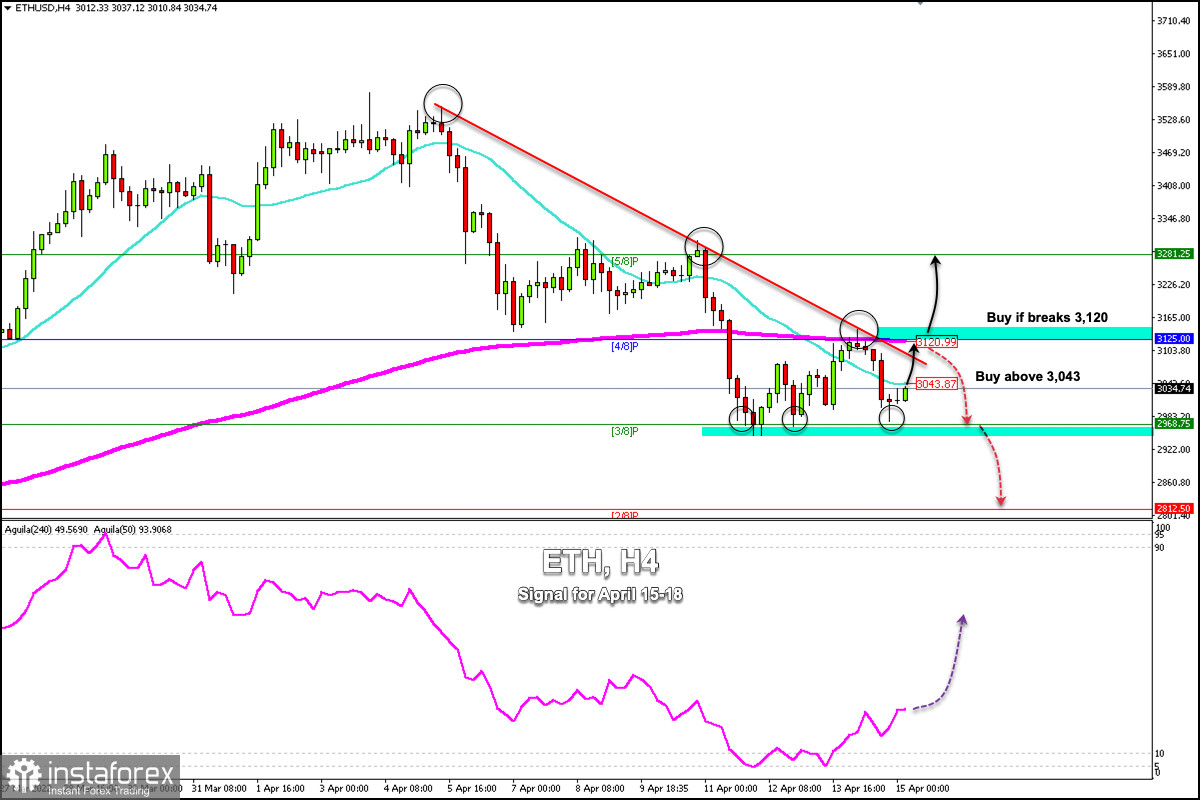

Ethereum price (ETH/USD) has reached a vital support level around 3/8 Murray around 2,968. Since April 4, Ether began a sequential fall and reached a swing low of 2,948. Since April 11, it is consolidating around the psychological level of 3,000.

Ethereum price has tumbled approximately 21% after rejected at the resistance of 7/8 Murray around 3,593.

This drop puts ETH at a turning point, indicating that the trend could go in either direction. Investors can expect a bounce around the level 3/8 Murray to start another rally.

The resulting rally must break the 21 SMA located at 3,043 and deal with the 200 EMA at 3,120. A daily close above 4/8 Murray at 3,125 could be a bullish sign and can reach as high as 8/8 Murray at 3,750.

The outlook is bullish. ETH is expected to reach even the psychological level of 4,000.

Conversely, a break of the support of 3/8 Murray will open the doors for the bears to take control.

In this case, the price of Ethereum will fall freely until it reaches 2/8 Murray at 2,500, which is a key support level that will prevent a further accelerated decline.

In a very negative scenario for ETH, a break of 2,500 could accelerate the downward movement to the area 2,000, especially if Bitcoin also collapses.

In the short term, our trading plan is to buy above 2,962 (3/8) or above the 21 SMA around 3,043, with targets at 3,120. If the bullish force breaks the downtrend channel and consolidates above the 200 EMA, we could continue buying with targets at 3,593.

Since April 12, the eagle indicator is giving a positive signal. It is likely that in the coming days there will be a recovery of Ether and it could reach the level of 3,593 (7/8 Murray).