Crypto Industry News:

In a letter sent today to Twitter CEO Bret Taylor, entrepreneur Elon Musk has offered to buy the entire company for $ 54.20 per share, stating that the social networking platform has "extraordinary potential" that it will "unlock."

In a 13D filing with the US Securities and Exchange Commission, Musk states that:

"Since I made my investment, I realize that the company will neither prosper nor serve this social imperative in its current form. Twitter needs to be transformed into a private company," he said.

Then Musk categorically states that this is "my best and final offer and if it is not accepted I will have to reconsider my position as a shareholder."

On March 14, Musk became Twitter's largest shareholder after acquiring a 9.2% stake worth more than $ 3 billion. In recent weeks, he has claimed that he wants to use the platform for freedom of speech and greater public participation by tweeting a poll about the addition of an edit button that garnered over 4.4 million votes.

Based on share statistics released on February 10 of this year, Twitter currently has 800.64 million shares, making Musk's $ 54.20-a-share offering roughly $ 43.4 billion.

Technical Market Outlook:

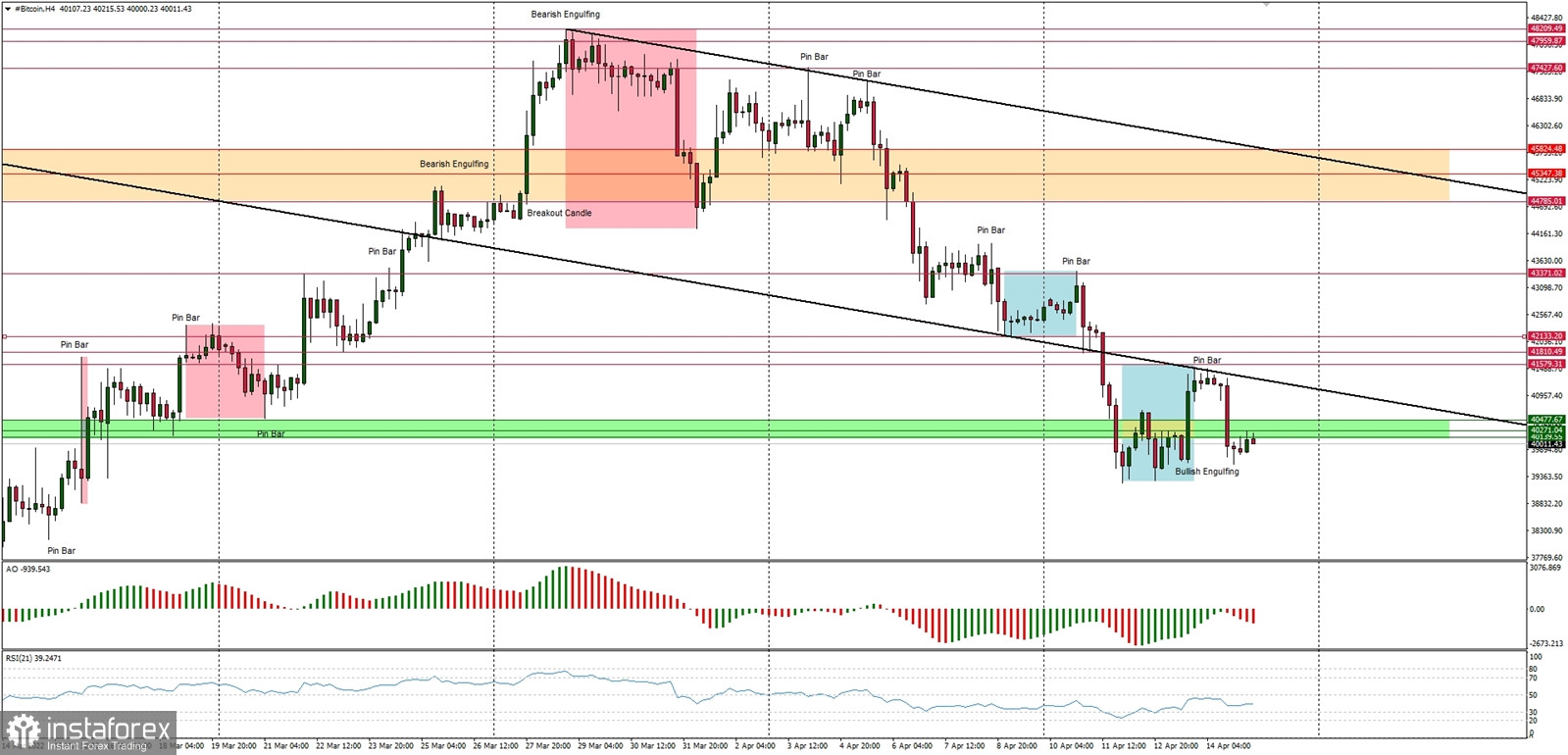

The BTC/USD bounce has been faded and the market erased all the recent gains. The local high was made at the level of $41,495, which is now a technical resistance. Only a sustained breakout above the level of $48,200 would change the outlook to more bullish and the down trend could have been terminated. The key short-term technical resistance is located at the level of $42,133. On the other side, the next target for bears is seen at the level of $37,509.

Weekly Pivot Points:

WR3 - $50,831

WR2 - $49,471

WR1 - $45,659

Weekly Pivot - $43,872

WS1 - $40,465

WS2 - $38,484

WS3 - $34,936

Trading Outlook:

The market still keeps trying to bounce after over the 60% correction was made since the ATH at the level of $68,998. So far Bitcoin bulls retraced only a 38% of the last wave down and reversed. When this level is clearly broken, the BTC is back to the up trend, otherwise the bearish pressure might push down the BTC towards the level of $29,254.