Crypto Industry News:

The Ministry of Finance (MinFin) of Russia finalized a bill called "On digital currency" and sent it to the Russian government for approval. The draft federal act clarifies the regulations related to trading and mining cryptocurrencies.

On April 8, Russia's Finance Ministry announced the revision and finalization of the upcoming Cryptocurrency Law, which provides regulatory clarity related to circulation, issuance, trading, mining and other activities in the cryptocurrency market.

While unconfirmed reports of cryptocurrency legalization by Russia surfaced in early April 16, the thriving cryptocurrency community on Twitter has embraced the announcement with open arms.

As the dust settled, the cryptocurrency community on Twitter soon realized that they were celebrating a little early, and soon removed the tweets that cheered on the legal status of cryptocurrencies in Russia.

The hype around Russia legalizing cryptocurrencies was sparked by a report by the local Russian daily newspaper "Kommersant", which reportedly received an authentic final version of the bill. According to local media, the bill recommended the acceptance of the digital currency "as a tender that is not a monetary unit of the Russian Federation", which has not yet been enacted as law by the Russian government.

While the MinFin has finalized the bill and handed it over to the government, it is still pending an official announcement about its approval as a law.

The report also emphasized that the draft law recommends creating a regulatory framework for cryptocurrency activities while sharing the grounds for registered operators.

Technical Market Outlook:

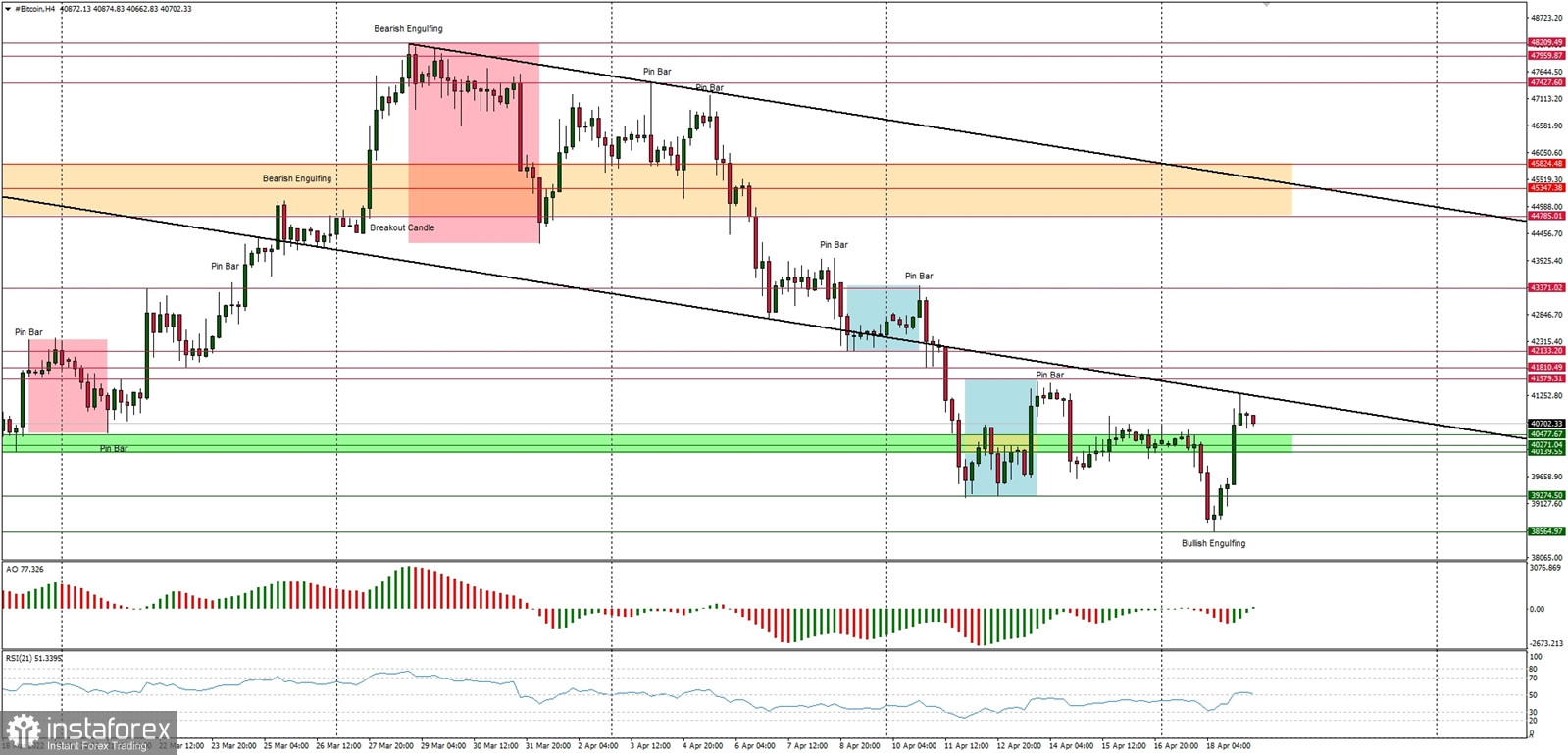

The BTC/USD pair bounced from the level seen at $38,664 and is testing the the lower channel line. The next target for bulls is seen at the level of $41,579 and is this level is clearly violated, then the bulls might have a chance to extend the rally towards $43,371. The market conditions are still oversold, but the momentum is neutral already, so the bulls are working to increase the dominance on the market. The nearest technical support is seen at $40,477, $40,271 and $40,139.

Weekly Pivot Points:

WR3 - $46,129

WR2 - $44,704

WR1 - $42,258

Weekly Pivot - $40,652

WS1 - $38,302

WS2 - $36,789

WS3 - $34,347

Trading Outlook:

The last push down on the Bitcoin H4 time frame chart was completely retraced as the V-shape reversal was made very quickly. The bulls are temporary in control of the market and they are heading towards the level of $41,579 first, then higher towards $43,371. The key supply zone is located between the levels of $44,785 - $45,826.