Crypto Industry News:

The Russian Federal Tax Service (FTS) joined the debate on cryptocurrency regulation in Russia with an unexpectedly blunt proposal - to allow Russian companies to use digital currencies as a payment method for international transactions.

On Wednesday, the local newspaper reported that the FTS had left an official opinion on the draft cryptocurrency bill prepared by the Ministry of Finance. In its comments, the agency suggested that Russian companies could use cryptocurrencies for certain operations:

"This will allow corporate entities to pay for goods and services in line with foreign trade agreements and receive revenues from foreign entities in digital currency."

The initiative could fundamentally change the spirit of the proposed framework, which previously ruled out any role of digital currencies other than investment assets. The current draft contains a clause according to which the prohibition of using cryptocurrencies as a payment method applies "in all cases where the law does not provide otherwise."

The FTS has proposed to take action on the basis of this reservation to diversify the payment options available to Russian companies engaged in international trade under the conditions of severe financial sanctions imposed on the country.

The agency has also reportedly specified that companies will have to buy and sell digital currencies via regulated crypto wallets and stock exchange platforms.

In response to FTS feedback, the Ministry of Finance left a "partial support" mark, indicating that the matter requires further deliberation and discussion.

Technical Market Outlook:

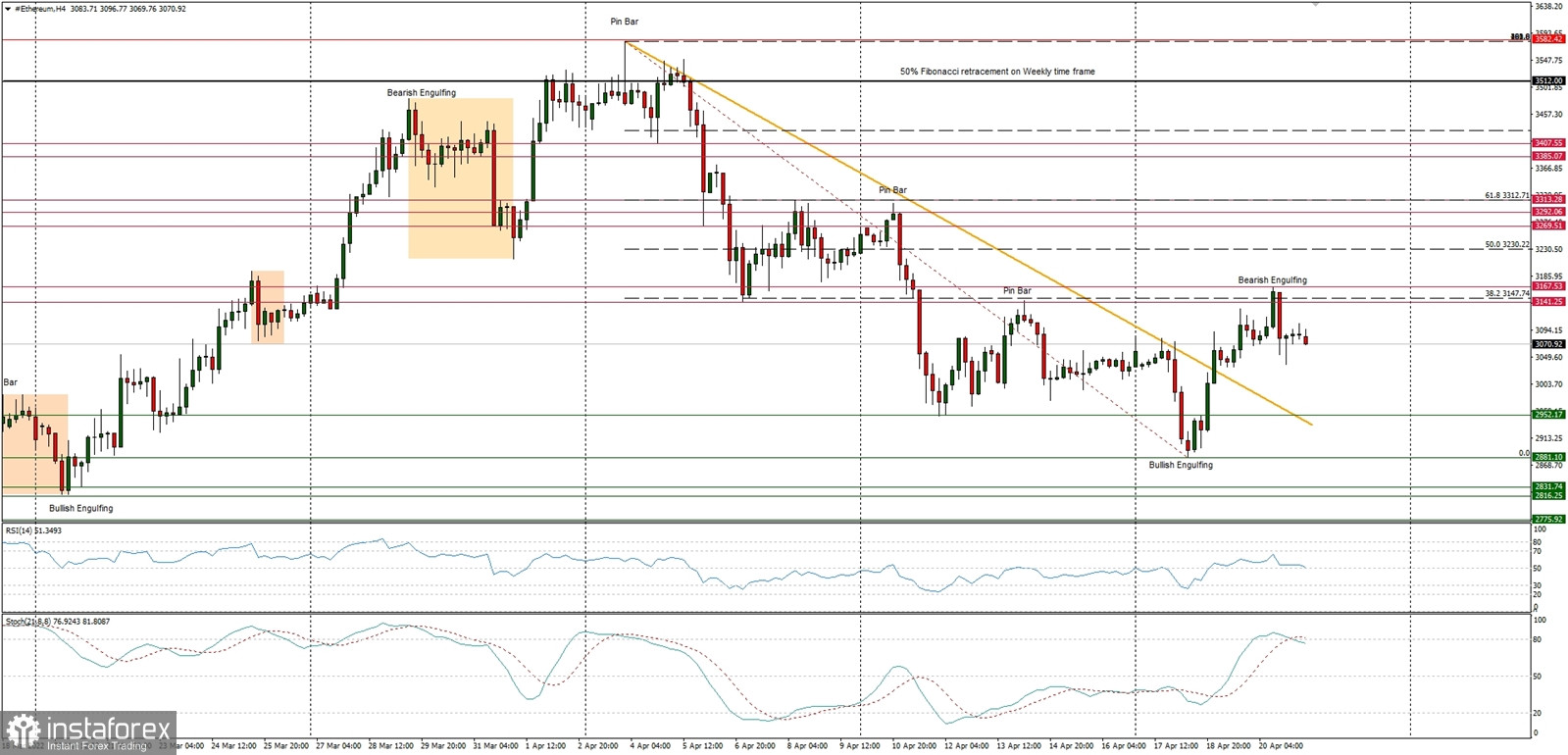

The ETH/USD pair had manage to retrace 38% of the last wave down and hit the level of $3,167, which is just a tad above the retracement level seen at $3,147. The Bearish Engulfing pattern made at the top of the bounce helped the bears to slam the price back towards the technical support located at $3,030. The market conditions at the H4 time frame chart are now extremely overbought, so a consolidation period is now due. Any violation of the level of $2,952 would likely expose the swing low located at $2,881 for the test again.

Weekly Pivot Points:

WR3 - $3,558

WR2 - $3,417

WR1 - $3,209

Weekly Pivot - $3,065

WS1 - $2,886

WS2 - $2,742

WS3 - $2,529

Trading Outlook:

The market bounce from the level of $2,878 might be the beginning of a stronger advance above $3k again, so this level is a must to keep the eye on it. The bulls are temporary in control of the market and they are heading towards the level of $3,141 first, then lower towards $3,313.