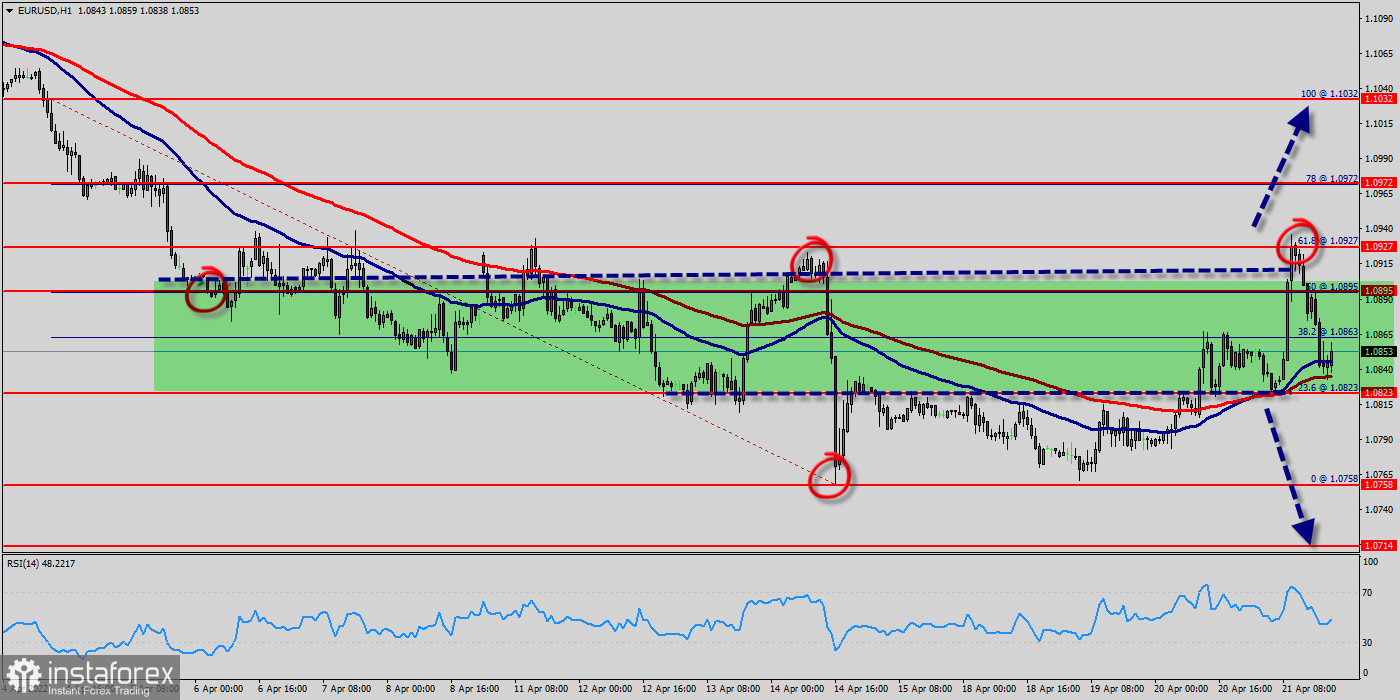

The EUR/USD pair continues to move upwards from the level of 1.0758. Today, the first support level is currently seen at 1.0758, the price is moving in a bullish channel now. Furthermore, the price has been set above the strong support at the level of 1.0758. This support has been rejected three times confirming the veracity of an uptrend.

It should be noted that volatility is very high for that the UR/USD pair is still moving between 1.0758 and 1.0972 in coming hours.

On the H1 chart. the level of 1.0758 coincides with the double bottom, which is expected to act as major support today. Since the trend is above the 00% Fibonacci level, the market is still in an uptrend.

But, major support is seen at the level of 1.0714.

Furthermore, the trend is still showing strength above the moving average (100).

Thus, the market is indicating a bullish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside.

Accordingly, the pair is still in the uptrend from the area of 1.0758 and 1.0972. The EUR/USD pair is trading in a bullish trend from the last support line of 1.0758 towards the first resistance level at 1.0927 in order to test it.

A strong support will be found at the level of 1.0758 providing a clear signal to buy with a target seen at 1.0927.

This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Now, the pair is likely to begin an ascending movement to the point of 1.0758 and further to the level of 1.0927.

If the trend breaks the major resistance at 1.0927, the pair will move upwards continuing the bullish trend development to the level 1.0972 in order to test the daily resistance 2. The EUR/USD pair is showing signs of strength following a breakout of the highest level of 1.0972.

Tips :

Idea about breakout :

Breakout strategy is one of the most strategy well-known among traders even it seems complex. But the most important to find the trend power from Y = aX + b, in order to find measure market sentiment because it is a locating tool.

Breakout one: waits for an act of slowing down in volatility and then trades in the direction of the next breakout. It is very short-term in nature, uses fixed stop losses and profit targets, and works best in rapid movement markets.

Breakout two: a breakout strategy that looks to go long when a currency pair breaks above its daily trading range, short on a break below. On the other hand, an explicit channel breakout strategy, it uses the Speculative Sentiment Index trend comb out to confirm whether or not price is potential to continue in the direction of the breakout. It opens a trade with several units and catch up with to pass while continue in the same direction entries and exits according to a pair's Average True Range.

Pivot Point

The most of professional traders and market makers use pivot point to determine potential resistance and support levels. Simply, put a pivot point and its resistance and support levels are areas at which the direction of price movement can probably change.

To identify the pivot point and its resistance/support levels, you should use historic rates to determine future prices. It mean using the previous period's high, low and closing level to determine future resistance and support in this regard. Therefore, the pivot point is the central axis (it acts as an orbit) among three up levels that they are referred to resistances and three down levels referred to supports. The pivot point is especially useful in the short term (daily or weekly), as well as it is also used for a range or breakout. In this book will know more about standard pivot point, Fibonacci pivot point, Camarilla pivot point, Woodie pivot point and Demark pivot point.

Pivot point formula:

Pivot point = (High (previous) + Low (previous) + Close (previous)) / 3

To calculate the daily pivot point, then it uses the previous day's high, low and close of yesterday in the M15 chart. In other words, Pivot point for today's intraday charts would be based solely on yesterday's high, low and close.