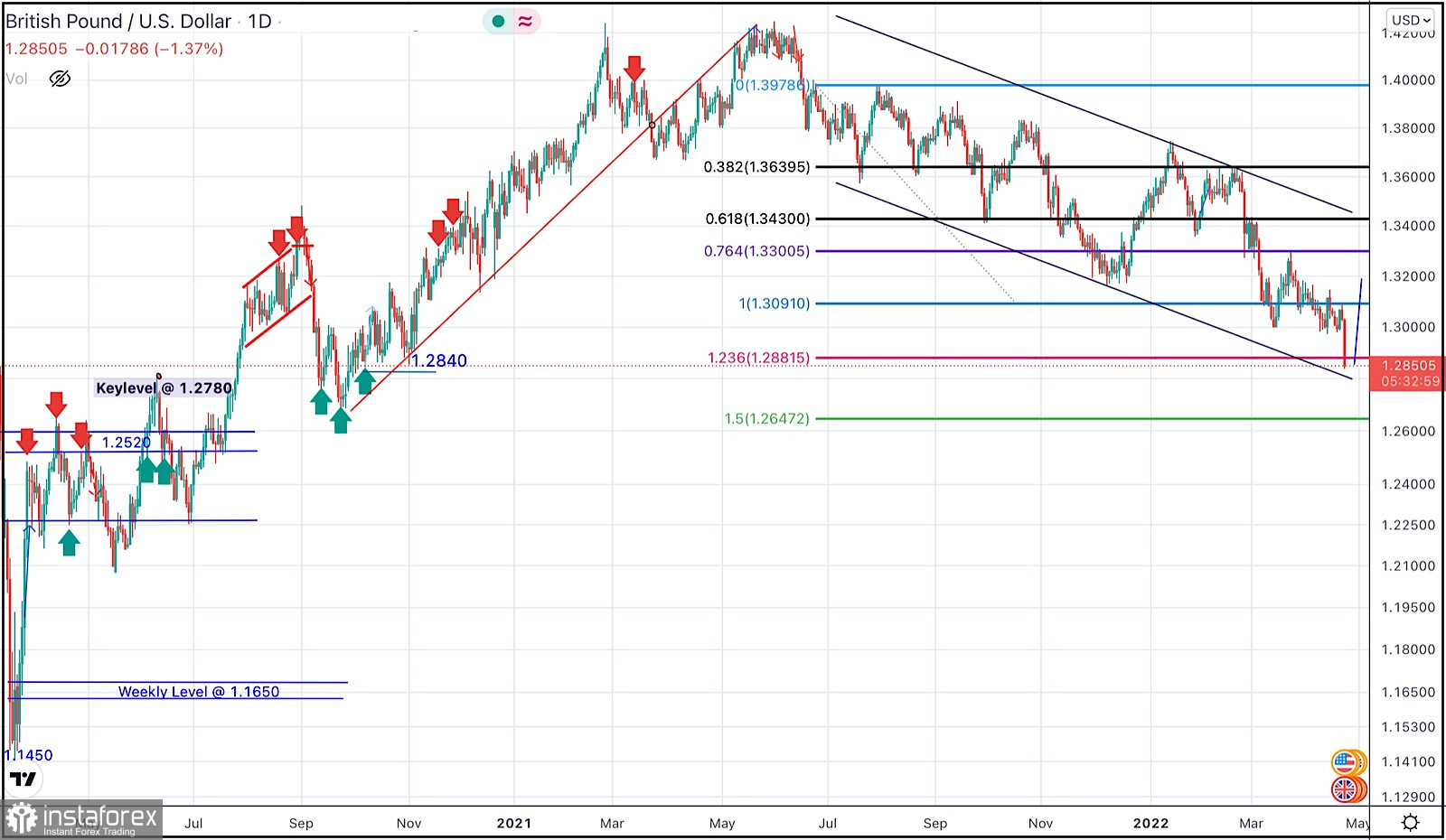

The GBPUSD pair has been moving within the depicted bearish channel since July.

Recently, BUYERS were watching the price levels of 1.3730 to have some profits off their trades as it stood as a key-resistance which offered significant bearish rejection recently.

The short-term outlook turned bearish when the market went below 1.3600. This enhanced the bearish side of the market towards 1.3400 which brought the pair back towards 1.3600 for another re-test.

Hence, the recent bullish pullback towards 1.3600 should have been considered for SELL trades as it corresponded to the upper limit of the ongoing bearish channel.

It's already running in profits. Bearish persistence below 1.3090 was needed to enable further downside continuation towards 1.2900 (the lower limit of the movement channel).

Instead, bullish rejection has arised many times around 1.3000 standing as a significant Daily Support where the previous consolidation range has arised.

However, as expected, bearish persistence below 1.3090 enabled bearish extension towards 1.2880 where some bullish recovery should be anticipated.

Bullish breakout above 1.3090 abolishes the short-term bearish scenario and may enable quick bullish advancement towards 1.3300 and probably 1.3600 if sufficient bullish momentum is expressed.