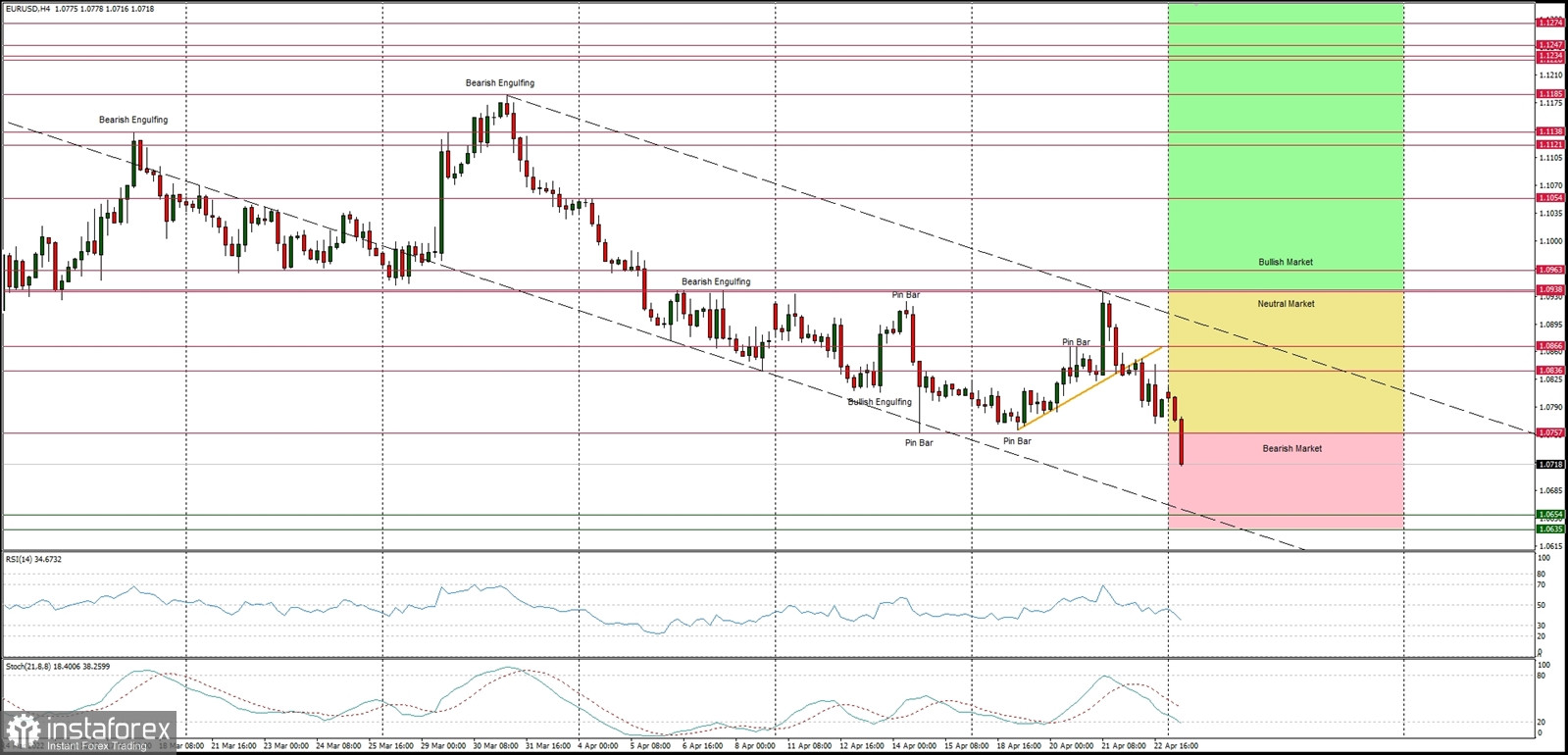

Technical Market Outlook

The EUR/USD pair had broken below the last week low seen at the level of 1.0757 as the bearish pressure intensify. The local low was made at the level of of 1.0710 (in the time of writing the analysis), however, in a case of the down move continuation, the next target for bears is seen at the level of 1.0654 - 1.0635. The nearest technical resistance is located at 1.0836. Despite the oversold market conditions on the H4 and Daily time frame charts, the down trend continues and there is no indication of trend termination or reversal just yet.

Weekly Pivot Points:

WR3 - 1.1064

WR2 - 1.0994

WR1 - 1.0884

Weekly Pivot - 1.0825

WS1 - 1.0717

WS2 - 1.0643

WS3 - 1.0535

Trading Outlook:

The market is still in control by bears that pushed the price way below the level of 1.1185, so a breakout above this level is a must for bulls for a trend reversal. The next long-term technical support is located at 1.0639. The up trend can be continued towards the next long-term target located at the level of 1.1494 (high from 06.02.2022) only if bullish cycle scenario is confirmed by breakout above the level of 1.1186 and 1.1245, otherwise the bears will push the price lower towards the next long-term target at the level of 1.0639 or below.