Crypto Industry News:

Although Twitter's management initially tried to block Elon Musk's bid related to the takeover, the people responsible for the platform decided to re-examine the proposal. This could mean that the popular website will be sold to a billionaire later this week.

After Elon Musk bought 9.2% of Twitter shares and resigned his seat on the board, there were suspicions that the billionaire was looking to take over the entire company. A few days later, the richest man in the world made a proposal to buy Twitter, for which he wanted to spend 43 billion dollars. At the same time, he informed that if the transaction was finalized, it would reduce the remuneration of the management board to zero. This could save Twitter about $ 3 million a year.

Opinions on whether Twitter should fall into the hands of Elon Musk are divided. Some believe that a billionaire who repeatedly influenced the market sentiment with his tweets should not have a decisive vote on the platform used by top politicians. It is worth recalling that the account of Elon Musk (@elonmusk) is currently watched by 83.3 million people. This means that it is ranked eighth on the list of the most popular accounts across the site.

Technical Market Outlook:

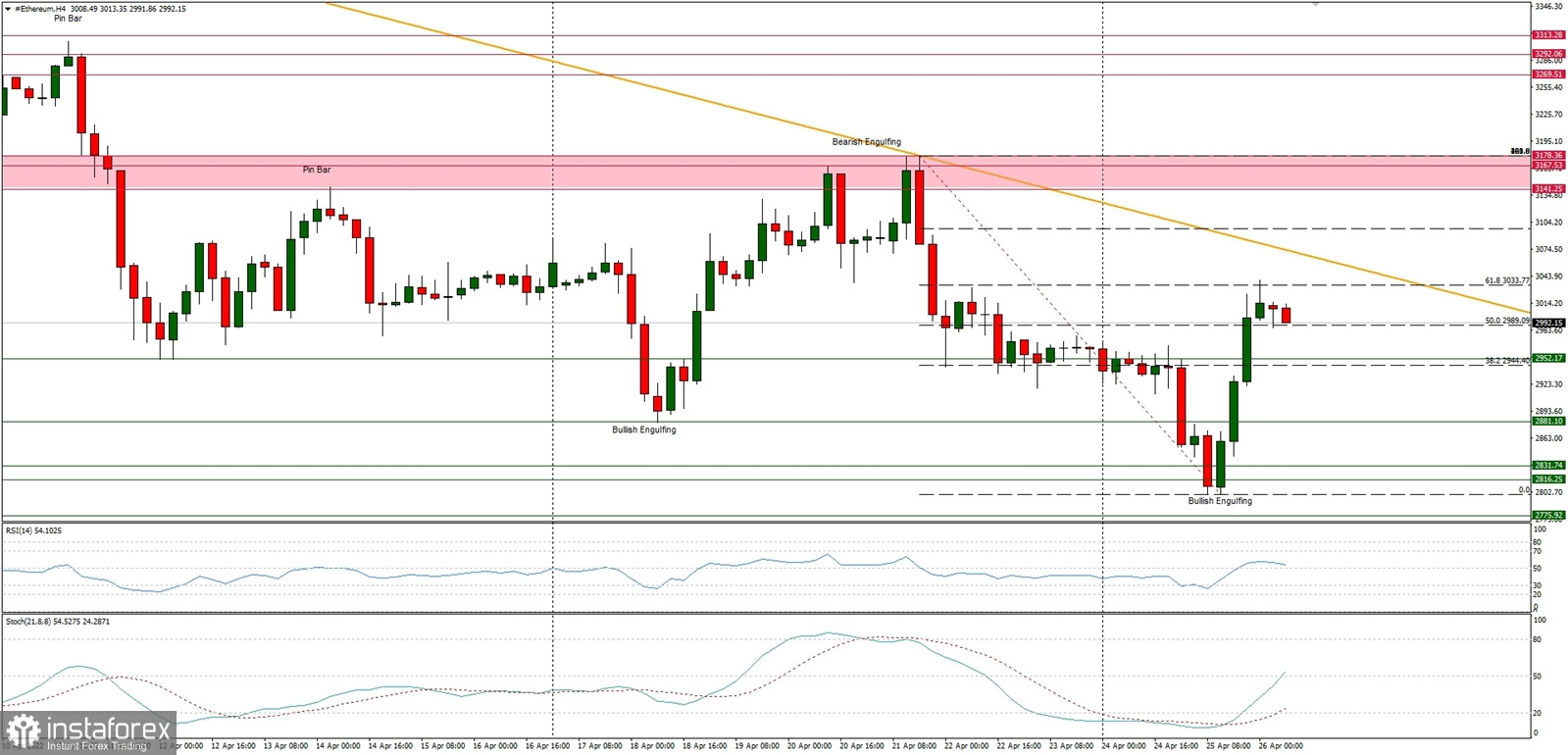

The ETH/USD pair had retraced 61% of the last wave down as the local low was made at the level of $2,799. The Bullish Engulfing candlestick pattern helped the bulls to hit the level of $3,033 again and the market is consolidating the recent gains in a narrow range. In order to make a full V-shape reversal, the bulls must break above the last high seen at the level of $3,178. The nearest technical resistance are: $3,037, $3,147 and $3,167.

Weekly Pivot Points:

WR3 - $3,378

WR2 - $3,278

WR1 - $3,078

Weekly Pivot - $2,916

WS1 - $2,787

WS2 - $2,680

WS3 - $2,474

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames continues. So far every bounce and attempt to rally is being used to sell Ethereum for a better price by the market participants, so the bearish pressure is still high. The key long term technical support is seen at the level of $2,646.