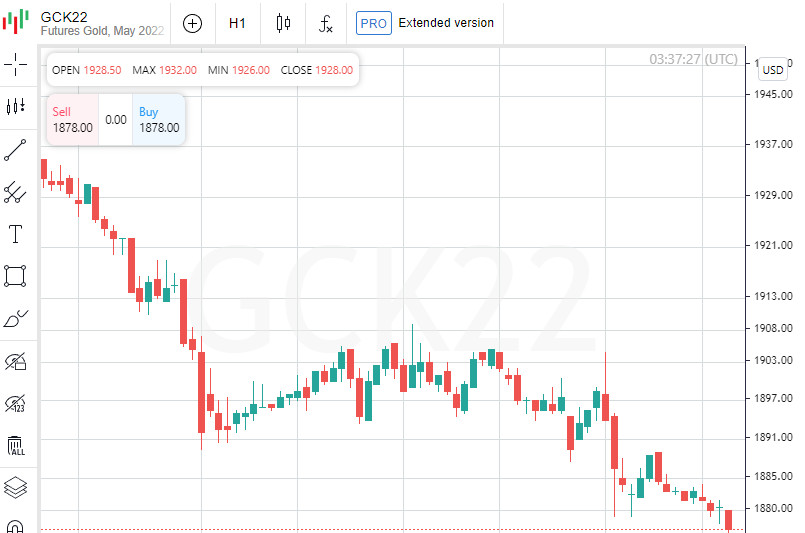

June COMEX gold futures fell $15.40, or 0.8%, to $1,888.70 an ounce. This is the lowest closing price for the most actively traded contracts since February 25th. May silver futures fell 8 cents, or 0.3%, to $23.46 an ounce.

Gold is being hampered by further gains in the dollar, which rose to its highest level since 2017 on the ICE, analysts said. A stronger dollar makes commodities traded in that currency more expensive for holders of other currencies. The dollar is getting support on expectations of a more active increase in interest rates by the Fed and curtailment of stimulus measures amid record inflation growth.

Rupert Rowling, an analyst at Kinesis Money, noted that gold quotes could not stay above $1,900, although the current situation in the world should encourage purchases of this metal, which is considered a defensive asset. Such dynamics reflects the degree of influence of the US Federal Reserve's actions on the market.

The expert also noted that the increase in interest rates by the US Federal Reserve is almost guaranteed in May and June and very likely in July. Against this background, investors' interest in gold, which does not bring guaranteed income, has weakened. About a month ago, gold quotes exceeded $2,000 per ounce.

He also added that $1,900 per ounce is historically considered very high. Given the fragile state of the markets at the moment, prices can quickly resume growth amid rising investor fears.

July copper futures rose 0.2% to $4.475 a pound.

July platinum futures fell 0.2% to $910.40 an ounce, while June palladium futures edged up 0.8% to $2,195.10 an ounce.