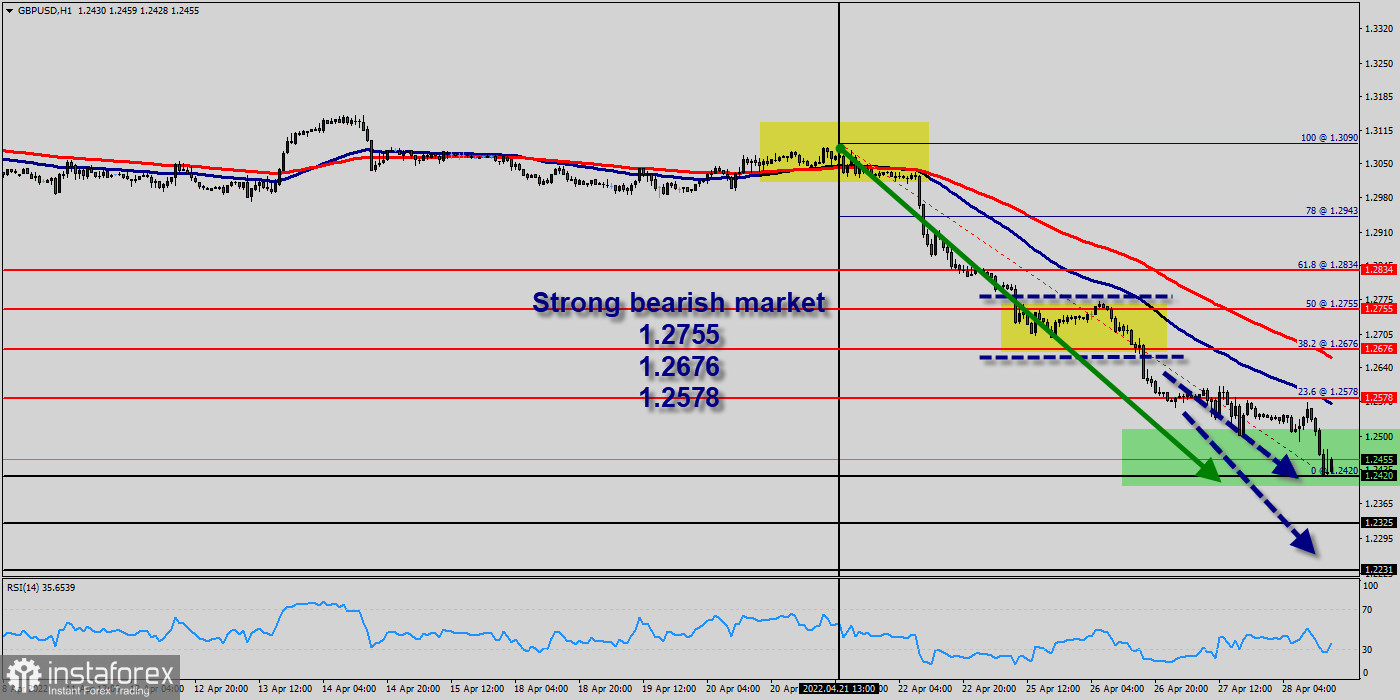

The GBP/USD pair is still consolidating at the 1.2420 area, following a rejection from the 50-day and 100-day moving averages. These levels (1.2755, 1.2676 and 1.2578) act as support after getting broken to the downside a few weeks ago.

The main trend is down according to the daily swing chart. A trade through 1.2420 will change the main trend to down. A move through 1.2420 will signal a resumption of the downtrend.

The GBP/USD pair price moved into a bearish zone below the levels 1.2755, 1.2676 and 1.2578. The GBP/USD pair even extended decline below the 1.2578 level before somewhat recovering.

On the one-hour time frame, we can spot what seems to be a real breakout below the 1.2578 level. A bearish reversal could be anticipated, as the RSI indicator signaled that GBP/USD pair is oversold (below 30%) on this time frame.

RSI (14) has made a recent bearish exit which is in line with the bearish exit we're seeing in price. The trend is still showing strength above the moving average (100) and (50). Thus, the market is indicating a bearish opportunity below 1.2578.

If the GBP/USD pair fails to break through the resistance level of 1.2578, the market will decline further to 1.2325. This would suggest a bearish market because the RSI indicator is still in a positive area and does not show any trend-reversal signs.

The pair is expected to drop lower towards at least 1.2325with a view to test the daily support 2.

On the contrary, if a breakout takes place at the resistance level of 1.2755, then this scenario may become invalidated.